Welcome to the weekly market review, this section is dedicated to providing Moomoo CAB members with key investment news and insights from this week, as well as a preview of significant events that may impact the market in the coming week.

Macroeconomic Trends

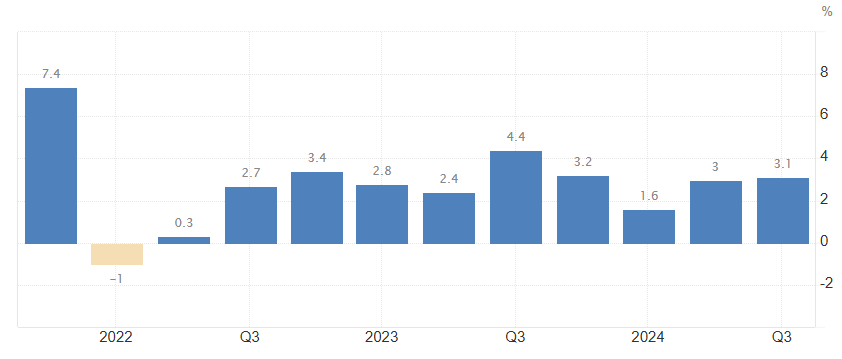

In the third quarter of 2024, the USA's economic growth was 3.1%, exceeding previous expectations.

The annualized growth rate of the USA's economy in the third quarter of 2024 was 3.1%, higher than the second estimate of 2.8% and also higher than the 3% in the second quarter. This is the highest growth rate so far this year. The growth rate of personal spending is the fastest since the first quarter of 2023 (3.7%, compared to the second estimate of 3.5%). This is mainly due to a surge in Commodity consumption of 5.6% (compared to the second estimate of 5.6%) and robust growth in service consumption (2.8% compared to 2.6%). In addition, fixed investment also increased more than expected (2.1% vs. 1.7%). Equipment investment soared (10.8% vs. 10.6%), while structural investment (−5% vs. −4.7%) and residential investment (−4.3% vs. −5%) declined. Government consumption growth was also revised up to 5.1% (versus 5%). Additionally, due to upward revisions in exports (9.6% vs. 7.5%) and imports (10.7% vs. 10.2%), the negative impact of net trade diminished (−0.43 percentage points vs. the second estimate of −0.57 percentage points). On the other hand, private inventories dragged economic growth down by 0.22 percentage points, while the second estimate was a decline of 0.11 percentage points.

The Federal Reserve lowered the federal funds rate and predicts a slowdown in the pace of interest rate cuts due to increasing inflation concerns.

The Federal Reserve lowered the federal funds rate and predicts a slowdown in the pace of interest rate cuts due to increasing inflation concerns.

The Federal Open Market Committee lowered the federal funds target rate by 25 basis points and forecasted a slowing pace of interest rate cuts next year as policymakers raised their outlook on inflation.

The Federal Reserve announced on Wednesday at the end of a two-day meeting that the target rate was lowered to between 4.25% and 4.5%. While the decision to lower the rate previously was unanimous, this time Beth M. Hammack of the Cleveland Federal Reserve Bank voted against it, as she favored stabilizing the benchmark borrowing cost at 4.5% to 4.75%.

In November 2024, Japan's inflation rate surged to the highest level seen since last year.

In November 2024, Japan's annual inflation rate rose from 2.3% last month to 2.9%, marking the highest level since October 2023. Food prices recorded the largest increase in eight months (4.8%, up from 3.5% in October), with the biggest rises in fresh vegetables and food items. Meanwhile, electricity prices (9.9% vs 4.0%) and natural gas prices (5.6% vs 3.5%) surged significantly without energy subsidies since May. Increases were also seen in housing (0.9% vs 0.8%), clothing (2.9% vs 2.8%), transportation (0.9% vs 0.5%), furniture and household items (3.7% vs 4.4%), medical care (1.6% vs 1.7%), entertainment (4.5% vs 4.3%), and miscellaneous items (1.1% vs 1.1%). In contrast, prices for communication (-3.0% vs -3.5%) and education (-1.0% vs -1.0%) further declined. The core inflation rate in November rose from 2.3% in October to a new three-month high of 2.7%, exceeding the expected 2.6%. On a monthly basis, the CPI increased by 0.6%, the highest in 13 months.

Capital Flow

Federal Reserve (Fed) officials anticipate that there will only be a 25 basis point cut in interest rates in 2025.

The long-term neutral rate has been raised to 3%.

Gold prices have fallen under the influence of the Fed's hawkish outlook and future demand challenges.

On Friday, gold prices hovered around $2,600 per ounce, experiencing a weekly decline due to the Fed's hawkish stance. The Fed indicated there may only be two rate cuts next year, reflecting a cautious attitude towards monetary easing. Strong U.S. GDP data and increased consumer spending further supported expectations of slowing the pace of easing. This environment has dampened the demand for gold, as reduced monetary easing decreases the attractiveness of non-yielding assets like gold. Additionally, the short-term outlook for gold is facing extra pressure from declining physical demand in India, with expectations that India's gold imports will significantly decrease in December.

With strong growth and a favorable market environment, Bitcoin is expected to reach the milestone of $0.2 million by 2025.

Bitcoin experienced a historic rebound in 2024, with prices soaring 150% and breaking the $0.1 million mark. Supported by significant events such as the approval of a Bitcoin spot ETF, the interest rate cut cycle, and favorable regulatory changes, Bitcoin's current valuation target is to reach $0.2 million by 2025. In this optimistic context, the cryptocurrency market is expected to rise further, potentially ending the year with a 'Christmas rally.'

Company News

Weak sales outlook, Micron's decline marks the largest drop in four years.

On Wednesday, Micron Technology released disappointing Earnings Reports for the first quarter of fiscal year 2025, with its stock price hitting the biggest drop in over four years. The company's guidance for revenue and EPS for the next quarter was significantly below market expectations, leading to a decline in its stock price. The weak outlook is primarily attributed to three factors: slowing demand for datacenter SSDs, slower-than-expected inventory digestion in consumer markets like personal computers and smart phones, and oversupply in the NAND memory industry. Nevertheless, Micron achieved significant improvement in inventory levels, and its adjusted revenue also exceeded Wall Street's expectations.

Broadcom's Market Cap exceeds one trillion, ranking eighth globally.

On December 13, Broadcom's stock soared over 24%, closing at $224.8 per share. The company's Market Cap surpassed the $1 trillion mark for the first time, making it the 12th company globally and the 9th in the USA to reach a $1 trillion Market Cap. Broadcom also became the third semiconductor company to surpass a Market Cap of $1 trillion, following NVIDIA and Taiwan Semiconductor.

Broadcom's leading position in ASICs gives it an advantage in the future AI competition. The company is developing custom AI chips with three major clients (Google, Meta, ByteDance) and is collaborating with two other companies to research and develop the next generation AIXPU. Broadcom plans to convert these clients into revenue-generating customers before 2027 to expand its market share.