Buffett took advantage of the three-day decline in US stocks this week to increase his holdings in a number of companies. According to regulatory documents, Berkshire Hathaway increased its holdings of Occidental Petroleum by 8.9 million shares (worth 0.405 billion US dollars), 5 million shares of Sirius XM (worth 0.113 billion US dollars), and 45 million dollars of VeriSign shares from Tuesday to Thursday, respectively. Overall, Berkshire invested more than $0.56 billion in three days.

On Christmas Eve, Buffett took advantage of the sharp decline in US stocks in recent days to increase his holdings in many companies, once again demonstrating his “I am greedy when others are afraid” investment philosophy.

1. Energy industry: Occidental Petroleum

According to regulatory documents on Thursday evening EST, Buffett's Berkshire Hathaway increased its holdings of Occidental Petroleum by 8.9 million shares between Tuesday and Thursday, with a total value of 0.405 billion US dollars, making its shareholding ratio more than 28%.

According to regulatory documents on Thursday evening EST, Buffett's Berkshire Hathaway increased its holdings of Occidental Petroleum by 8.9 million shares between Tuesday and Thursday, with a total value of 0.405 billion US dollars, making its shareholding ratio more than 28%.

Occidental Petroleum (Occidental Petroleum) is a Houston-based energy producer famous for being founded by legendary oil tycoon Armand Hammer (Armand Hammer), and is currently the sixth largest shareholder of Berkshire Hathaway.

It is worth noting that Occidental Petroleum's stock price has fallen by more than 10% this month, and has fallen by 24% since this year. Despite this, Buffett is still optimistic about the company's development prospects, but he has ruled out the possibility of a full takeover.

In the US stock market on Friday, Occidental Petroleum once rose more than 5.7%.

2. Audio entertainment field: Sirius XM

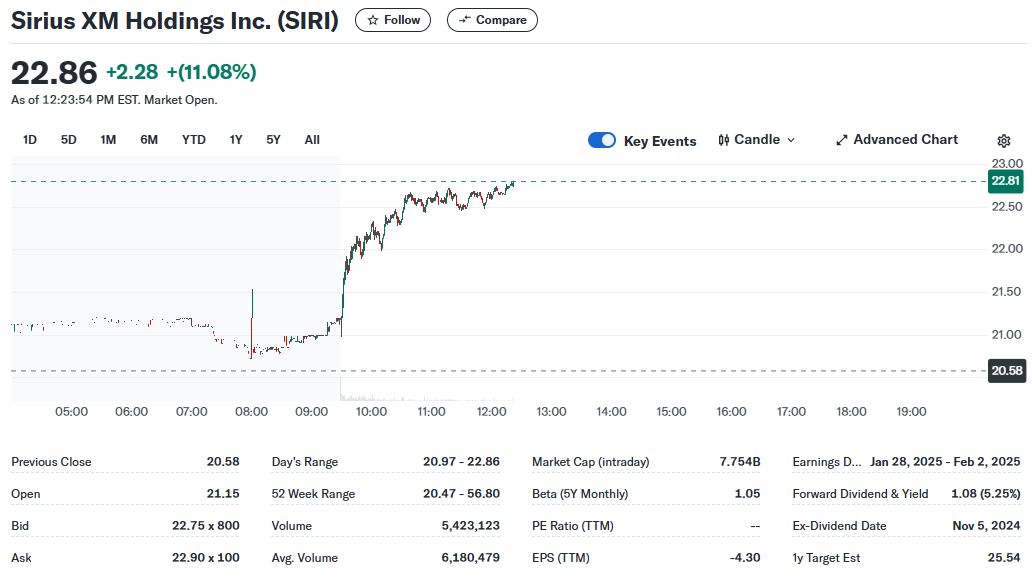

In addition to Occidental Petroleum, Berkshire Hathaway also laid out the audio entertainment sector and purchased approximately 5 million shares of Sirius XM worth approximately $0.113 billion. The New York-based satellite broadcaster's sell-off was even more intense, with a 23% drop this month and a cumulative decline of 62% this year.

Buffett began increasing his Sirius XM holdings after billionaire John Malone's Liberty Media completed a deal to merge its tracking stock with other parts of the audio entertainment company in early September. Currently, Berkshire Hathaway's ownership of Sirius XM has risen to about 35%. Despite Sirius XM facing challenges such as loss of users and unfavorable demographic changes, Buffett seems optimistic about its future development.

Sirius XM once rose more than 10.7% in the US stock market on Friday.

3. Internet field: VeriSign

Berkshire Hathaway also invested in the internet sector and purchased approximately 0.234 million shares of VeriSign, worth about $45 million. VeriSign, an internet infrastructure service provider, saw its share price drop 6% this year, lagging significantly behind the overall performance of the tech industry.

Buffett initially purchased VeriSign shares in 2013, and the shareholding ratio has not been adjusted for many years. This increase in holdings may indicate that Buffett is still confident in VeriSign's long-term value, even though the company's performance this year has not been as good as expected.

In the US stock market on Friday, VeriSign once rose more than 3.9%.

Notably, since Sirius XM and VeriSign are two smaller investments, these transactions may have been handled by Buffett's investment deputies Todd Combs and Ted Weschler.

All in all, Berkshire has bought more than $0.56 billion worth of shares over the past three trading days, and Buffett has seized the market correction opportunity to buy these stocks at a lower price.

根据美东时间周四晚间的监管文件显示,巴菲特旗下的伯克希尔·哈撒韦公司在本周二至周四期间,增持了890万股西方石油公司的股票,总价值为4.05亿美元,使其持股比例超过28%。

根据美东时间周四晚间的监管文件显示,巴菲特旗下的伯克希尔·哈撒韦公司在本周二至周四期间,增持了890万股西方石油公司的股票,总价值为4.05亿美元,使其持股比例超过28%。