Whales with a lot of money to spend have taken a noticeably bearish stance on Intel.

Looking at options history for Intel (NASDAQ:INTC) we detected 31 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 54% with bearish.

From the overall spotted trades, 17 are puts, for a total amount of $2,575,335 and 14, calls, for a total amount of $697,550.

From the overall spotted trades, 17 are puts, for a total amount of $2,575,335 and 14, calls, for a total amount of $697,550.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $14.0 to $30.0 for Intel over the recent three months.

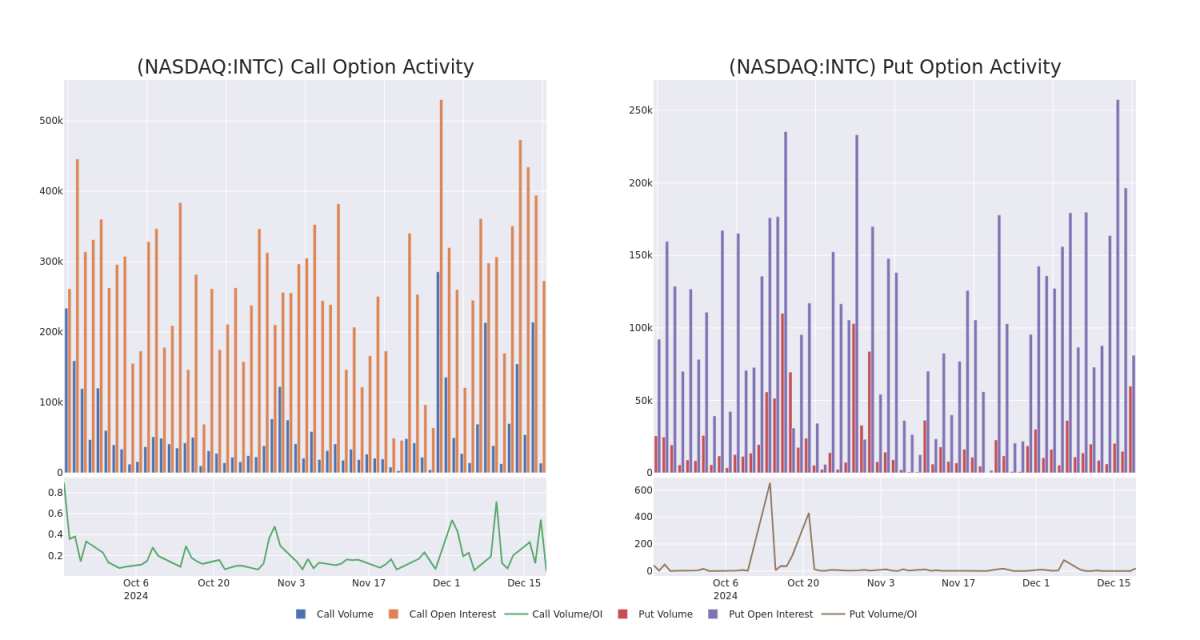

Insights into Volume & Open Interest

In today's trading context, the average open interest for options of Intel stands at 17705.65, with a total volume reaching 73,527.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Intel, situated within the strike price corridor from $14.0 to $30.0, throughout the last 30 days.

Intel Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTC | PUT | TRADE | BULLISH | 04/17/25 | $4.8 | $4.7 | $4.71 | $23.00 | $471.0K | 2.8K | 9.8K |

| INTC | PUT | SWEEP | BULLISH | 04/17/25 | $4.75 | $4.7 | $4.7 | $23.00 | $465.3K | 2.8K | 4.9K |

| INTC | PUT | SWEEP | BULLISH | 04/17/25 | $4.8 | $4.75 | $4.75 | $23.00 | $452.2K | 2.8K | 6.4K |

| INTC | PUT | SWEEP | BEARISH | 04/17/25 | $7.1 | $7.05 | $7.1 | $26.00 | $212.2K | 994 | 300 |

| INTC | PUT | SWEEP | BEARISH | 09/19/25 | $6.95 | $6.85 | $6.95 | $25.00 | $207.8K | 28.5K | 300 |

About Intel

Intel is a leading digital chipmaker, focused on the design and manufacturing of microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors and was the prime proponent of Moore's law for advances in semiconductor manufacturing. Intel remains the market share leader in central processing units in both the PC and server end markets. Intel has also been expanding into new adjacencies, such as communications infrastructure, automotive, and the Internet of Things. Further, Intel expects to leverage its chip manufacturing capabilities into an outsourced foundry model where it constructs chips for others.

After a thorough review of the options trading surrounding Intel, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Intel's Current Market Status

- Trading volume stands at 37,848,879, with INTC's price down by -0.72%, positioned at $19.16.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 35 days.

What Analysts Are Saying About Intel

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $21.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from B of A Securities has revised its rating downward to Underperform, adjusting the price target to $21.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Intel with Benzinga Pro for real-time alerts.