Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Jiangsu Changhai Composite Materials Co., Ltd (SZSE:300196) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

How Much Debt Does Jiangsu Changhai Composite Materials Carry?

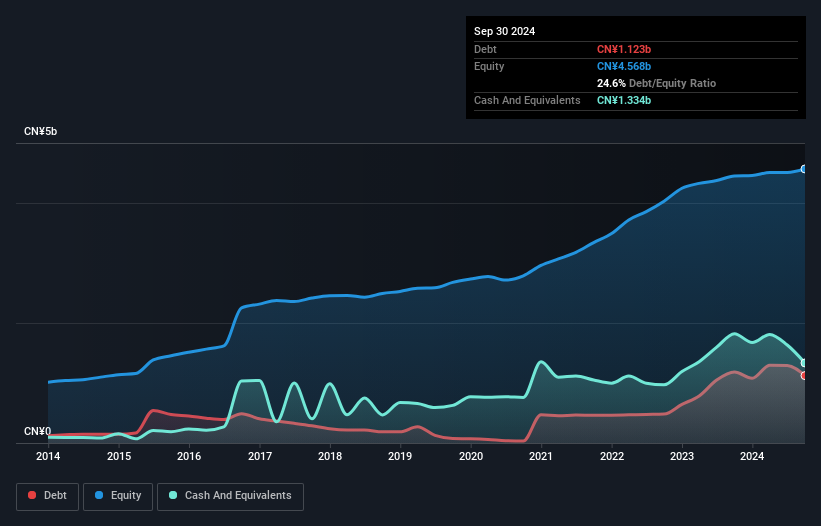

The image below, which you can click on for greater detail, shows that Jiangsu Changhai Composite Materials had debt of CN¥1.12b at the end of September 2024, a reduction from CN¥1.18b over a year. However, its balance sheet shows it holds CN¥1.33b in cash, so it actually has CN¥211.2m net cash.

How Healthy Is Jiangsu Changhai Composite Materials' Balance Sheet?

The latest balance sheet data shows that Jiangsu Changhai Composite Materials had liabilities of CN¥1.36b due within a year, and liabilities of CN¥921.4m falling due after that. Offsetting these obligations, it had cash of CN¥1.33b as well as receivables valued at CN¥992.6m due within 12 months. So these liquid assets roughly match the total liabilities.

The latest balance sheet data shows that Jiangsu Changhai Composite Materials had liabilities of CN¥1.36b due within a year, and liabilities of CN¥921.4m falling due after that. Offsetting these obligations, it had cash of CN¥1.33b as well as receivables valued at CN¥992.6m due within 12 months. So these liquid assets roughly match the total liabilities.

This state of affairs indicates that Jiangsu Changhai Composite Materials' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the CN¥4.60b company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, Jiangsu Changhai Composite Materials boasts net cash, so it's fair to say it does not have a heavy debt load!

The modesty of its debt load may become crucial for Jiangsu Changhai Composite Materials if management cannot prevent a repeat of the 40% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Jiangsu Changhai Composite Materials's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Jiangsu Changhai Composite Materials has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Jiangsu Changhai Composite Materials saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Jiangsu Changhai Composite Materials has net cash of CN¥211.2m, as well as more liquid assets than liabilities. So although we see some areas for improvement, we're not too worried about Jiangsu Changhai Composite Materials's balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Jiangsu Changhai Composite Materials has 2 warning signs we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.