Zhejiang Juli Culture Development Co.,Ltd. (SZSE:002247) shareholders might be concerned after seeing the share price drop 14% in the last week. But that doesn't change the reality that over twelve months the stock has done really well. Looking at the full year, the company has easily bested an index fund by gaining 23%.

While the stock has fallen 14% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

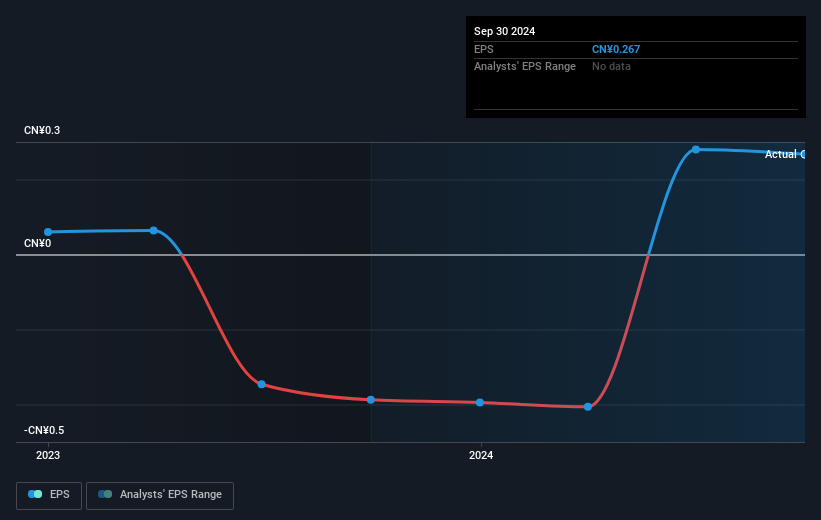

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Zhejiang Juli Culture DevelopmentLtd went from making a loss to reporting a profit, in the last year.

Zhejiang Juli Culture DevelopmentLtd went from making a loss to reporting a profit, in the last year.

The result looks like a strong improvement to us, so we're not surprised the market likes the growth. Generally speaking the profitability inflection point is a great time to research a company closely, lest you miss an opportunity to profit.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Zhejiang Juli Culture DevelopmentLtd's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Zhejiang Juli Culture DevelopmentLtd shareholders have received a total shareholder return of 23% over one year. Notably the five-year annualised TSR loss of 0.5% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Zhejiang Juli Culture DevelopmentLtd you should be aware of, and 1 of them shouldn't be ignored.

We will like Zhejiang Juli Culture DevelopmentLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.