Welcome to the Markets Weekly Update, the column committed to delivering essential investing insights for the week and key events that could move markets in the week ahead.

Macro Matters

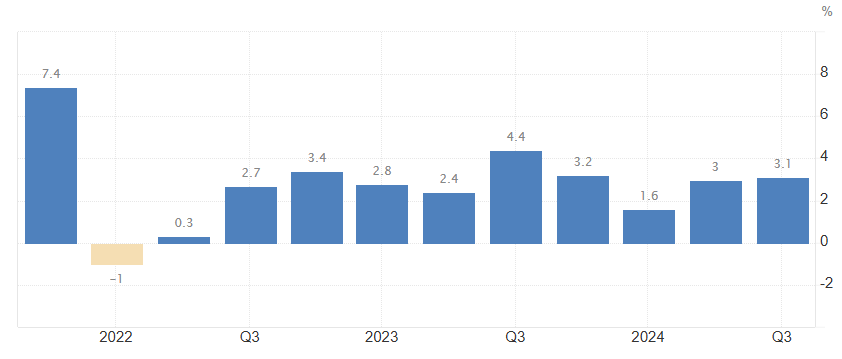

U.S. Economy Expands by 3.1% in Q3 2024, Surpassing Previous Estimates

The US economy expanded an annualized 3.1% in the third quarter of 2024, higher than 2.8% in the second estimate and above 3% in Q2. It is the biggest growth rate so far this year. Personal spending increased at the fastest pace since Q1 2023 (3.7% vs 3.5% in the second estimate). It was boosted by a 5.6% surge in consumption of goods (vs 5.6% in the second estimate) and a robust spending on services (2.8% vs 2.6%). Also, fixed investment rose more than anticipated (2.1% vs 1.7%). Investment in equipment soared (10.8% vs 10.6%) while structures (-5% vs -4.7%) and residential investment (-4.3% vs -5%) declined. Government consumption growth was also revised higher to 5.1% (vs 5%). In addition, the contribution of net trade was less negative (-0.43 pp vs -0.57 pp in the second estimate), with both exports (9.6% vs 7.5%) and imports (10.7% vs 10.2%) revised higher. On the other hand, private inventories dragged 0.22 pp from the growth, compared to a 0.11 pp drop in the second estimate.

