① The proposal for the general authorization of share issuance by Bank Of Zhengzhou faced opposition from 28.4% of attending H shareholders. ② Although increasing shares can bring external capital injection to the bank, it will to some extent dilute the interests of existing shareholders. ③ The profit distribution plan for Bank Of Zhengzhou in 2023 encountered opposition from 83.111365% of attending H shareholders, but it ultimately passed smoothly.

According to the Financial Association on December 19 (Reporter Peng Kefa), the votes against at the shareholders' meeting can, to some extent, be viewed as an important reference indicator for the company's market-oriented decision-making.

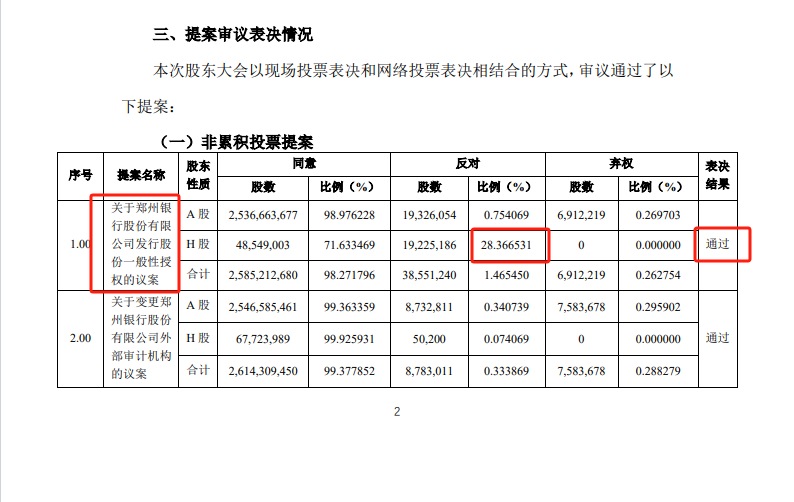

On the evening of December 18, Bank Of Zhengzhou announced that five proposals were passed at the second extraordinary shareholders' meeting. However, Financial Association reporters noted that the proposal for the general authorization of share issuance by Bank Of Zhengzhou faced opposition from 28.4% of attending H shareholders. Such a high number of opposing votes is quite rare in the bank's shareholders' meetings.

Bank Of Zhengzhou passed five resolutions; the proposal for general share issuance faced significant opposition from H shareholders.

Bank Of Zhengzhou passed five resolutions; the proposal for general share issuance faced significant opposition from H shareholders.

According to public information, Bank Of Zhengzhou held the second extraordinary shareholders' meeting on December 18, 2024, with online voting taking place on the same day. The equity registration date was December 13, and investors holding Bank Of Zhengzhou stocks after the market closed on that day could participate in voting. A total of five proposals were audited at this shareholders' meeting, including the proposal for the general authorization of share issuance by Bank Of Zhengzhou. The voting results showed that all five proposals were approved.

Financial Association reporters noted that while the vast majority of approval votes exceeded 90%, the proposal for general share issuance by Bank Of Zhengzhou encountered significant opposition: H shareholder opposition votes reached 28.366531%. Nonetheless, due to the high number of approval votes from A-share shareholders, the final approval ratio for the proposal among A and H shareholders still reached 98.3%.

An industry Analyst told Financial Association reporters that increasing shares can indeed bring external capital injection to the bank, but it will to some extent dilute the interests of existing shareholders, which is why H shareholders presented large-scale opposition votes. Additionally, compared to A-share investors, Hong Kong stock small shareholders have a noticeably stronger sense of shareholder awareness and are more willing to express their opinions.

Bank Of Zhengzhou's announcement yesterday showed that the proportion of shareholders attending and voting was not high. A total of 798 people, including shareholders and their appointed representatives, attended the extraordinary shareholders' meeting, representing 2,630,676,139 shares with voting rights, accounting for approximately 35.418669% of the total voting shares. Among them, 797 A-share shareholders and their appointed representatives represented 2,562,901,950 A-shares, accounting for approximately 34.506177% of the total voting shares; one H-share shareholder and their appointed representative represented 67,774,189 H-shares, accounting for approximately 0.912492% of the total voting shares.

The H shareholders of Bank Of Zhengzhou have a precedent for being "out of sync."

According to public information, there have been previous cases where proposals at the Bank Of Zhengzhou's shareholder meeting were "blocked" by H shareholders.

On the evening of June 27 this year, Bank Of Zhengzhou issued an announcement regarding the resolution of the 2023 Annual General Meeting of Shareholders. The announcement indicated that the proposal for the profit distribution plan for the 2023 fiscal year was opposed by 83.111365% of attending H shareholders, but it was still successfully passed.

Why was the shareholder meeting opposed? This is related to Bank Of Zhengzhou's "dividend history." The net income attributable to shareholders of the listed company from 2020 to 2023 was 3.168 billion yuan, 3.226 billion yuan, 2.422 billion yuan, and 1.85 billion yuan respectively, and there has been no cash dividend for four consecutive years since the dividend in 2019. Moreover, according to the announcement from Bank Of Zhengzhou, the profits for 2023 will be used to supplement the bank's capital instead of being distributed as dividends.

Earlier, at the Bank Of Zhengzhou's shareholder meeting in June 2021, the proposal on the "2020 profit distribution and capital reserve transfer to increase share capital plan" was rejected by the first H shareholder meeting in 2021. The core reason was also due to "no cash dividends this year," opting instead to implement a capital reserve conversion to increase shares. According to the announcement, the opposing proportion for this proposal was 35.07%, and it failed to obtain over two-thirds of the shareholders' approval. However, the proposal was subsequently passed.

It is worth noting that regarding the issue of "no dividends for many consecutive years," Bank Of Zhengzhou's Chairman Zhao Fei has previously stated that next year, Bank Of Zhengzhou will, in accordance with relevant laws and regulations and the provisions of Bank Of Zhengzhou's Articles of Association, comprehensively consider various factors related to profit distribution and share the results of development with shareholders.