The performance aspect is poor.

On December 20, the "monster stock" Guangdong Guangzhou Daily Media hit the limit down, having recorded a three-day rise previously. The current stock price of Guangdong Guangzhou Daily Media is 9.11 yuan, with a total of 8 increases over the past 11 days. Since September this year, Guangdong Guangzhou Daily Media has seen a cumulative increase of over 180%. From December 6 to December 19, the stock price increased by 105.27%.

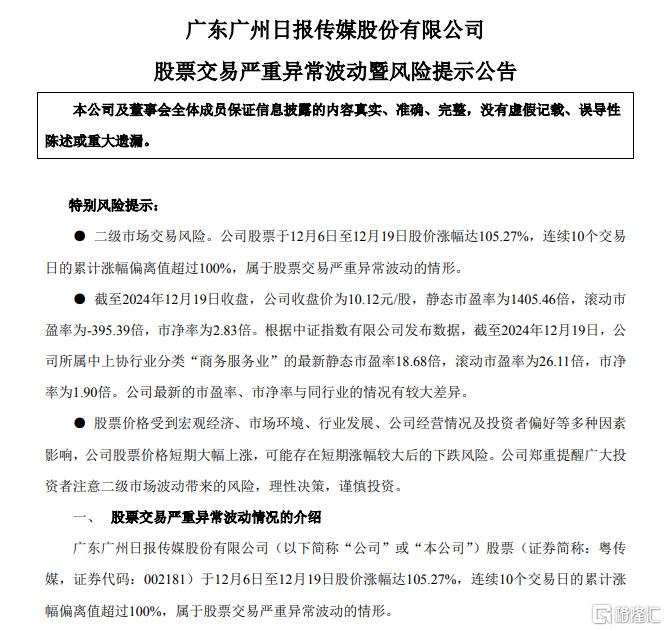

On the evening of December 19, the company announced that the stock price from December 6 to December 19 increased by 105.27%, with the cumulative increase over 10 trading days deviating by more than 100%, which belongs to a case of severe abnormal fluctuations in stock trading. The company's latest PE and PB are significantly different from those of its Industry peers. The company’s stock price has surged significantly in the short term, which may pose a risk of decline after such a large short-term increase.

Market analysis suggests that the abnormal movement in the price of Guangdong Guangzhou Daily Media is related to the recent hot topic of "initial public offering economy." This GAINIANBANKUAI includes aspects such as millet economy, edge AI, short dramas, video content generation, concerts, and games.

Market analysis suggests that the abnormal movement in the price of Guangdong Guangzhou Daily Media is related to the recent hot topic of "initial public offering economy." This GAINIANBANKUAI includes aspects such as millet economy, edge AI, short dramas, video content generation, concerts, and games.

Guangdong Guangzhou Daily Media's main Business involves short dramas, Asia Vets imaging, and AI entertainment, which has garnered market attention. At the same time, the company frequently appears on the leaderboard, indicating intense capital competition.

Despite the strong stock performance, the financial results of Guangdong Guangzhou Daily Media are not ideal.

Net income decreased by 85383.7% in the first three quarters.

According to data, Guangdong Guangzhou Daily Media achieved revenue of 0.406 billion yuan in the first three quarters of this year, a year-on-year increase of 7.54%, but the net income was a loss of 38.033 million yuan, a year-on-year decrease of 85383.7%. In the first half of 2024, the company achieved revenue of 0.262 billion yuan, a year-on-year increase of 7.59%, but the net profit attributable to the parent company was a loss of 55.4891 million yuan.

Looking at it over a longer period, the performance has continued to decline from 2021 to 2023.

From 2021 to 2023, Guangdong Guangzhou Daily Media's losses were 90.0954 million yuan, 38.4927 million yuan, and 8.3602 million yuan respectively, representing year-on-year decreases of 71.26%, 57.28%, and 78.28%.

Continuous penalties.

Guangdong Guangzhou Daily Media has frequently faced regulatory penalties, which further increases the company's uncertainty.

Guangdong Guangzhou Daily Media received a warning letter from the Guangdong Securities Regulatory Commission and a supervision letter from the Shenzhen Stock Exchange in June this year, due to errors in accounting corrections and retrospective adjustments, which led to a significant discrepancy between the performance forecast disclosed by Guangdong Guangzhou Daily Media on January 31, 2024, and the 2023 annual report, while also making the financial data in the 2022 annual report and the 2023 semi-annual report inaccurate.

In addition, during the acquisition process of Shanghai Champs Elysees Advertising Media Co., Ltd., the company has also been punished by the Securities Regulatory Commission due to issues of inflated revenue and profits.

Despite this, the stock price of Guangdong Guangzhou Daily Media has recently shown abnormal fluctuations, with 8 out of the last 11 trading days hitting the price limit, resulting in a total increase of 95%.

This rapid increase in stock price has also raised concerns in the market. Due to the company's latest PE and PB being significantly different from those of the industry, and the substantial increase in stock price in the short term, there is a considerable risk of decline. Therefore, although the market is optimistic about the future of Guangdong Guangzhou Daily Media, investors still need to be cautious about its potential risks.

市场分析认为,

市场分析认为,