Berkshire added two consumer companies in the third quarter.

The stock god suddenly takes action and is sweeping the market in the USA.

Berkshire purchased stocks of Occidental Petroleum, Sirius XM, and VeriSign worth over 0.56 billion USD in three days this Tuesday, Wednesday, and Thursday.

Specifically, Berkshire increased its shareholding in Occidental Petroleum at a price of 0.405 billion USD, acquiring nearly 8.9 million shares, with shareholding exceeding 28%; it purchased about 5 million shares of Sirius XM for approximately 0.113 billion USD; and bought around 0.234 million shares of VeriSign for about 45 million USD.

Specifically, Berkshire increased its shareholding in Occidental Petroleum at a price of 0.405 billion USD, acquiring nearly 8.9 million shares, with shareholding exceeding 28%; it purchased about 5 million shares of Sirius XM for approximately 0.113 billion USD; and bought around 0.234 million shares of VeriSign for about 45 million USD.

Despite the fact that major indices in the USA have continuously hit new highs this year, these three stocks have all experienced declines. Occidental Petroleum's stock price has dropped 19% this year, ranking at the bottom in the S&P 500 Index; the satellite broadcasting company Sirius XM has fallen 56%; and the Internet Plus-Related company VeriSign has dropped over 3% this year.

After news of Buffett's increased shareholding emerged, the three stocks all saw increases overnight, with Occidental Petroleum up 3.9%, Sirius XM up over 12.15%, and VeriSign up 2.79%.

The stock god has been selling stocks in the past two years, accumulating a large amount of cash. According to its earnings reports, Buffett net sold 127 billion USD of stocks in the first nine months of this year. Among these, in the third quarter, he sold holdings worth 36 billion USD and bought stocks valued at 1.5 billion USD.

In the third quarter, Berkshire initiated positions in two consumer companies: Domino's Pizza and swimming pool supplies distributor Pool Corp. As of the end of the third quarter, Berkshire held 1.28 million shares of Domino's Pizza, with a position market value of approximately 0.549 billion USD; it held 0.404 million shares of Pool Corp, with a position market value of approximately 0.152 billion USD.

