① Berkshire Hathaway purchased stocks from Occidental Petroleum, Sirius XM, and VeriSign within three days; ② Buffett's investment assistants Todd Combs and Ted Weschler may have conducted the trades for Sirius XM and VeriSign.

On December 21, according to financial news (Editor Zhao Hao), regulatory documents show that "The Oracle of Omaha" Warren Buffett went on a shopping spree in the US stock market close to Christmas, increasing his shareholding in stocks like Occidental Petroleum during a weak market.

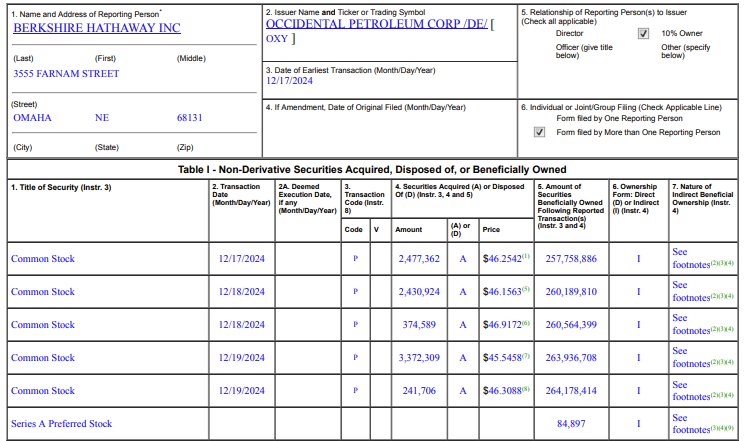

According to regulatory documents submitted late Thursday (December 19), Berkshire Hathaway purchased stocks from Occidental Petroleum (stock code: OXY), Sirius XM (SIRI), and VeriSign (VRSN) on Tuesday, Wednesday, and Thursday.

Berkshire increased its holdings in Occidental Petroleum by nearly 8.9 million shares at a price of $0.405 billion, raising its ownership stake in the company to over 28%.

Berkshire increased its holdings in Occidental Petroleum by nearly 8.9 million shares at a price of $0.405 billion, raising its ownership stake in the company to over 28%.

Additionally, Berkshire purchased about 5 million shares of Sirius XM for approximately $0.113 billion and about 0.234 million shares of VeriSign for about $45 million.

Analysis suggests that compared to the trade with Occidental Petroleum, the transactions involving Sirius XM and VeriSign are much smaller, possibly executed by Buffett's investment assistants Todd Combs and Ted Weschler, who manage some of Berkshire's investments.

Overall, Berkshire bought stocks worth over $0.56 billion within three days, and both Occidental Petroleum and Sirius XM were purchased at recent lows, perhaps indicating that "The Oracle of Omaha" considers these to be undervalued stocks.

As of the time of publication, Occidental Petroleum's stock price has risen over 5%, but has still fallen over 5% this month, once hitting its lowest point since March 2022. Sirius XM performed even worse, rising nearly 10% during the day, but has cumulatively dropped 57% this year, hitting a new low not seen since 2012 earlier this month.

Currently, Occidental Petroleum is the sixth largest holding in Berkshire, behind Apple, American Express, Bank of America, Coca-Cola, and Chevron. Buffett has stated that Berkshire has no intention of fully acquiring Occidental Petroleum.

According to a report submitted last month, Berkshire has net sold stocks for the eighth consecutive quarter, and the company did not repurchase any stocks in the third quarter, marking the first time since 2018. At that time, some analysts believed that Berkshire accumulating cash could be a warning signal.

Buffett's recent actions may also indicate a reversal in the 'Oracle of Omaha's' sentiment towards the market, with the move to increase holdings in Occidental Petroleum possibly representing his recognition of potential opportunities in the traditional energy sector.

Buffett has mentioned that due to ESG (Environmental, Social, and Governance) issues and investor apathy towards the traditional energy industry, the value of the oil industry has been long undervalued over the past few decades.

However, with Trump about to take office, the energy policy in the USA and ESG policies may undergo drastic changes. Compared to the Biden administration's achievements in promoting ESG disclosures, Trump has been outspokenly opposed to eco-friendly and related issues.

其中,伯克希尔以4.05亿美元的价格增持了近890万股西方石油,使其对后者的持股比例超过28%。

其中,伯克希尔以4.05亿美元的价格增持了近890万股西方石油,使其对后者的持股比例超过28%。