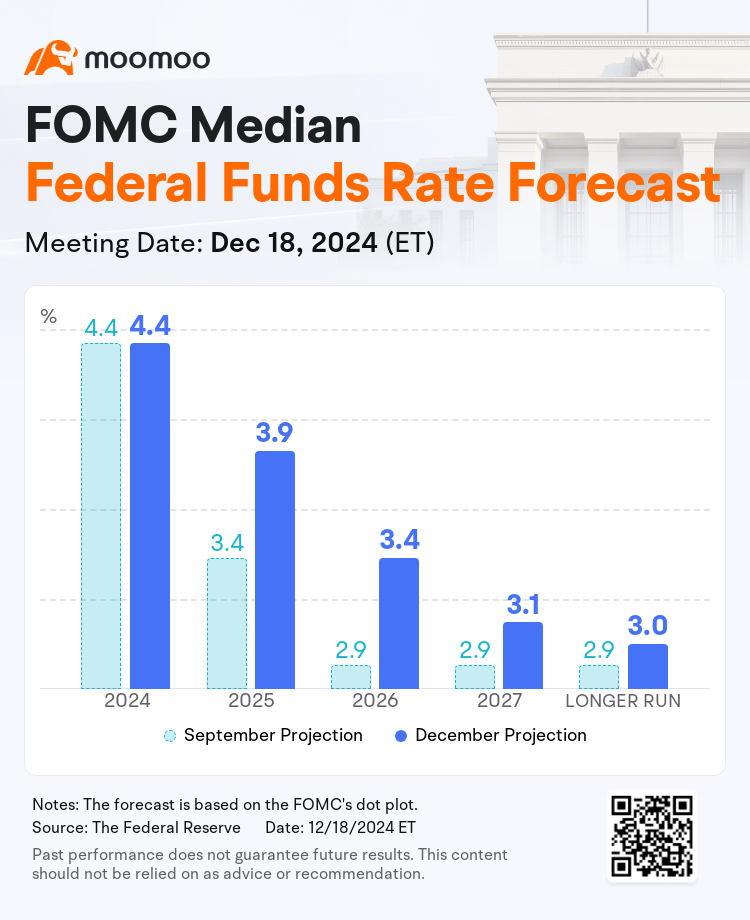

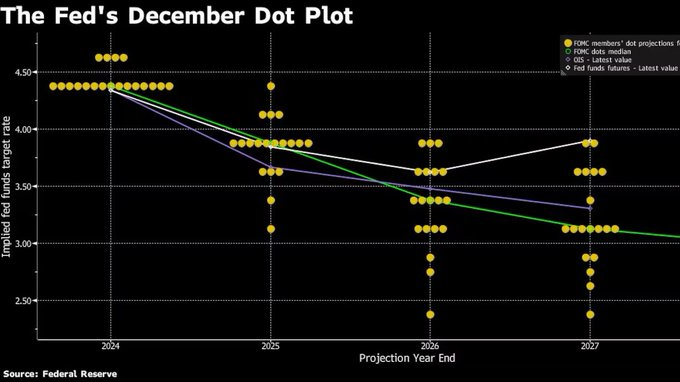

Federal Reserve Cuts Federal Funds Rate, Forecasts Slower Reductions Amid Rising Inflation Concerns

Federal Reserve Cuts Federal Funds Rate, Forecasts Slower Reductions Amid Rising Inflation Concerns

The Federal Open Market Committee lowered the target federal funds rate by 25 basis points and forecast a slower pace of reductions next year as policymakers raised their inflation outlook.

The target rate was lowered to a range of 4.25%-4.5% Wednesday, the Federal Reserve said in a statement Wednesday at the end of policymakers' two-day meeting. While the previous decision to lower rates was unanimous, this time around, Federal Reserve Bank of Cleveland Beth M. Hammack voted against the move, preferring instead to hold the benchmark borrowing cost steady at 4.5% to 4.75%.

Japan Experiences Sharp Inflation Increase in November 2024, Reaching Highest Rate Since Last Year

The annual inflation rate in Japan climbed to 2.9% in November 2024 from 2.3% in the prior month, marking the highest reading since October 2023. Food prices rose at the steepest pace in eight months (4.8% vs 3.5% in October), with fresh vegetables and fresh food contributing the most to the upturn. Meantime, electricity prices (9.9% vs 4.0%) and gas prices (5.6% vs 3.5%) sharply accelerated with the absence of energy subsidies since May. Additional upward pressure also came from housing (0.9% vs 0.8%), clothing (2.9% vs 2.8%), transport (0.9% vs 0.5%), furniture and household utensils (3.7% vs 4.4%), healthcare (1.6% vs 1.7%), recreation (4.5% vs 4.3%), and miscellaneous items (1.1% vs 1.1%). In contrast, prices fell further for communication (-3.0% vs -3.5%) and education (-1.0% vs -1.0%). The core inflation rate rose to a 3-month high of 2.7% in November, up from 2.3% in October and surpassing estimates of 2.6%. Monthly, the CPI increased by 0.6%, the highest figure in 13 months.

Smart Money Flow

Federal Reserve officials expect only two quarter point rate reductions for 2025.

The long run neutral rate is raised to 3%.

Gold Prices Dip Amid Hawkish Federal Reserve Outlook and Challenges in Future Demand

Gold hovered around $2,600 per ounce on Friday, poised for a weekly decline under the influence of a hawkish Federal Reserve. The Fed indicated only two potential rate cuts next year, reflecting a cautious approach to monetary easing. Strong US GDP data and increased consumer spending further supported a slower easing pace. This environment has dampened gold demand, as reduced monetary easing lessens the appeal of non-yielding assets like bullion. Moreover, gold's near-term outlook faces added pressure from declining physical demand in India, where a significant drop in December gold imports is expected.

Bitcoin Eyes $200,000 Milestone by 2025 Amidst Robust Growth and Favorable Market Conditions

Bitcoin has seen a historic rally in 2024, with its price soaring over 150% and breaking the $100,000 mark. Supported by significant events such as the approval of Bitcoin spot ETFs, rate-cut cycles, and favorable regulatory changes, Bitcoin is now being targeted for a $200,000 valuation by 2025. Amidst this bullish backdrop, the cryptocurrency market anticipates further gains, potentially capping the year with a 'Santa Rally'.

Top Corporate News

Micron Falls Most in Four Years on Sluggish Sales Outlook

Shares of Micron Technology experienced their largest drop in over four years following the release of disappointing Q1 FY2025 earnings on Wednesday. Both the company’s revenue and EPS guidance for the next quarter fell significantly short of expectations, leading to a decline in share price. The weak outlook can be attributed to three main factors: a slowdown in demand for data center SSDs, slower-than-expected inventory absorption in consumer markets like PCs and smartphones, and an industry-wide oversupply of NAND memory. On a positive note, Micron made significant strides in improving its inventory levels, and its adjusted operating income surpassed Wall Street's forecasts.

