Google Entered 'Code Red' After ChatGPT Release, But Gemini 2.0 And Quantum Chip Give Investors 'Renewed Confidence,' Says This Portfolio Manager

Google Entered 'Code Red' After ChatGPT Release, But Gemini 2.0 And Quantum Chip Give Investors 'Renewed Confidence,' Says This Portfolio Manager

Alphabet Inc.'s (NASDAQ:GOOG) (NASDAQ:GOOGL) latest advancements in artificial intelligence and quantum computing are helping the tech giant rebuild its reputation and investor confidence.

Alphabet Inc.(纳斯达克:GOOG)(纳斯达克:GOOGL)在人工智能和量子计算方面的最新进展正在帮助这家科技巨头重建其声誉和投资者信心。

What Happened: After the release of OpenAI's ChatGPT in late 2022, Google had reportedly declared a "Code Red,"

发生了什么:在2022年底OpenAI的ChatGPT发布后,谷歌据说宣布了一个“红色警报”,

The company faced criticism for lagging behind rivals like Microsoft Corporation (NASDAQ:MSFT), which partnered with OpenAI to integrate ChatGPT-like capabilities into its products.

该公司因落后于像微软-T(纳斯达克:MSFT)这样的竞争对手而受到批评,后者与OpenAI合作,将类似ChatGPT的功能整合到其产品中。

However, Google's latest developments have shifted the narrative, reported Financial Times.

然而,金融时报报道称,谷歌的最新发展改变了这一叙事。

OpenAI's ChatGPT Makes Headway In Search, Threatening Google's Reign

OpenAI的chatgpt概念股在搜索领域取得进展,威胁到谷歌的统治地位。

"Alphabet has been under the microscope since ChatGPT was released," said Tiffany Hsia, a U.S. equity portfolio manager at AllianceBernstein and a Google shareholder. "Gemini 2.0 and the quantum chip give investors renewed confidence that they are one of the leading tech powerhouses."

“自从ChatGPT发布以来,Alphabet一直受到关注,”AllianceBernstein的美国股票投资组合经理以及谷歌股东Tiffany Hsia表示。“Gemini 2.0和量子芯片让投资者对他们作为领先科技巨头之一的信心恢复。”

This year, Google launched Gemini 2.0, Veo 2 and Imagen 3 models for video and image generation, along with a quantum computing breakthrough with its Willow chip.

今年,谷歌推出了Gemini 2.0、Veo 2和Imagen 3模型用于视频和图像生成,并推出了一项量子计算突破,使用其Willow芯片。

It also unveiled a custom AI accelerator chip, the Trillium Tensor Processing Unit, to challenge Nvidia Corporation's (NASDAQ:NVDA) dominance.

它还推出了一款自定义人工智能加速器芯片,Trillium张量处理单元,以挑战英伟达(纳斯达克:NVDA)的主导地位。

Other innovations include Project Mariner, which compiles research reports and acts on behalf of users, and Project Astra, which enables real-time answers across text, video, and audio through smart glasses.

其他创新包括海洋项目(Project Mariner),该项目整理研报并代表用户行动,以及星辰项目(Project Astra),它通过智能眼镜实现文本、视频和音频的实时答案。

Why It Matters: Google has also faced growing competition and scrutiny. It still dominates the search market with a 90% share, but new players like OpenAI and Anthropic pose a credible threat.

这有何重要性:谷歌也面临着日益增长的竞争和审查。它在搜索市场仍占据90%的份额,但OpenAI和Anthropic等新玩家构成了可信威胁。

The company also faces regulatory hurdles with the U.S. Department of Justice seeking to break up Google's ad tech business and is challenging its dominance in search.

该公司还面临监管障碍,美国司法部寻求拆分谷歌的广告技术业务,并挑战其在搜索中的主导地位。

Last week, Google also cut 10% of its top management positions as part of a multi-year initiative to streamline operations and enhance efficiency.

上周,谷歌还裁减了10%的高管职位,作为一项多年的计划,以优化运营并提高效率。

Despite these challenges, Alphabet Class A and C shares have risen around 38% on a year-to-date basis.

尽管面临这些挑战,Alphabet A类和C类股票在年初至今上涨约38%。

It currently has a market capitalization of $2.351 trillion, making it the fifth most valuable company in the world following Apple, Nvidia, Microsoft and Amazon.

目前其市值为2.351万亿,使其成为全球第五大最有价值的公司,仅次于苹果、英伟达、微软和亚马逊。

Price Action: Alphabet's Class A shares rose by 1.54% on Friday, closing at $191.41, while Class C shares climbed 1.72% to end at $192.96, according to Benzinga Pro data.

价格走势:根据Benzinga Pro数据,Alphabet A类股票在周五上涨1.54%,收于191.41美元,而C类股票上涨1.72%,收于192.96美元。

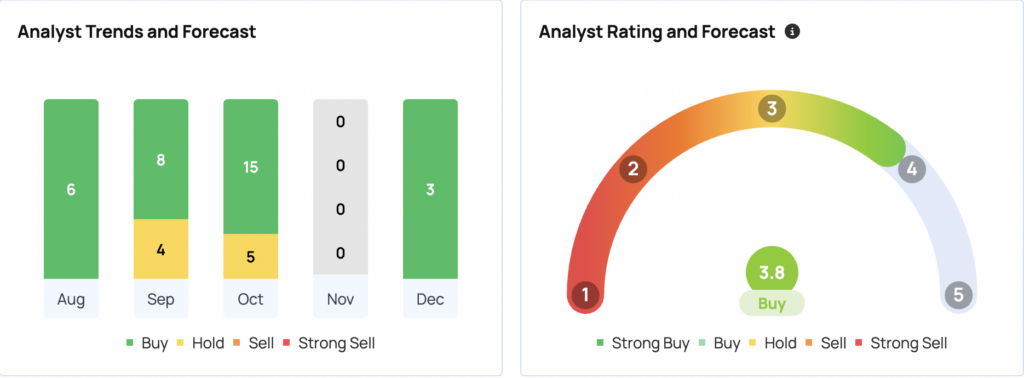

The latest analyst updates from JP Morgan, Goldman Sachs, and Baird place an average price target of $215.67 on Alphabet's Class A shares, suggesting a potential gain of 11.87%.

JP Morgan、高盛和贝尔德的最新分析师更新对Alphabet A类股票的平均目标价为215.67美元,暗示潜在增益为11.87%。

Similarly, Oppenheimer, Jefferies, and Pivotal Research have set an average price target of $225 for Class C shares, projecting an upside of 15.9%.

同样,Oppenheimer、Jefferies和Pivotal Research已将C类股票的平均目标价格设定为225美元,预计上涨幅度为15.9%。

- After Google's $2.7B Acquisition Of Founders And Staff, This AI Startup Abandons Large Language Model Plans And Shifts Focus Away From Chatbots

- 在谷歌以27亿美元收购创始人和员工之后,这家人工智能创业公司放弃了大型语言模型计划,并将重心转向非聊天机器人领域

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

免责声明:此内容部分由Benzinga Neuro生成,并由Benzinga编辑审核和发布。

However,

However,