As the demand slows down, it triggers a crisis in the Industry, and car sales in Europe declined last month.

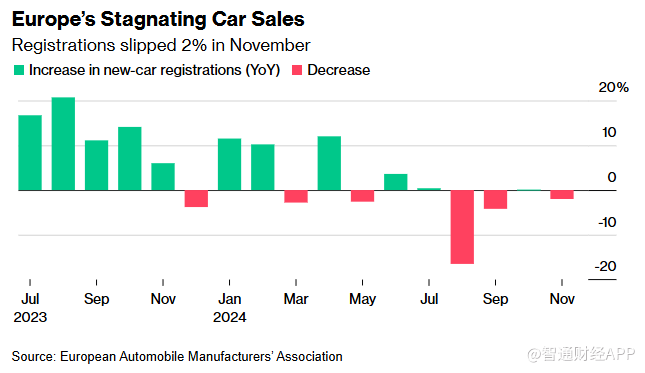

According to Zhito Finance APP, as demand slows down causing a crisis in the Industry, car sales in Europe dropped last month. The European Automobile Manufacturers Association (ACEA) announced that in November, new car registrations decreased by 2% compared to the same period last year, down to 1.06 million units, with France and Italy experiencing the most significant declines. Spain is the only major market in the region where sales increased.

Auto Manufacturers are struggling to address the sales slowdown in Europe, where consumers continue to face rising living costs. Some countries have eliminated subsidies for Electric Vehicles, further undermining the demand for low-emission cars, which are often more expensive than RBOB Gasoline vehicles.

Car sales in Europe are stagnant.

Car sales in Europe are stagnant.

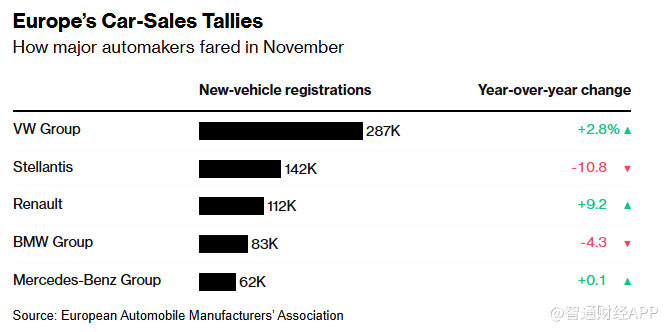

Major European Auto Manufacturers, including Volkswagen and Stellantis NV (STLA.US), are accelerating efforts to cut costs while trying to appease unions. This crisis has also impacted Auto Parts suppliers and startups like Swedish Battery company Northvolt AB, which applied for bankruptcy protection in November.

The European Automobile Manufacturers Association stated that in November, sales of pure Electric Vehicles in Europe slightly increased by 0.9% year-on-year, thanks to strong sales in the United Kingdom, where discounts stimulated demand. From January to November, sales of pure Electric Vehicles in Europe still saw a slight decline. Last month, registrations of Plug-in Hybrid Vehicles dropped by 8.6%.

As consumers in Europe struggle to adapt to electric vehicles, the registration numbers for non-plug-in hybrid vehicles are on the rise. These vehicles are powered by internal combustion engines and small batteries, with a 16% increase in sales in November.

Sales data for major auto manufacturers in Europe for November.

The impact of the slowdown in the auto industry is profound. Volkswagen plans to lay off workers and close factories at an unprecedented rate, while Stellantis is trying to recover from a disastrous year. If auto manufacturers fail to meet the stricter European auto emission regulations set to take effect next year, they will face billions of euros in fines each.

Suppliers have also announced significant cost-saving measures to cope with declining demand. As the crisis hits the supply chain of the auto industry, parts manufacturers like Bosch, ZF, and Schaeffler are laying off thousands of workers.

Other industries are finding opportunities in this situation. German military industry companies are recruiting auto workers, and radar manufacturer Hensoldt AG is in talks with two different auto parts suppliers to hire entire teams.

欧洲汽车销售停滞不前

欧洲汽车销售停滞不前