The rise of Bitcoin is partly attributed to Trump's victory in the USA elections, with the market generally expecting a friendly stance towards Cryptos from the Trump administration. According to data from Hedge Fund Research, Funds adopting a crypto strategy averaged a 46% increase in November, with an ROI of 76% year-to-date.

Recently, the price of Bitcoin broke the $0.1 million mark, sparking a new wave of enthusiasm, and some hedge funds focused on Cryptos have made substantial profits.

According to data from Hedge Fund Research, funds adopting Cryptos strategies saw an average increase of 46% in November, with a year-to-date ROI of 76%.

This surge is partly attributed to Trump's victory in the USA election, as the market widely expects that the Trump administration's friendly stance towards Cryptos will sharply contrast with the previous relatively conservative position of the Biden administration. Damien Miller, managing partner of MP Alpha Capital, stated:

This surge is partly attributed to Trump's victory in the USA election, as the market widely expects that the Trump administration's friendly stance towards Cryptos will sharply contrast with the previous relatively conservative position of the Biden administration. Damien Miller, managing partner of MP Alpha Capital, stated:

"Trump's election is good news for digital Assets, as it will provide clearer regulations and create a more friendly and collaborative environment for Bitcoin and blockchain."

Bitcoin breaking the $100,000 mark brings a bumper harvest for Cryptos Funds.

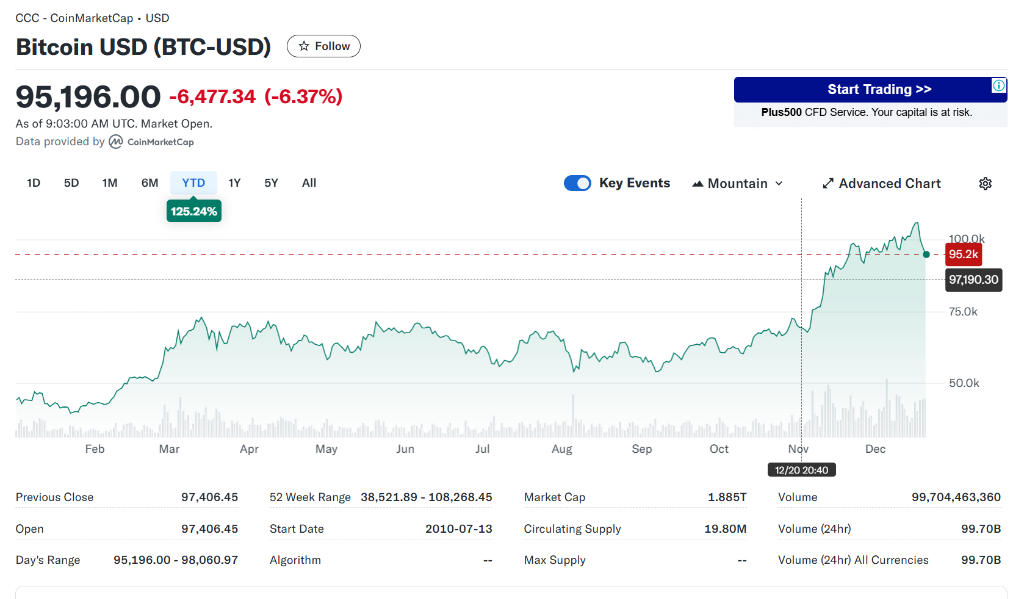

So far this year, the price of Bitcoin has risen by 130% to about $100,000, driving the total market capitalization of major Cryptos from $1.8 trillion to $3.5 trillion. As of the time of this report, Bitcoin has fallen to $95,196 per coin.

Investors generally believe that the Trump administration's attitude towards Cryptos will be more friendly than the previous administration. According to Hedge Fund Research data, funds adopting a crypto strategy rose an average of 46% in November, with a year-to-date ROI of 76%.

This performance far exceeds the industry average, as the average yield of hedge funds during the same period was only 10%. Brevan Howard Asset Management and billionaire Mike Novogratz's crypto investment management company Galaxy Digital are the biggest winners in this wave of digital asset surges.

According to the Financial Times in the United Kingdom, citing informed sources, Brevan Howard's main crypto fund rose 33% in November, with a cumulative increase of 51% in the first 11 months of this year. As one of the largest hedge fund management companies, Brevan Howard launched a dedicated crypto Business in 2021, managing assets up to 35 billion USD.

Galaxy's hedge fund strategy rose 43% in November, and 90% cumulatively in 2024. This New York-based company has more than doubled its managed assets to 4.8 billion USD over the past two years by acquiring assets from bankrupt crypto companies.

Analysts believe that despite the crypto market's decline this week due to the Federal Reserve hinting that interest rate cuts next year may be less than expected, this does not overshadow its overall strong performance.

Is the regulatory environment changing? Institutional investors are entering the market.

In 2022, the industry was plunged into a deep crisis due to the collapse of Sam Bankman-Fried's FTX Exchange, with Bitcoin prices dropping to around 15,500 USD at one point. However, in January 2024, the USA Securities and Exchange Commission approved 11 Exchange-Traded Bitcoin funds, opening the door for institutional and retail investors to enter the crypto market.

Last week, the world's largest Asset Management company, Blackrock, also stated that they believe there is ample reason to include Bitcoin in a multi-asset investment portfolio.

In addition, some macro hedge funds have also increased their investments in digital assets. MP Alpha Capital's 20 million dollar Global macro hedge fund has risen by more than 30% this year. The company's partner, Miller, stated that their investment strategy revolves around the institutional adoption of digital assets, as well as a macro backdrop of loose monetary policy, a weak dollar, and ample liquidity.

We have performed well in digital assets: Bitcoin, Ethereum, and Bitcoin miners.

Nevertheless, several managers warned that the surge in Bitcoin should prompt investors to pause for a review. Huang from NextGen Digitalventure stated that although he is Bullish on Bitcoin and Cryptos in the long term, 'no asset will rise in a straight line.'

这波涨势部分归功于特朗普在美国大选中获胜,市场普遍预期,特朗普政府对加密货币友好的立场,将与拜登政府此前的相对保守态度形成鲜明对比。MP Alpha Capital的管理合伙人Damien Miller表示:

这波涨势部分归功于特朗普在美国大选中获胜,市场普遍预期,特朗普政府对加密货币友好的立场,将与拜登政府此前的相对保守态度形成鲜明对比。MP Alpha Capital的管理合伙人Damien Miller表示: