On December 19, the Hong Kong Stock Exchange, a wholly-owned subsidiary of the Hong Kong Stock Exchange (00388), published a consultation document to seek market opinions on proposals to optimize pricing and open markets in the initial public offering market.

The Zhitong Finance App learned that on December 19, the Hong Kong Stock Exchange, a wholly-owned subsidiary of the Hong Kong Stock Exchange (00388), published a consultation document to seek market opinions on suggestions relating to optimizing pricing and open markets in the initial public offering market. The consultation period lasts for three months and ends on March 19, 2025 (Wednesday). The Hong Kong Stock Exchange proposed a comprehensive reform of the initial public offering market pricing process and open market regulatory framework to ensure that its listing mechanism is attractive and competitive for existing and potential issuers.

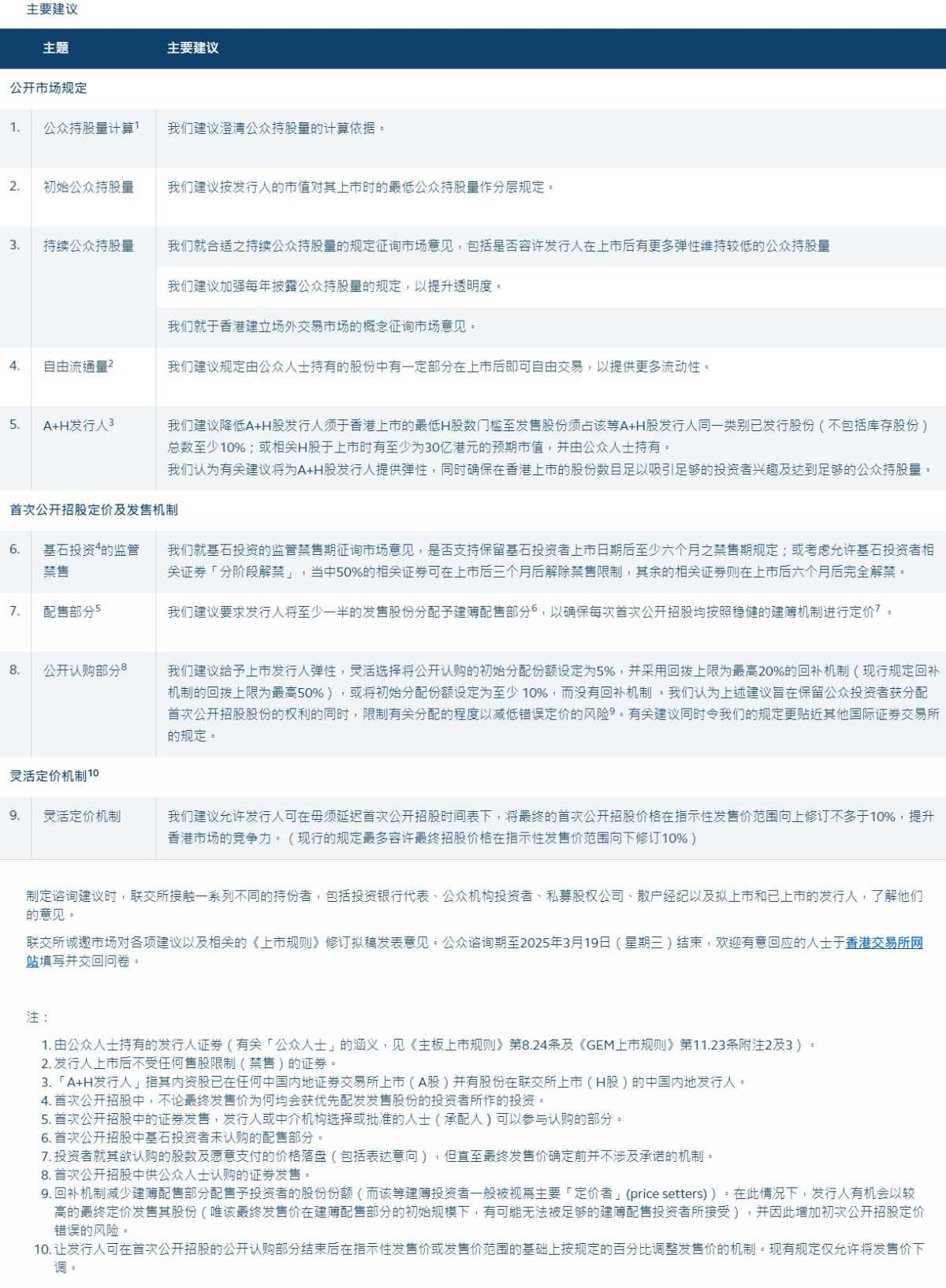

Specific measures include:

The proposal to optimize the pricing process in the initial public offering market is aimed at increasing the participation of “bargaining power” investors to reduce the large gap between the final offer price and the actual transaction price after listing.

The proposal to optimize the pricing process in the initial public offering market is aimed at increasing the participation of “bargaining power” investors to reduce the large gap between the final offer price and the actual transaction price after listing.

Review the regulations on open market requirements to ensure that issuers have sufficient shares for public investors to trade at the time of listing; at the same time, relax some restrictions on public shareholding (the amount currently stipulated may be very large in monetary terms).

“HKEx is committed to ensuring that our listing framework and continuing listing requirements are sound and competitive, and to strengthen Hong Kong's position as a leading global capital raising center,” said Wu Kit-ping, HKEx's Head of Listing. We are pleased to present new proposals to strengthen the initial public offering (IPO) pricing and offering mechanism to support high-quality companies from around the world to list and thrive in the Hong Kong capital market. We will continue to optimize various mechanisms to ensure that the listing system keeps pace with the times and meets the needs of the market. We are also recommending revising the open market regulations to enhance Hong Kong's reputation as an open and transparent market and increase its appeal to global issuers and investors.”

优化首次公开招股市场定价流程的建议旨在增加“具议价能力”投资者的参与,以减少最终发售价与在上市后的实际交易价格之间存在较大差距的情况。

优化首次公开招股市场定价流程的建议旨在增加“具议价能力”投资者的参与,以减少最终发售价与在上市后的实际交易价格之间存在较大差距的情况。