① Fosun Pharmaceutical and Fuhong Hanlin jointly issued a comprehensive document to absorb and merge Fuhong Hanlin. Currently, there are no plans to list them on other exchanges. ② After privatization is completed, Fuhong Hanlin will continue to engage in its current main business, and existing employees will be retained and existing employment and recruitment practices will not be affected.

“Science and Technology Innovation Board Daily”, December 23 (Reporter Zheng Bingxun) A week after announcing that the preliminary conditions for the absorption and merger of Fuhong Hanlin (2696.HK) had been met, Fosun Pharmaceuticals (600196.SH) and Fuhong Hanlin issued a joint announcement announcing the sending of comprehensive documents for the privatization of Fuhong Hanlin by Fosun New Pharmaceuticals.

As of the last practical date (December 20, 2024), Fosun Pharmaceutical is wholly owned by Fosun Pharmaceutical Development, while Fosun Pharmaceutical Industry Development is wholly owned by Fosun Pharmaceutical.

According to the comprehensive document, Fuhong Hanlin has issued 0.163 billion H shares and 380 million unlisted shares. The corresponding cancellation prices are HK$24.60 and RMB 22.44 per share (equivalent to HK$24.60 per H share at the exchange rate), which is about 36.67% compared to HK$18.00 for H shares on an undisturbed day.

According to the comprehensive document, Fuhong Hanlin has issued 0.163 billion H shares and 380 million unlisted shares. The corresponding cancellation prices are HK$24.60 and RMB 22.44 per share (equivalent to HK$24.60 per H share at the exchange rate), which is about 36.67% compared to HK$18.00 for H shares on an undisturbed day.

The total amount required by Fosun Pharmaceutical to cancel Fuhong Hanlin's H shares and unlisted shares is HK$3.225 billion and RMB 1.991 billion respectively.

Fu Hong Hanlin further elaborated on privatization considerations in the comprehensive document, saying that the biopharmaceutical industry is full of challenges, including drug collection and regulatory reforms in China, as well as geopolitical tension and other global macroeconomic factors. However, Fu Hong Hanlin expects to increase the commercialization of new products in the next few years, and R&D and marketing activities may bring additional investment and expenses.

However, since Fuhong Hanlin was listed on the main board of the Hong Kong Stock Exchange in September 2019, its shares have been traded within a relatively low price range for most of the time, and trading volume has been sluggish, limiting the company's ability to finance from the market. After privatization, Fuhong Hanlin expects to drastically reduce the administrative resources required to maintain its listing status.

As the sponsor of the merger, Fosun Pharmaceutical also stated that after the privatization is completed, Fuhong Hanlin will continue to carry out its current main business, and that Fuhong Hanlin's existing employees and existing employment and recruitment practices will not be affected.

Meanwhile, as of the last practical date, Fuhong Hanlin has no plans to list on China or any other overseas exchange. However, if Fuhong Hanlin faces share sales and capital market opportunities in the future, it will consider and promote the corresponding opportunities.

According to data, Fuhong Hanlin is an innovative pharmaceutical company mainly engaged in R&D, production and sales of monoclonal antibody (mAb) drugs. By the end of June 2024, in addition to 5 products approved for marketing in China with a total of 23 indications and 3 products marketed in overseas markets such as Europe and the United States, Fuhong Hanlin also had more than 50 molecular pipelines. The drug forms covered monoclonal antibodies, double antibodies, antibody-conjugated drugs (ADC), recombinant proteins, small molecule conjugated drugs, etc.

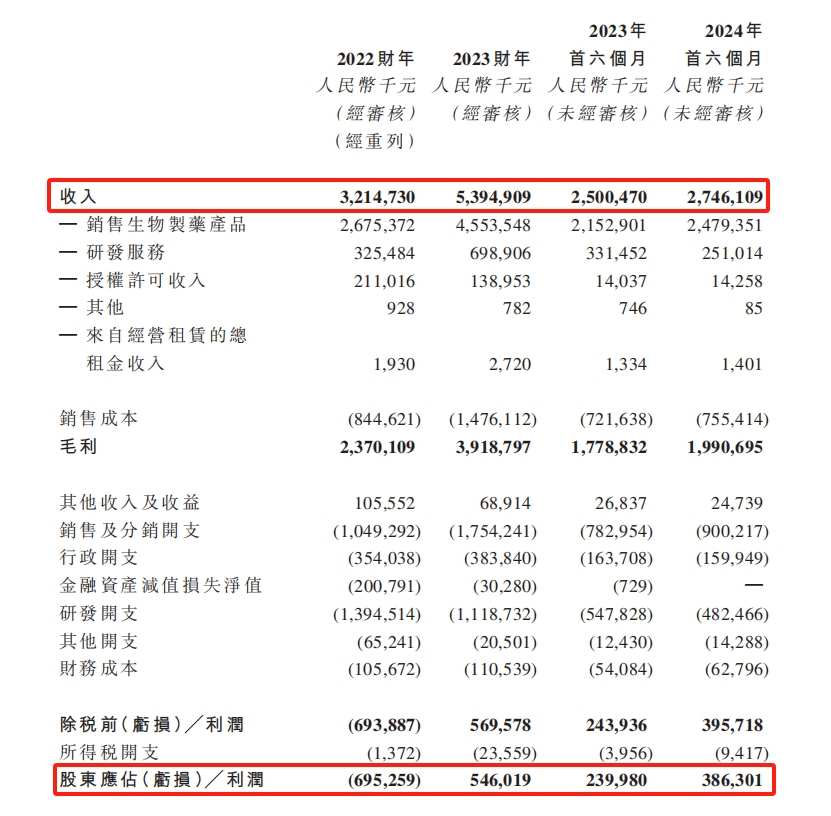

Specifically, the five products marketed by Fuhong Hanlin include Han Quyou (trastuzumab for injection), Hans form (sululizumab injection), Hanlikon (rituximab injection), Handayuan (adalimumab injection), and Hanbetai (bevacizumab injection). In 2022, 2023, and the first half of 2024, drug sales revenue accounted for 83.2%, 84.4%, and 90.3% of Fuhong Hanlin's total revenue, respectively.

Benefiting from the increase in product sales, Fuhong Hanlin achieved full-year profit for the first time in 2023, achieving revenue of 5.395 billion yuan, an increase of 67.8% over the previous year, and a net profit of 0.546 billion yuan. In the first half of 2024, Fuhong Hanlin achieved revenue of 2.746 billion yuan, a year-on-year increase of 9.82%, and net profit to mother of 0.386 billion yuan, an increase of 60.97% over the previous year.

根据综合文件,复宏汉霖已发行1.63亿股H股和3.80亿股非上市股份,对应注销价分别为每股24.60港元和22.44元人民币(按汇率计算,相当于H股每股24.60港元),相较于不受干扰日H股18.00港元

根据综合文件,复宏汉霖已发行1.63亿股H股和3.80亿股非上市股份,对应注销价分别为每股24.60港元和22.44元人民币(按汇率计算,相当于H股每股24.60港元),相较于不受干扰日H股18.00港元