Berkshire has purchased stocks worth over 0.56 billion dollars in the past three trading days.

As Christmas approaches, the "stock god" Buffett is making significant purchases in the U.S. stock market.

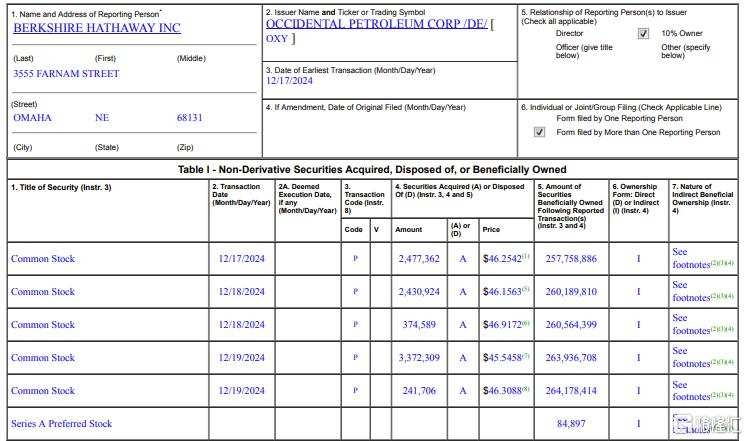

On Thursday local time (December 19), a regulatory document revealed that Berkshire Hathaway purchased an additional 8.9 million shares of Occidental Petroleum for $0.405 billion between December 17 and 19, increasing its shareholding ratio to over 28%.

During the same period, Berkshire also acquired about 5 million shares of Sirius XM (SIRI.US) worth approximately $0.113 billion, as well as 234,000 shares of VeriSign (VRSN.US) valued at around $45 million. These two transactions were relatively small in scale; therefore, they were likely conducted by Buffett's investment deputies Todd Combs and Ted Weschler.

During the same period, Berkshire also acquired about 5 million shares of Sirius XM (SIRI.US) worth approximately $0.113 billion, as well as 234,000 shares of VeriSign (VRSN.US) valued at around $45 million. These two transactions were relatively small in scale; therefore, they were likely conducted by Buffett's investment deputies Todd Combs and Ted Weschler.

Overall, Berkshire purchased stocks worth over $0.56 billion in the past three trading days.

Analysts stated that Buffett took advantage of the market pullback; the three stocks he chose to increase his shareholding in have relatively cheap prices.

According to the latest closing price, Occidental Petroleum rose by 3.9%, reporting at $47.13. Occidental Petroleum has dropped over 6% this month and nearly 20% this year. This Energy company is known for being founded by legendary oil tycoon Armand Hammer and is Berkshire Hathaway's sixth-largest holding. Buffett has ruled out the possibility of a full acquisition.

The sell-off of Satellite Broadcasting company Sirius XM has been more intense. This company has seen a decline for six consecutive days, with Sirius XM's stock price dropping over 12% on Friday, but has accumulated a loss of over 14% this month, and has fallen 56% year-to-date.

Internet Plus-Related company VeriSign has also had a tough year, with its stock price dropping over 3% cumulatively in 2024, significantly lagging behind the Technology Sector. Berkshire Hathaway first purchased this technology stock in 2013 and has not adjusted its shareholding ratio over the years.

在同一时期,

在同一时期,