During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the information technology sector.

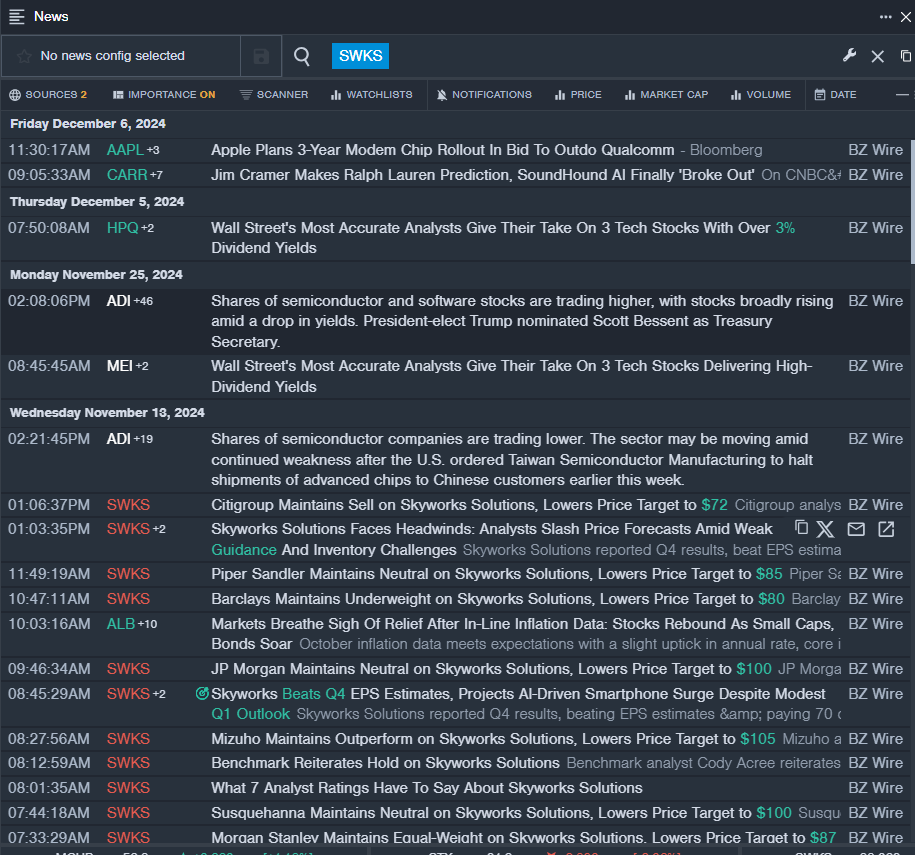

Skyworks Solutions, Inc. (NASDAQ:SWKS)

- Dividend Yield: 3.16%

- Citigroup analyst Atif Malik maintained a Sell rating and cut the price target from $83 to $72 on Nov. 13. This analyst has an accuracy rate of 83%.

- Piper Sandler analyst Harsh Kumar maintained a Neutral rating and cut the price target from $95 to $85 on Nov. 13. This analyst has an accuracy rate of 83%.

- Recent News: On Nov. 13, the company reported adjusted EPS of $1.55, which beat the analyst consensus estimate of $1.52. Quarterly sales of $1.025 million were in line with the analyst consensus estimate.

- Benzinga Pro's real-time newsfeed alerted to latest SWKS news.

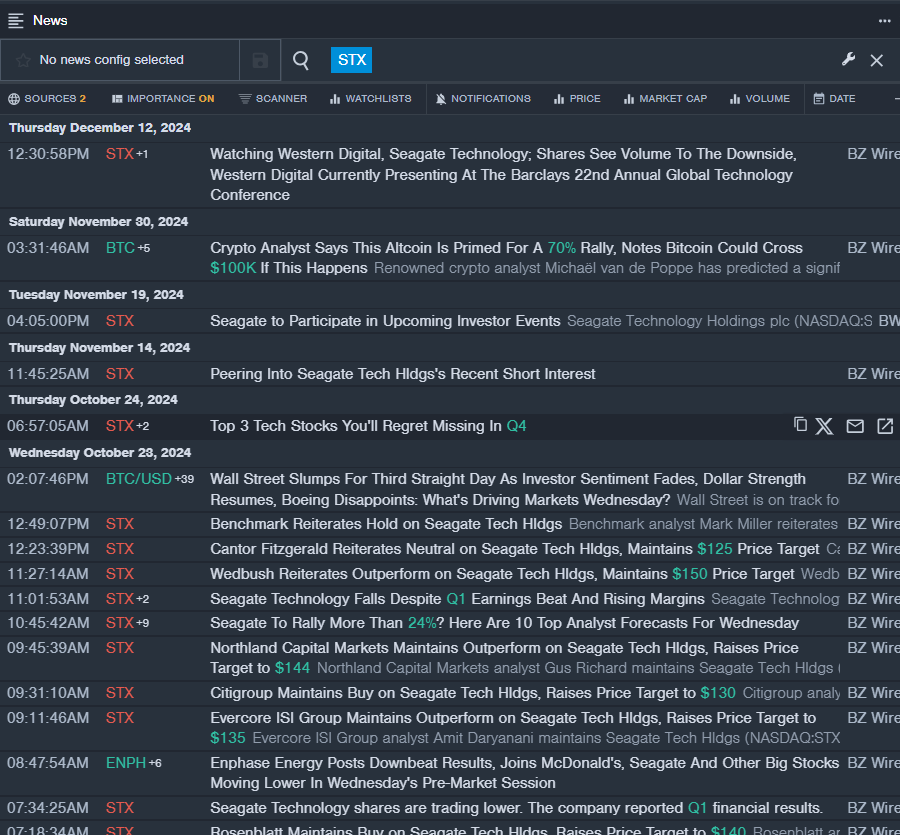

Seagate Technology Holdings plc (NASDAQ:STX)

- Dividend Yield: 3.14%

- Cantor Fitzgerald analyst C J Muse reiterated a Neutral rating with a price target of $125 on Oct. 23. This analyst has an accuracy rate of 72%.

- Wedbush analyst Matt Bryson reiterated an Outperform rating with a price target of $150 on Oct. 23. This analyst has an accuracy rate of 82%.

- Recent News: On Oct. 22, the company reported first-quarter revenue of $2.17 billion, beating the consensus of $2.119 billion.

- Benzinga Pro's real-time newsfeed alerted to latest STX news

Microchip Technology Incorporated (NASDAQ:MCHP)

- Dividend Yield: 3.24%

- B of A Securities analyst Vivek Arya downgraded the stock from Neutral to Underperform and cut the price target from $80 to $65 on Dec. 16. This analyst has an accuracy rate of 81%.

- Stifel analyst Tore Svanberg maintained a Buy rating and lowered the price target from $90 to $87 on Dec. 3. This analyst has an accuracy rate of 81%.

- Recent News: On Dec. 3, Microchip cut revenue guidance for the December 2024 quarter and announced manufacturing restructuring plans after a deep dive into the company's operations..

- Benzinga Pro's charting tool helped identify the trend in MCHP stock.

Read More:

Read More:

- Dow Dips Over 1,100 Points, Falling For 10th Session As Powell Adopts Hawkish Stance: Greed Index Moves To 'Fear' Zone