The stock price has nearly tripled since the beginning of the year.

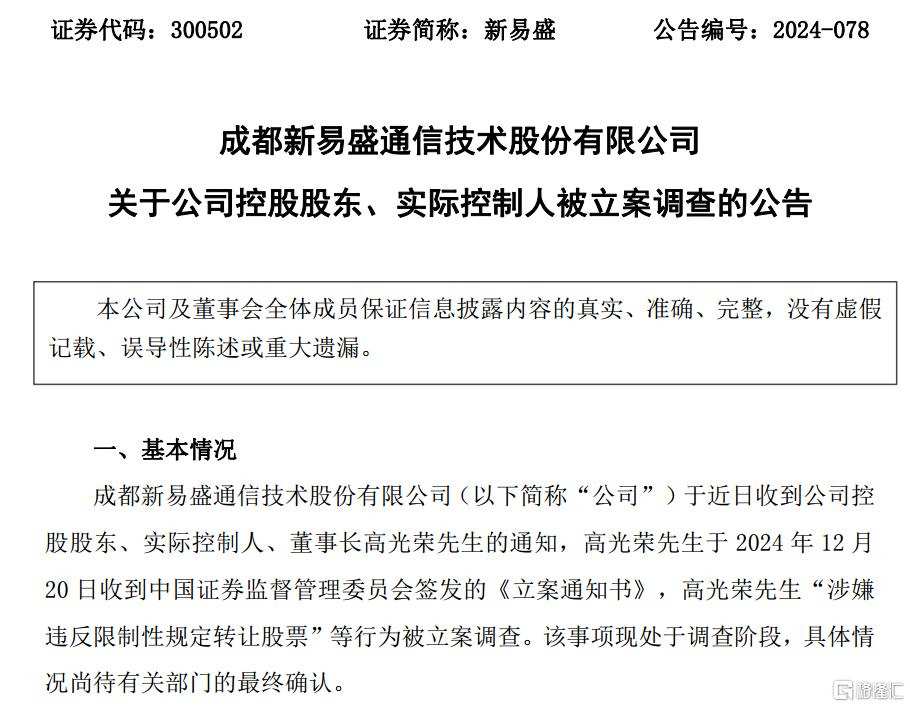

On the evening of December 22, the CPO star stock Eoptolink Technology Inc. announced that the company's controlling shareholder, actual controller, and Director Gaoguangrong received the "Notice of Case Filing" issued by the China Securities Regulatory Commission on December 20, 2024, due to suspected violations of restrictive regulations regarding the transfer of Stocks, and has been placed under investigation.

The company stated that this matter is currently under investigation, and specific circumstances are awaiting final confirmation by the relevant authorities. Gaoguangrong's personal transfer of Stocks is under investigation and is unrelated to the company's Operations, and will not affect the company; all operations and production are normal.

The company will continue to monitor the progress of the above matters and will strictly fulfill its information disclosure obligations in accordance with the relevant laws and regulations.

The company will continue to monitor the progress of the above matters and will strictly fulfill its information disclosure obligations in accordance with the relevant laws and regulations.

Over 0.06 million shareholders are affected.

According to the announcement, Gaoguangrong is currently under investigation by the China Securities Regulatory Commission, and specific circumstances are awaiting final confirmation by the relevant authorities.

Data shows that Gaoguangrong was born in May 1969 and has served as the Chairman of Eoptolink Technology Inc. since December 2011, with a pre-tax salary of 1.1262 million yuan obtained from Eoptolink in 2023.

According to the third quarter report, Gao Guangrong is the company's largest Shareholder, holding 52.46 million Stocks, with a shareholding ratio of 7.40%. Based on the latest stock price, the market value of the Shares held is approximately 6.749 billion yuan. As of the end of the third quarter, the company has a total of 64,877 Shareholders.

As early as April 26 last year, Eoptolink Technology Inc. disclosed Gao Guangrong's Shareholding reduction plan, which plans to reduce a total of no more than 5 million Shares of the company through centralized bidding or block trading (accounting for 0.99% of the company's total share capital, and also accounting for 0.99% of the total share capital after excluding 4,200 Shares in the repurchase special Account), to be carried out within six months after the announcement date of this Shareholding reduction plan, starting fifteen trading days later.

As a leader in the domestic optical module Industry, Eoptolink Technology Inc. is one of the few companies capable of mass delivery of 100G and 400G optical modules and mastering the packaging technology of high-speed optical device chips. The stock price trend of the company has always attracted market attention.

Benefiting from the continuous improvement in industry prosperity, the company achieved revenue of 5.13 billion yuan in the first three quarters of this year, a year-on-year increase of 145.82%; Net income of 1.646 billion yuan, a year-on-year increase of 283.20%. Among them, the Net income for the third quarter was 0.781 billion yuan, a year-on-year increase of 453.07%.

As of the close of the last trading day, Eoptolink Technology Inc. reported 128.65 yuan per share, with a total Market Cap of 91.19 billion yuan. Since January of this year, the stock price of Eoptolink Technology Inc. has nearly tripled; from the beginning of 2023 to the present, the stock price has increased by nearly eight times.

Regulate the Shareholding reduction behavior of listed company Shareholders.

It is worth mentioning that similar incidents involving Eoptolink Technology Inc. are not isolated.

On the same evening, Tianshun Co. also announced that the actual controller Wang Puyu received the "Notice of Investigation" issued by the China Securities Regulatory Commission on December 20, 2024. Wang Puyu is suspected of violating information disclosure laws and regulations as well as transferring securities against restrictive provisions, and the CSRC decided to file a case against Wang Puyu.

The company stated that the investigation into the actual controller’s personal stock transfer is unrelated to the company's operations and will not have an impact on the company, with production and operation continuing normally.

The market has always shown high concern regarding illegal shareholding reduction, and the two investigations announced last night reflect the regulatory authority's sustained strict stance against illegal activities in the capital markets.

With the rapid development of the capital markets, some illegal activities have seriously disrupted market order and harmed investors' legitimate rights and interests. In response to the chaos of shareholding reductions, regulatory authorities are continuously assessing and improving the reduction system and actively repairing loopholes.

In May 2024, the CSRC issued the "Interim Measures for the Administration of Shareholdings Reduction by Shareholders of Listed Companies" and the "Management Rules for Changes in Shares Held by Directors, Supervisors, and Senior Management of Listed Companies", together with the "Special Regulations for Shareholdings Reduction by Venture Capital Fund Shareholders of Listed Companies", collectively forming the '1+2' share reduction regulatory system.

The CSRC stated that it will adhere to a 'long-toothed and thorny' approach, strictly enforcing laws to combat illegal share reductions, increasing penalties for various kinds of illegal reductions, raising the cost of violations, and comprehensively using administrative penalties, regulatory measures, self-regulatory measures, or trading restrictions to seriously address excessive reductions, violations of pre-disclosure reduction, sensitive period trading, and evasion of restricted reductions, thereby creating a strong deterrent and maintaining order in the capital markets.