Deep-pocketed investors have adopted a bearish approach towards Qualcomm (NASDAQ:QCOM), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in QCOM usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 19 extraordinary options activities for Qualcomm. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 26% leaning bullish and 42% bearish. Among these notable options, 7 are puts, totaling $664,115, and 12 are calls, amounting to $1,189,524.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $140.0 to $180.0 for Qualcomm during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $140.0 to $180.0 for Qualcomm during the past quarter.

Volume & Open Interest Development

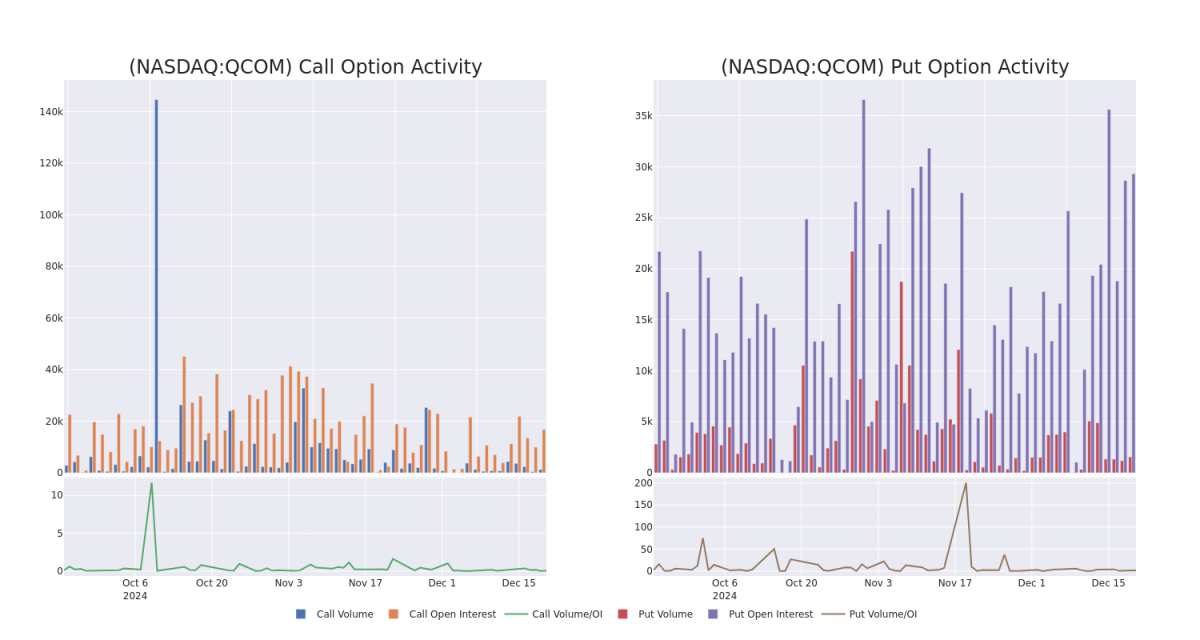

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Qualcomm's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Qualcomm's substantial trades, within a strike price spectrum from $140.0 to $180.0 over the preceding 30 days.

Qualcomm Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | CALL | SWEEP | BULLISH | 06/20/25 | $23.75 | $23.3 | $23.75 | $140.00 | $474.6K | 142 | 200 |

| QCOM | CALL | SWEEP | BEARISH | 02/21/25 | $2.29 | $2.13 | $2.14 | $180.00 | $242.0K | 2.8K | 20 |

| QCOM | PUT | SWEEP | BULLISH | 12/20/24 | $15.05 | $14.5 | $14.5 | $165.00 | $211.7K | 1.2K | 26 |

| QCOM | PUT | SWEEP | BEARISH | 01/17/25 | $5.9 | $5.7 | $5.75 | $150.00 | $129.3K | 8.2K | 390 |

| QCOM | PUT | SWEEP | NEUTRAL | 01/17/25 | $18.15 | $17.85 | $18.01 | $170.00 | $90.0K | 8.6K | 346 |

About Qualcomm

Qualcomm develops and licenses wireless technology and designs chips for smartphones. The company's key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G, 4G, and 5G networks. Qualcomm's IP is licensed by virtually all wireless device makers. The firm is also the world's largest wireless chip vendor, supplying nearly every premier handset maker with leading-edge processors. Qualcomm also sells RF-front end modules into smartphones, as well as chips into automotive and Internet of Things markets.

Current Position of Qualcomm

- With a volume of 4,767,794, the price of QCOM is up 1.8% at $153.1.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 40 days.

What The Experts Say On Qualcomm

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $180.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Melius Research has revised its rating downward to Hold, adjusting the price target to $180.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Qualcomm with Benzinga Pro for real-time alerts.