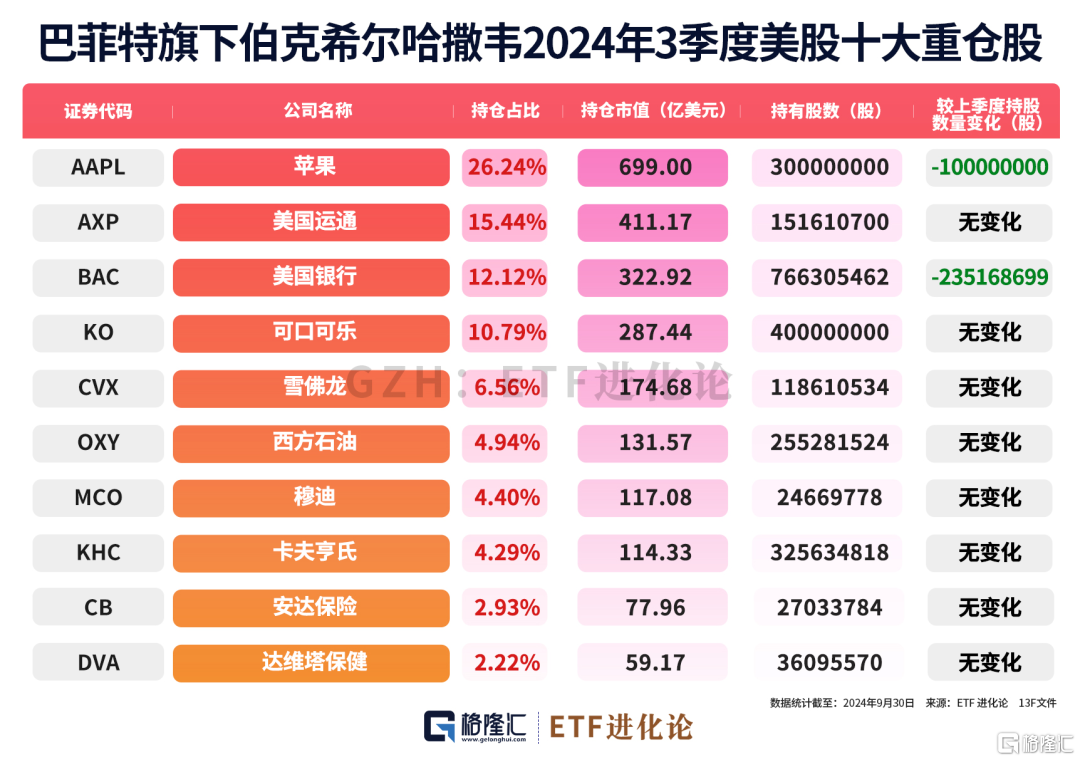

In the third quarter, Buffett reduced his holdings by 0.1 billion shares of Apple. Although Apple remains Berkshire's largest heavy stock, the number of shares has plummeted from 0.905 billion shares at the beginning of the year to 0.3 billion shares. Buffett also reduced his holdings by 0.235 billion shares of Bank of America in the third quarter, with the latest holding number at approximately 0.766 billion shares.

In addition to Apple and Bank of America, Buffett also reduced his holdings in the third quarter, including Utah Beauty (ULTA), Satellite broadcasting company Sirius, Charter Communications, and aircraft parts manufacturer Heico. Among these, Utah Beauty (ULTA), a beauty retail company, was a new acquisition for Berkshire in the second quarter, but the holding period was very short, and 96.5% of its holdings were sold in the third quarter.

As of the end of the third quarter, Berkshire held 40 stocks, with a holding market value of 266.379 billion USD, and the top ten holdings accounted for 89.68% of the total market value. Among Berkshire's heavy holdings, Apple still ranks first, with a holding market value of approximately 69.9 billion USD, accounting for 26.24% of the portfolio; American Express ranks second, with a holding market value of approximately 41.1 billion USD, accounting for 15.44% of the portfolio, with no change in the number of shares from the previous quarter; Bank of America, Coca-Cola, and Chevron each account for over 6% of the portfolio.

(The content of this article consists of objective data information listing and does not constitute any investment advice.)

Berkshire has net sold US stocks for eight consecutive quarters, accumulating a large amount of cash. By the end of the third quarter, Berkshire's cash reserves surged to 325.2 billion dollars, setting a historical record, a significant increase of 157.2 billion dollars compared to the 168 billion dollars at the beginning of the year.

…

"Oracle of Omaha" Buffett donated approximately 1.1 billion USD in charitable donations again on the eve of Thanksgiving this year.

Berkshire issued a statement that Buffett will convert his 1,600 shares of Berkshire Class A stock into 2.4 million shares of Class B stock, and will donate these shares to four family foundations.

With this donation, Buffett has donated more than 58 billion dollars since 2006, accounting for 56.6% of his holdings in Berkshire Hathaway stocks.

After this donation, Buffett's holdings of Berkshire Hathaway Class A shares will decrease to 206,363 shares (approximately 147.4 billion dollars), a reduction of 56.6% since his commitment in 2006.

Buffett stated that in 2004, before the death of his first wife, Susie, they jointly owned 508,998 shares of Class A stock. Buffett noted that after his passing, his children will be fully responsible for gradually distributing all of his Berkshire shares. These shares currently account for 99.5% of his wealth.

Buffett believes that wealthy parents need to leave their children a suitable amount of money, enough for them to do what they want yet not enough for them to sit idle and waste away for a lifetime.

In his latest letter to shareholders, Buffett wrote, "Death always comes; it makes life unpredictable and cruel. Sometimes it visits an infant in a cradle, and other times it may come for you after a century. Looking back, I have been very fortunate, but the price is that my children are now running out of time; they are 71, 69, and 66 years old respectively."

具体来看,伯克希尔以4.05亿美元的价格增持了近890万股西方石油,目前持股比例超过28%;以约1.13亿美元购买了约500万股Sirius XM股票;以约4500万美元买了约23.4万股威瑞信股票。

具体来看,伯克希尔以4.05亿美元的价格增持了近890万股西方石油,目前持股比例超过28%;以约1.13亿美元购买了约500万股Sirius XM股票;以约4500万美元买了约23.4万股威瑞信股票。