As 2024 draws to a close, the year has been marked by a succession of pivotal global events. Financial markets saw significant volatility, with various asset classes posting notable performances.

The U.S. stock market, in its second bullish year, repeatedly shattered records. Nvidia claimed the crown, tech giants reigned supreme, and AI continued to fuel the market's ascent. Globally, interest rates took a downturn amidst ongoing geopolitical tensions, propelling gold to unprecedented heights. Meanwhile, the U.S. election ushered in the Trump 2.0 era, setting the stage for America's transformation into a crypto hub. Against this backdrop, Bitcoin surged past the pivotal $100,000 mark.

Join us as we revisit the unforgettable moments that defined this extraordinary year in finance!

1) Trump and Musk Triumph

1) Trump and Musk Triumph

The U.S. presidential election was the year's most impactful financial event. Trump won the election and swept Congress, becoming the first non-consecutive two-term president since 1892.

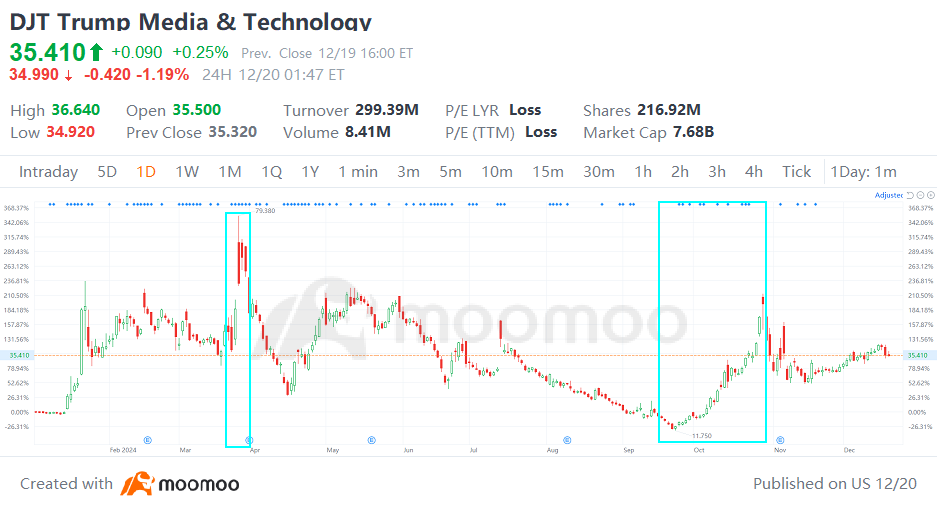

Shares of $Trump Media & Technology (DJT.US)$ have experienced significant volatility amid election developments. In March, after Donald Trump secured the Republican nomination, the DJT index surged over 50%. In July, following an attempted shooting at a weekend campaign rally, speculation of a Trump victory drove a more than 30% single-day surge when markets opened on Monday. As election day approached in October, Trump's betting odds surpassed those of Kamala Harris, pushing DJT up nearly 120% for the month.

Elon Musk, Tesla's founder and the world’s richest person, emerged as another winner in the election. Following the shooting incident, Musk backed Trump, donating over $250 million to his campaign. Trump praised Musk as a "super genius" and appointed him to head the "Department of Government Efficiency." Besides, Trump's initiatives to scrap electric vehicle incentives and strengthen autonomous driving policies are anticipated to favor $Tesla (TSLA.US)$, a frontrunner in full self-driving technology. Since the Nov. 5 election, Tesla shares have soared over 75%, hitting a peak of $488. During this period, Elon Musk's net worth has jumped by nearly $200 billion.

2) Bitcoin's Soaring Rise

$Bitcoin (BTC.CC)$ has surged close to 130% since the start of 2024, surpassing silver and Saudi Aramco to become the world's seventh-largest asset, with its market cap briefly exceeding $2 trillion.

The year 2024 is pivotal for Bitcoin, catalyzing a sustained bull market. In January, Bitcoin spot ETFs were approved. April brought the halving event, while September initiated an interest rate cut cycle. November saw Donald Trump winning the U.S. election and the introduction of Bitcoin spot ETF options. In December, Trump appointed crypto advocate Paul Atkins as SEC chair, propelling Bitcoin from $70,000 to over $100,000.

