Financial giants have made a conspicuous bearish move on Humacyte. Our analysis of options history for Humacyte (NASDAQ:HUMA) revealed 9 unusual trades.

Delving into the details, we found 11% of traders were bullish, while 77% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $370,504, and 4 were calls, valued at $132,840.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $4.0 to $7.5 for Humacyte over the recent three months.

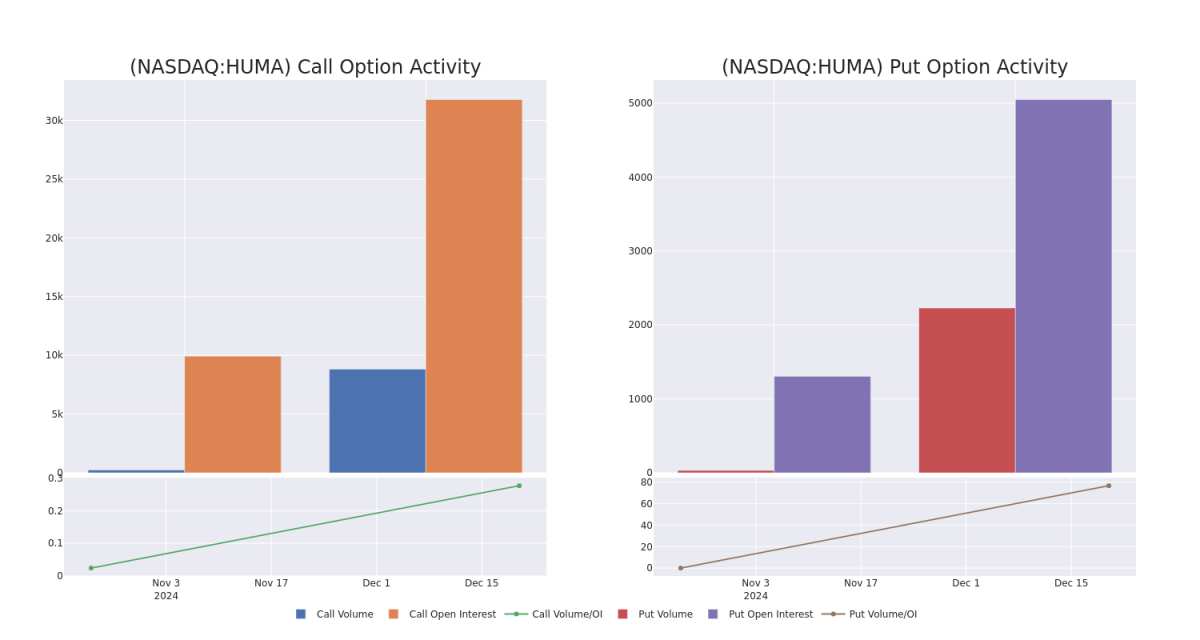

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Humacyte's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Humacyte's significant trades, within a strike price range of $4.0 to $7.5, over the past month.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Humacyte's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Humacyte's significant trades, within a strike price range of $4.0 to $7.5, over the past month.

Humacyte Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HUMA | PUT | SWEEP | BEARISH | 01/17/25 | $1.35 | $1.3 | $1.35 | $5.50 | $114.5K | 21 | 384 |

| HUMA | PUT | SWEEP | BEARISH | 03/21/25 | $1.45 | $1.4 | $1.45 | $5.00 | $100.0K | 4.4K | 63 |

| HUMA | PUT | SWEEP | BEARISH | 02/21/25 | $1.45 | $1.25 | $1.45 | $5.00 | $64.8K | 10 | 512 |

| HUMA | PUT | SWEEP | BULLISH | 01/17/25 | $0.7 | $0.65 | $0.65 | $4.50 | $57.9K | 141 | 908 |

| HUMA | CALL | TRADE | BEARISH | 12/20/24 | $2.25 | $2.0 | $2.0 | $4.00 | $40.0K | 1.0K | 208 |

About Humacyte

Humacyte Inc is developing a disruptive biotechnology platform to deliver universally implantable bioengineered human tissues and organs designed to improve the lives of patients and transform the practice of medicine. It develops and manufactures acellular tissues to treat a wide range of diseases, injuries, and chronic conditions.

After a thorough review of the options trading surrounding Humacyte, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Humacyte Standing Right Now?

- With a trading volume of 42,801,618, the price of HUMA is up by 66.66%, reaching $5.77.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 91 days from now.

What Analysts Are Saying About Humacyte

3 market experts have recently issued ratings for this stock, with a consensus target price of $21.666666666666668.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from D. Boral Capital keeps a Buy rating on Humacyte with a target price of $25. * An analyst from HC Wainwright & Co. has revised its rating downward to Buy, adjusting the price target to $15. * An analyst from D. Boral Capital persists with their Buy rating on Humacyte, maintaining a target price of $25.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Humacyte with Benzinga Pro for real-time alerts.