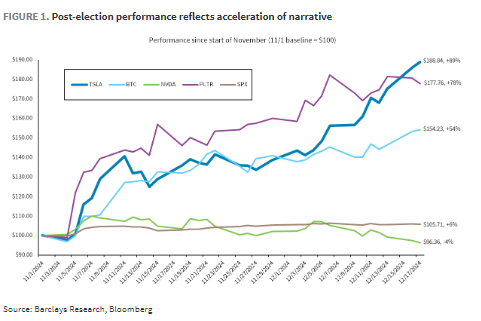

Barclays believes that the rise of Tesla and Bitcoin is driven by a similar logic: both are fueled by investors "crazy buying into the story," which has become disconnected from the fundamentals. Additionally, the frenzied Bid for Call Options after the election has also pushed up Tesla's stock price to some extent.

Musk has "bet" on Trump to welcome the "harvest season", and Tesla's stock price has soared.

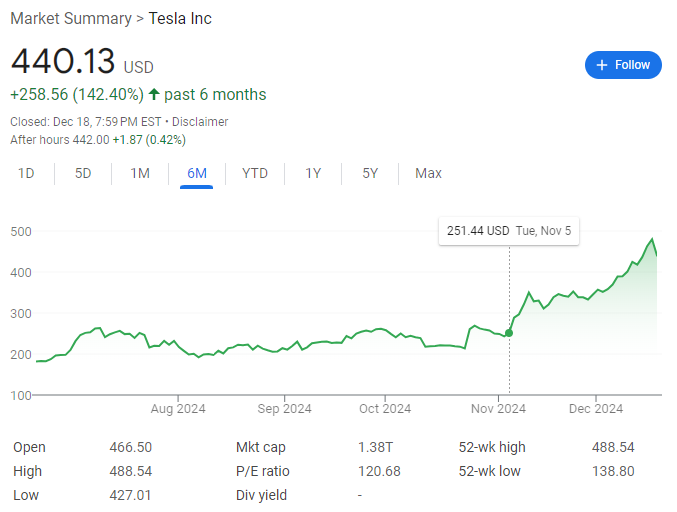

Since the U.S. election day on November 5, Tesla's stock price has accumulated a 75% increase, and over the past six months, it has more than doubled.

How to understand Tesla's current surge?

How to understand Tesla's current surge?

On December 19, Barclays Analysts Michael Tyndall and Pushkar Tendolkar stated in a report that Tesla's stock price surge is almost analogous to the explosive rise of Bitcoin.

Barclays believes that after the election, Tesla's stock price has nearly doubled, with the PE increasing from 80 times before the election to 145 times, while its fundamentals have not significantly improved—this phenomenon reflects that Tesla's narrative has been exaggerated, especially in the fields of autonomous driving and AI.

The election did not boost the fundamentals, but frenzied sentiment drove stock prices to soar.

Barclays stated in its report that the rise of Tesla and Bitcoin shares a similar logic: both are driven by investors 'going crazy for the story'.

The report suggests that for investors, Tesla's appeal lies not only in the auto sector but also in the company's potential in areas like robotics and AI. However, viewing Tesla as an AI company, it is still some distance from the over 300% increase seen by NVIDIA so far.

The report states that while the election drove Tesla's recent surge, the Trump administration's policies may be 'mixed blessings' for Tesla, with the fundamentals not being as 'positive' as the market imagines.

Firstly, Trump advocates cutting tax incentives for new energy vehicles, which could harm Tesla's competitors more, but at the same time, Tesla's market share of about two-thirds of the USA sales is also expected to be affected.

Secondly, Tesla is expected to benefit from relaxed regulations on autonomous driving, but if this relaxation occurs before Tesla makes comprehensive technological advancements, it may instead advantage Tesla's main competitor in autonomous driving, Waymo.

The report also mentions that Musk's 'successful alignment' has brought premium to Tesla's stock price but also entails corresponding risks, as Tesla is the only publicly listed company in Musk's business empire.

Barclays also believes that the rise in Tesla's stock price is driven by technical factors, especially unusual activity in the options market, leading to a phenomenon known as 'gamma squeeze'.

"Gamma squeeze" refers to the phenomenon where the increase in Call Options buying pushes up stock prices, causing more options to move into the money, leading traders to continue buying stocks to hedge their risk exposure, which further drives up stock prices.

The report states that since the election, the nominal trading volume of Tesla's Call Options has averaged 100 billion USD. On the election day, the nominal trading volume of Tesla's Call Options reached as high as 245 billion USD, while the trading volume of other options in the market only reached 310 billion USD.

Additionally, after the election, the Call-Put ratio for Tesla Options was 1.7 times, significantly higher than the average level of 1.4 times in 2024, reflecting that investors want to leverage to chase the rise.

The bank indicated that during the period when the stock rose by 4-5% (that is, a Market Cap fluctuation of 50-60 billion USD), the excessive activity in options played a certain role.

HSBC Analysts also stated in their latest report that compared to the "seven sisters" of the Technology stocks, Tesla's fundamentals cannot support the current price trend.

For the upcoming fourth financial quarter, HSBC predicts that Tesla will find it difficult to maintain the strong performance of the third quarter, and the gross margin may decline by 140 basis points quarter-on-quarter.

Moreover, considering that over the past year, Tesla's market share in key markets has generally declined, institutions' sales forecasts for the company have also shown early signs of divergence, new models are still 'pending', and the established production capacity is limited, HSBC believes that Musk's expectation of achieving a 20%-30% sales growth for Tesla by 2025 is 'unrealistic'.

如何理解特斯拉本轮大涨?

如何理解特斯拉本轮大涨?