Increased investment opportunities, enhanced market liquidity, and a supportive regulatory environment have attracted substantial capital to Bitcoin. Within ten months of its debut, the Bitcoin ETF's assets surpassed $100 billion, reaching 82% of the U.S. gold ETF's size. Remarks by Federal Reserve Chair Jerome Powell in December, likening Bitcoin to digital gold, pushed the Bitcoin-to-gold ratio to a record high.

3) The Forces Behind "Black Monday"

Global financial markets faced a turbulent "Black Monday" on August 5, as the $S&P 500 Index (.SPX.US)$ dropped 3% and the $CBOE Volatility S&P 500 Index (.VIX.US)$ spiked 180% at one point. Japan's $Nikkei 225 (.N225.JP)$ plunged over 12%, marking its largest single-day decline ever, while South Korea's $Korea Composite Index (.KOSPI.KR)$ Index fell more than 8%, triggering a trading halt.

The unwinding of yen carry trades fueled the market selloff, driven by hawkish signals from the Bank of Japan and mounting US recession fears. On July 31, Japan unexpectedly raised interest rates by 15 basis points, the first hike in 30 years, exceeding market expectations and causing a sharp yen appreciation. US non-farm payroll data for July, released on August 2, missed forecasts, heightening recession concerns and sending US Treasury yields down. Traders had exploited cheap yen loans to invest in higher-yield markets for carry trade gains. However, with the yen strengthening, US stocks declining, and Treasury yields falling, carry trade profits were squeezed, prompting a reversal.

4) Nvidia's Ascendancy

$NVIDIA (NVDA.US)$ has cemented its lead in the AI industry, achieving over two years of rapid expansion and consistently exceeding Wall Street forecasts. The company’s stock has surged more than 160% so far this year.

Nvidia’s ascent has been meteoric, swiftly claiming the crown as the king of the stock market. On February 22, the company unveiled its fiscal 2024 full-year results, highlighting explosive growth in its data center division. Revenue jumped 126% year-over-year, while net profit soared 581% from the prior year. The stock climbed more than 16% that day, adding $277 billion to its market value—a record single-day gain in U.S. stock market history. By the next day, Nvidia's market capitalization surpassed $2 trillion.

On April 19, despite a 10% drop on "Black Friday," the company set the stage for further growth. The leap from $1 trillion to $2 trillion took just nine months, and within 103 days, by June 5, Nvidia surpassed the $3 trillion mark. By June 18, Nvidia had overtaken Microsoft and Apple to become the world’s largest publicly traded company, with a market cap of $3.33 trillion.

5) Policy-Driven Rally in US-listed Chinese Stocks

Ahead of China's National Day, Beijing unveiled significant economic stimulus measures, sparking a robust rebound in Chinese assets worldwide. Over ten trading sessions, the Nasdaq Golden Dragon China Index surged more than 38%, while the $Hang Seng TECH Index (800700.HK)$ soared over 40%. Among US-listed Chinese stocks, $KE Holdings (BEKE.US)$ and $Bilibili (BILI.US)$ jumped more than 70%, with $JD.com (JD.US)$, $PDD Holdings (PDD.US)$, and $Kanzhun (BZ.US)$ each rising over 50%. $TAL Education (TAL.US)$ and $Trip.com (TCOM.US)$ advanced more than 40%.

On Sept. 24, the People’s Bank of China initiated comprehensive monetary stimulus and real estate support, including interest rate cuts and reduced reserve requirements. Two days later, the Politburo unveiled fiscal spending plans to boost consumption, manage local government debt, and stabilize the property market. These actions, along with expected additional measures, have bolstered market expectations for economic expansion.

By Dec. 9, a Politburo meeting laid the groundwork for more proactive fiscal policies by 2025, marking the first mention since 2010 of a "moderately loose monetary policy." There was also an unusual focus on stabilizing the property and stock markets. Following this announcement, the $NASDAQ Golden Dragon China (.HXC.US)$ Index closed up 8.5%, marking its best single-day gain since late September.

Source: Bloomberg, Yahoo Finance, Reuters, abc News

by moomoo News Olivia