科特估和中特估齊飛

硬科技再起一波,寒武紀漲6.28%,再創歷史新高,年內漲幅達400.85%,市值突破2800億。

對於飆漲的股價,有分析人士認爲,除了受美股芯片股的刺激之外,最近各大指數調倉也在一定程度上助力了寒武紀的爆發。寒武紀被調入上證50指數、中證A500指數,新的指數樣本在12月13日收市後生效。

寒武紀的股價就從2023年初最低點54.15元/股,上漲到最新收盤價675.95元,區間漲幅高達到驚人的1148%,成爲同期A股唯一的10倍芯片股。

寒武紀的股價就從2023年初最低點54.15元/股,上漲到最新收盤價675.95元,區間漲幅高達到驚人的1148%,成爲同期A股唯一的10倍芯片股。

面對股價屢創新高,有市場人士在提醒:寒武紀的業績與股價表現是嚴重背離的,寒武紀從2020年上市到2023年已連續多年虧損。

2021年至2023年,寒武紀營業收入分別爲7.21億元、7.29億元、7.09億元;2024年前三季度的營業收入爲1.85億元。寒武紀歸母淨利潤,2021年虧8.25億元,2022年虧12.56億元,2023年虧8.48億元,2024年前三季度虧7.24億元。

網友辣評:寒武紀今年前三季度營收不到2億,虧了7億,市值2800億,真沒想到,看不懂,但真的挺震撼的。

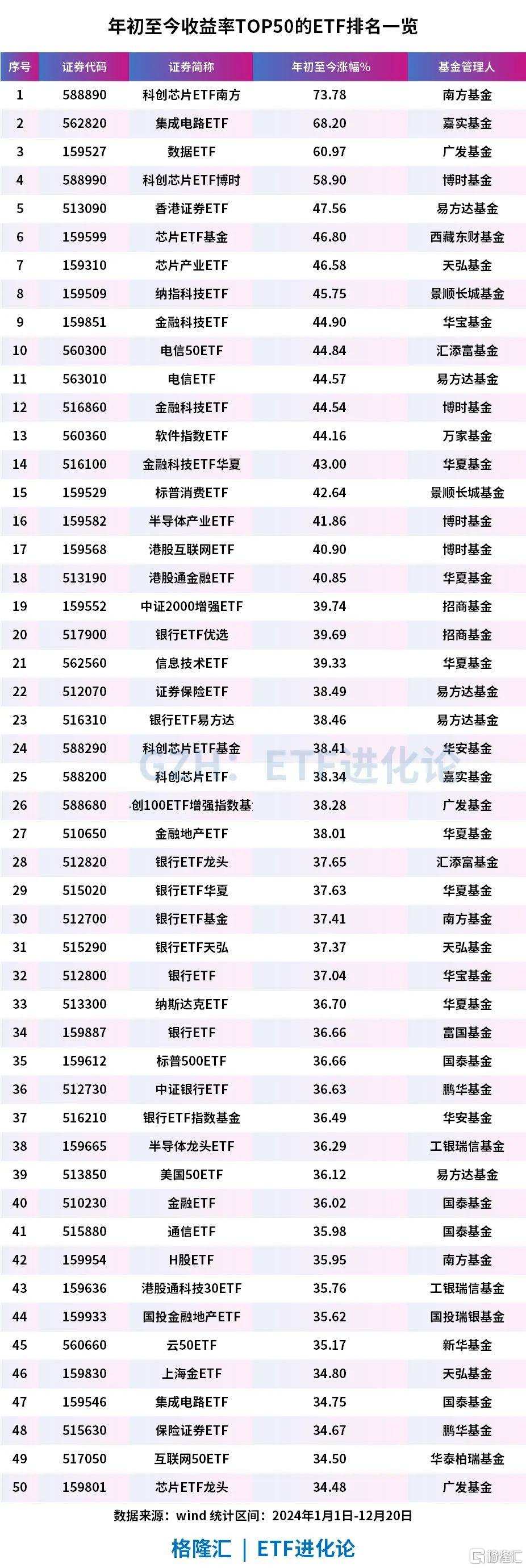

今年以來,市場科特估與中特估齊飛。科特估代表科創芯片ETF,中特估代表銀行ETF年內漲幅居前。

近期A股持續震盪,高股息信仰再度捲土重來。

作爲資本市場看影響市場定價的重要指標——10年期國債收益率,其變動影響着其他資產定價。作爲無風險利率的代表之一,近期該指標已罕見下破1.8%,創出2007年底以來的新低。

在無風險利率下行和年末避險需求增加的背景下,資金再度蜂擁至紅利資產。

其中,中證紅利低波指數年內漲幅超15%,相關ETF更是吸引大量資金流入。

數據顯示,近一個月以來,紅利主題ETF獲得了近200億元的淨流入。今年以來紅利相關ETF規模呈現爆發式增長,截至12月19日,紅利主題ETF總規模已突破千億大關。

(本文內容均爲客觀數據信息羅列,不構成任何投資建議)

(本文內容均爲客觀數據信息羅列,不構成任何投資建議)資金爲何湧入紅利資產?紅利資產由於多處在行業成熟期,競爭格局穩定,龍頭企業資本擴張意願下降,使得有更多資本提高分紅擴大投資者回報。

因此,在無風險利率持續下行背景下,紅利資產的高分紅屬性,吸引了大量追求穩健的資金。以保險資金爲例,2021年到2023年對高股息品種的配置比例呈上行趨勢。

Wind數據顯示,年初至今險資多次舉牌A股、H股上市公司,主要集中在公用事業、環保、銀行等高股息行業,大多爲紅利資產。

總體上,在利率下行的資產荒背景下,紅利資產由於股息率較高吸引資金配置。但另一方面,估值和股息率往往也有負相關性,一旦資金快速湧入推升短期估值使得股息率下降,也易引發震盪出現情緒波動。

A股迎來歷史性時刻。今年,A股上司公司分紅與回購態勢強勁,金額均創歷史新高,其中註銷式回購的逐步普及成爲顯著特徵,深刻影響着市場格局與投資者預期。

具體來看,多達3967家上市公司發佈現金分紅公告,涉及金額高達2.35萬億元。2114家上市公司實施回購,金額合計達1626.81億元。

A股再融資金額創17年新低。A股定增、可轉債和配股在內,這幾項加起來大約2152億元,同比大幅度下降71%。

從目前數據看,A股的分紅和回購金額大幅超過IPO、再融資以及股東減持的總金額。

近年來在政策的持續推動下,市場更加註重投資者回報,A股不再是圈錢市場了,逐步從融資市場轉向投資市場。

參照美股經驗,投資者回報的提升對市場長期走勢影響深遠。

數據顯示,美股最大買家其實是企業自身。2007-2023年期間,標普500指數成分股累計回購約9.5萬億美元,同期分紅總額約6.97萬億美元,IPO和再融資總額約2.17萬億美元。

分紅回購金額大幅超過融資金額,上市公司的分紅回購成了美股最重要的買家之一,真金白銀的流入推動了股市的長牛。

興業證券全球首席策略分析師張憶東日前表示,2024年,A股一改前幾年淨融資的格局,再融資、IPO融資、股東減持金額遠低於分紅和回購,A股市場開始明顯地走向淨回報。

高盛首席中國股票策略師劉勁津表示,A股上市公司今年接連回購,有望爲投資者帶來額外收益,明年回購總量有望較今年實現翻倍,預計明年上市公司股息和回購總額有望超過3萬億元。

今天週五啦,祝各位週末愉快,散會!