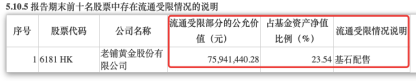

1. South China Emerging Economy 9-Month Hold ranks first in the annual performance list of QDII funds, boosted by the significant rise of its major holding, Lao Pu Gold, whose stock price has surged nearly 5 times since its listing, assisting in the growth of the fund's net value. 2. The fund holds a 23.54% stake in Lao Pu Gold, but due to the product's participation in the cornerstone placement of Lao Pu Gold, the stocks cannot be sold, resulting in a "passive" breach of the "double ten investment ratio limit."

On December 19, Financial Associated Press reported (Journalist Shen Shuhong) "A good wind helps propel me to the heights." A story of a new stock helping a public fund achieve the annual championship in QDII product performance is currently being played out in the capital markets.

As of December 18, South China Emerging Economy 9-Month Hold, managed by Wang Shicong, ranks first in the annual performance list of QDII funds with an annual return of 55.86%. Its top holding, Lao Pu Gold, has drastically boosted the net value of this QDII fund with its stock price skyrocketing nearly 5 times since its listing.

Although the fair value of the fund's holdings in Lao Pu Gold accounts for as much as 23.54% of the fund's net asset value, greatly exceeding the 10% position limit for a single stock, due to the prior participation in the cornerstone placement of Lao Pu Gold, and with the six-month lock-up period yet to expire, the stocks cannot be sold, and the fund can only "passively" breach the "double ten investment ratio limit."

Although the fair value of the fund's holdings in Lao Pu Gold accounts for as much as 23.54% of the fund's net asset value, greatly exceeding the 10% position limit for a single stock, due to the prior participation in the cornerstone placement of Lao Pu Gold, and with the six-month lock-up period yet to expire, the stocks cannot be sold, and the fund can only "passively" breach the "double ten investment ratio limit."

In addition to the above product, Huabao Nasdaq Select, Invesco Great Wall Nasdaq Technology Market Cap Weighted ETF, and Huaxia Global Technology Pioneer RMB, and Franklin Global Consumer Select A RMB have all exceeded a net value growth rate of 40% this year. Overall, nearly 90% of all QDII funds have achieved positive returns this year.

The QDII performance champion that was "limited for sale".

Time, fate, and luck are the true sentiments of many industry insiders regarding this product obtaining the annual QDII performance champion.

With less than 10 trading days left until the end of 2024, South China Emerging Economy 9-Month Hold leads significantly with over an 11% performance advantage over the second place in the QDII annual performance list - Huabao Nasdaq Select.

As the top holding stock of this product, Lao Pu Gold's stock price soared to 229 HKD per share within about six months of its listing this year, reaching an astonishing increase of around 5 times. This undoubtedly became the 'number one contributor' to the strong performance of the Southern China Emerging Economy's 9-month hold under Wang Shicong's leadership this year.

Looking at the holdings at the end of the third quarter, the fair value of Lao Pu Gold held by the aforementioned product accounted for as much as 23.54% of the net asset value of the fund, significantly exceeding the 10% position limit for holding a single stock. However, due to the previous cornerstone placement participation in Lao Pu Gold and the ongoing six-month lock-up period, the stocks cannot be sold, forcing the fund to breach the 'double ten investment ratio limit'.

Adjacent to Luxury Goods and positioned as high-end, Lao Pu Gold is considered by Guozheng International to have the potential to become a luxury product. The company's performance in the first half of this year was impressive: revenue reached 3.52 billion yuan, an increase of 148.34% year-on-year; the company's profit attributable to owners reached 0.588 billion yuan, an increase of 198.75% year-on-year. Compared to peers, the company boasts a leading net margin. In 2023, Lao Pu Gold's net margin was 13.1%. Lao Feng Xiang and Chow Tai Seng Jewellery had net margins of only 4.17% and 8.06% respectively.

According to the prospectus, as of May 2024, Lao Pu Gold has only opened 33 stores nationwide. Taking Beijing SKP as an example, Lao Pu Gold has set up two stores in this mall, generating a total revenue of 0.336 billion yuan in 2023, with a monthly sales per square meter exceeding 0.44 million yuan. In contrast, the average monthly sales per square meter at Beijing SKP that year was only 0.0177 million yuan.

In addition to providing great support for the net asset growth of Southern China Emerging Economy's 9-month hold, other heavyweights in this product also contributed significantly to its performance.

In this product's list of heavyweights at the end of the third quarter, POP MART, Meituan, Tesla, SCHOLAR EDU, and others have all experienced soaring stock prices this year. Among them, from the beginning of the year to now, POP MART's stock price has increased by 371.82%, while Meituan and Tesla's stock prices have risen by 95.48% and 93.12% respectively.

Heavyweights of Southern China Emerging Economy's 9-month hold at the end of the third quarter.

Nearly 90% of the products achieved positive returns this year.

For this year's capital markets, it has become an undeniable fact that the QDII market has achieved relatively high returns compared to other funds.

According to Wind data, as of December 18, among the 276 QDII funds (excluding new products established this year), 246 funds have achieved positive returns this year, accounting for 89.13%, with an average yield of 15.65%. There are 179 QDII funds with annual net value returns exceeding 10%, 43 exceeding 30%, and 5 exceeding 50%.

In contrast, the Southern China Emerging Economy fund has achieved a return of 55.86% over 9 months, while the Huabao Nasdaq Select, Invesco Nasdaq Technology Market Cap Weighted ETF, and Huaxia Global Technology Pioneer RMB, and Franklin Global Consumer Select A RMB have all surpassed 40% in net value growth rates, with annual returns of 44.12%, 42.92%, 42.82%, and 40.11% respectively.

In contrast, there are currently still 15 QDII products that have lost more than 10% this year. Among them, the Huabao Overseas China Growth, co-managed by Yang Yang and Zhou Jing, has a net value growth rate of only -17.47% this year. This product mainly focuses on sectors that will benefit in the long term during China's economic transformation and upgrading process, including upstream sectors revitalizing manufacturing and sectors related to new productivity; its major holdings include CMOC Group Limited, Zijin Mining Group, COSCO Shipping Holdings, and China Coal Energy among other resource stocks.

The Jia Shi Hang Seng Medical Care Connect managed by Wang Zihan, the Bosera Hang Seng Medical Care ETF managed by Wan Qiong, and Morgan China's Biomedical co-managed by Ye Min and Zhao Longlong have experienced losses of 16.08%, 15.41%, and 14.78% respectively this year.

虽然该基金持有老铺黄金的公允价值占基金资产净值的比例高达23.54%,大幅超过基金持有单只个股10%的仓位上限,但由于南方中国新兴经济9个月持有此前参与了老铺黄金的基石配售,在半年锁定期尚未结束的情形下,股票无法卖出,基金也只能“被动”突破“双十投资比例限制”。

虽然该基金持有老铺黄金的公允价值占基金资产净值的比例高达23.54%,大幅超过基金持有单只个股10%的仓位上限,但由于南方中国新兴经济9个月持有此前参与了老铺黄金的基石配售,在半年锁定期尚未结束的情形下,股票无法卖出,基金也只能“被动”突破“双十投资比例限制”。