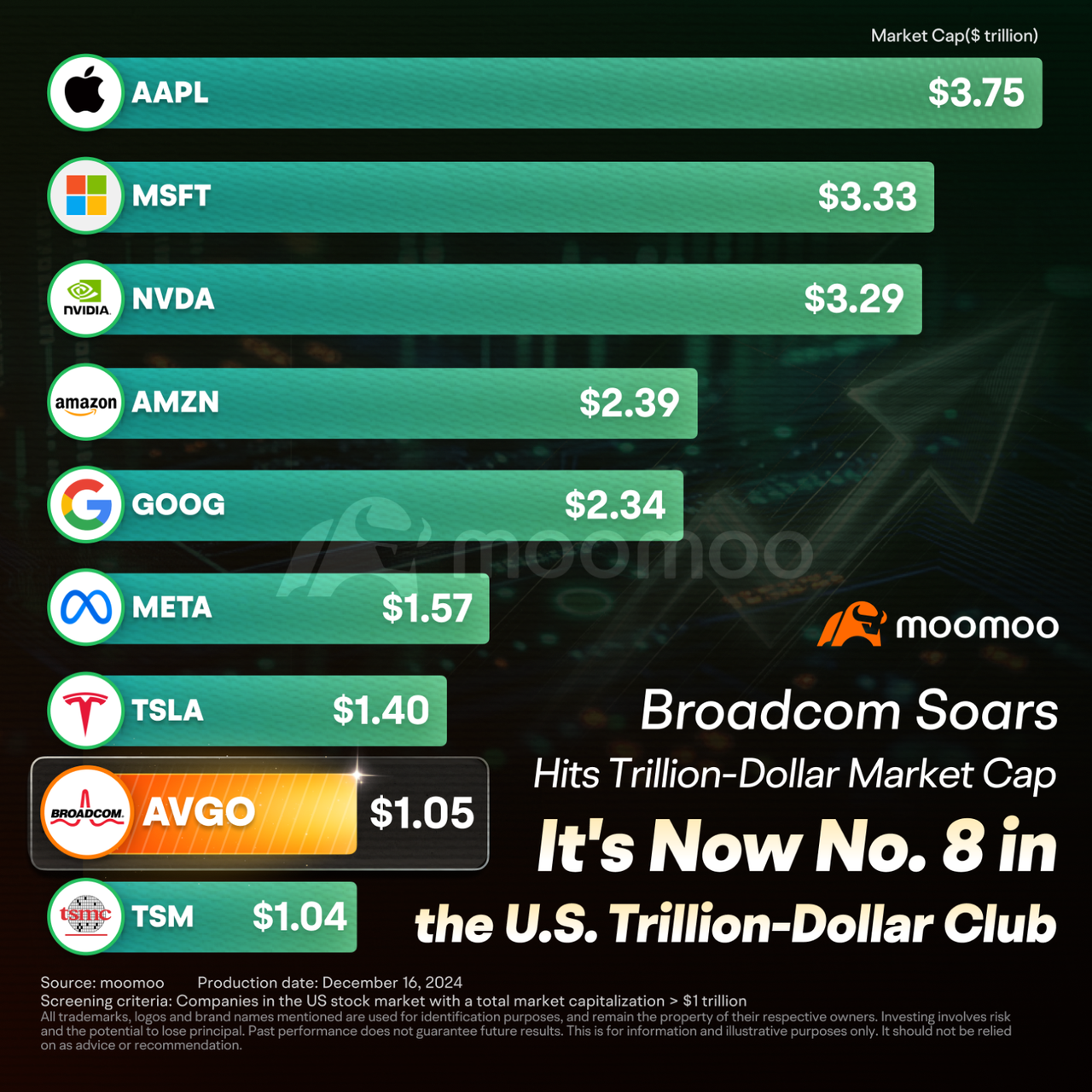

Broadcom Hits $1 Trillion Market Cap, Ranks 8th Globally

On December 13th, Broadcom's stock price surged by over 24%, closing at $224.8 per share. The company's market capitalization surpassed the $1 trillion mark for the first time, making it the 12th company globally and the 9th in the United States to achieve a market value of $1 trillion. It also became the third semiconductor company to break the $1 trillion market cap barrier, following NVIDIA and TSMC.

Broadcom's ASIC leadership positions it well for future AI competition. The company is developing custom AI chips with three major clients (Google, Meta, ByteDance) and working on next-gen AIXPUs with two others. It aims to convert these into revenue-generating customers by 2027, expanding its market.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.