New characters and driving forces are being derived and reflected in SHEIN

Recently, there have been frequent reports from SHEIN, which continues to kill all sides overseas.

According to Similarweb statistics, SHEIN became the most visited clothing and fashion brand in the world in Q3 2024.

Let's look at data released by LSA and others. In France, SHEIN has become the second-largest clothing and fashion brand, leading H&M, Primark, and even Kiabi, and is expected to surpass ZARA this year; in Germany, SHEIN has become the fourth largest clothing brand, after ZARA, C&A, and NIKE, and is likely to advance one more place this year; in Japan, SHEIN has the largest number of online users, over Uniqlo...

Let's look at data released by LSA and others. In France, SHEIN has become the second-largest clothing and fashion brand, leading H&M, Primark, and even Kiabi, and is expected to surpass ZARA this year; in Germany, SHEIN has become the fourth largest clothing brand, after ZARA, C&A, and NIKE, and is likely to advance one more place this year; in Japan, SHEIN has the largest number of online users, over Uniqlo...

This is equivalent to saying that almost all of the world's most representative fast fashion giants are on SHEIN's overtaking list.

Among the younger generation, the influence of the SHEIN brand is no different. According to a recent DCDX report, Disney, Roblox, Apple, ChatGPT, SHEIN, etc. became the top 25 brands that received the most attention from Gen Z in 2024. Among them, SHEIN became the only fashion clothing brand among the top 25 brands.

On the other side, the SHEIN platform side also continues to grow. Also, among the top 25 brands receiving the most attention from Gen Z, SHEIN and Amazon have become the only two e-commerce platforms among them. At the same time, the number of SHEIN users is still growing dramatically. From January to August this year, it grew the fastest among overseas platforms.

More merchants, especially a large number of domestic industry players, have accelerated their entry into the SHEIN platform to fill more categories, and merchant performance is also showing a surge. For example, on the eve of the recent “Black Five” promotion, the jewelry industry brought merchants to go overseas collectively through SHEIN, and sales of some merchants have increased 130% in a single day.

Behind the vibrant atmosphere, we see that new characters and driving forces are being derived and reflected in SHEIN. It's not just about catching up with ZARA, or the narrative logic of a fashion brand.

How do we understand and define such a multifaceted new species now?

01

Rising Core: Explaining the Primacy of the Fashion Industry by leaps and bounds

As Churchill said, only by seeing the farther past can we see the farther future. When we understand why SHEIN is leading the fashion industry, we can understand what kind of future it will lead to.

Looking back, what made SHEIN?

Fashion represents a business model that quickly brings the latest fashion trends into the hands of mass consumers.

The primacy of the industry can be attributed to speed, category, and price, especially the first two points.

From GAP, Uniqlo, ZARA, to SHEIN, the success of these fashion representative companies is built on this without exception.

The only difference is that, first, judging from the background of the times, consumer demand is becoming more diversified and personalized, and the fashion sector is also more varied and diversified, which naturally enhances the industry-first “standard”; second, each brand interprets the first nature of the industry to a different extent, and SHEIN has achieved a leapfrog breakthrough. For example, SHEIN has taken another big step forward in industrial efficiency and inventory turnover on the basis of excellent brands in the previous industry.

Achieving this is very difficult in itself. SHEIN proposed a “small order, quick revers+digital tools, and 'one chain to the end'” solution. The so-called “one chain to the end” means that from raw materials to users, it has opened up all the capabilities of the supply chain and completed the entire process from creation to delivery (see Liang Ning's “True Demand” for the concept here). These elements are almost indispensable, and together they have formed their differentiated competitive ability.

Specifically, SHEIN reduced the minimum production quantity of orders to 100 pieces, quickly tested and repeated the market response. If the sales trend is good, it will immediately return orders and stop production. Thus, it can not only guarantee the abundance of new products, but also generate explosive payments and reduce inventory. It can also benefit consumers and guarantee its own profit level.

However, small orders themselves are “thin and time-consuming”. For suppliers, splitting development costs among a limited number of orders may not make money or even lose money, making traditional cooperation models difficult to support.

Objectively, ZARA's “500-piece order” flexible supply chain capability is almost the limit of production it can achieve.

SHEIN's strong digital capabilities have expanded its space. For example, it uses digital tools to grasp fashion trends and consumer feedback in real time, promote design development with greater accuracy, enhance the possibility of explosions, profit margins, and deeply empower suppliers, including continuously building flexible supply chain standards to help suppliers upgrade their plants and make production simpler and more efficient.

Furthermore, SHEIN relies on the developed garment industry throughout the Pearl River Delta region, and it is difficult for the world to find a second supply chain that can support such high-frequency and diverse clothing production needs.

In the process, SHEIN has also achieved the benefits of consumers, brands, and suppliers, laying the foundation for sustainable development.

Just imagine, as the consumer base continues to expand, if it continues to enhance its interpretation of the fashion industry's primacy, and supply chain production capacity continues to expand, what can SHEIN do? SHEIN's supply chain model is so superior, can it be replicated in other industries?

One possible development path points to an open platform, raise the upper limit of supply chain and market space, and achieve two things in one stroke.

This is probably also the underlying logic of SHEIN's deepening platform model since 2023, forming a unique “own brand+platform” dual-engine development model. At the same time, as mentioned earlier, SHEIN has continued to receive positive feedback and achieve verification. The cog of fate may have begun to rotate at a high speed.

02

Next stop, the upgraded ZARA+ global Taobao complex?

Based on the above, looking further at SHEIN's platform-based layout, an evolutionary context is gradually becoming clear: from the online version of ZARA to the upgraded version of ZARA and the global version of Taobao.

Looking vertically, according to the current growth trend, it is only a matter of time before SHEIN's scale will surpass ZARA. At the same time, SHEIN's advantages in terms of speed and category will continue to expand, and extend to more categories in the fashion field, such as shoes, bags, accessories, etc., essentially strengthening the expression of fashion, and trending towards an upgraded version of ZARA.

Looking horizontally, SHEIN's fashion advantage has accumulated a strong traffic pool, and can be combined with overseas operation experience, supply chain capabilities, etc., to attract more merchants and achieve category expansion, and even premium product expansion. In turn, this will help obtain more traffic. The bilateral network effect is expected to become more prominent, thus supporting its platform-based development.

Ultimately, it intertwines to form a complex of the upgraded version of ZARA and the global version of Taobao.

Behind this, for merchants, if they have traffic, it is easier to sell sales, get real profits, or focus more energy on the production side to create high-quality products.

At the same time, SHEIN deeply empowers the continuous operation of merchants. For example, in the platform-based model, its flexible on-demand supply chain model is empowering more merchants and brands in the country's industrial belt, enabling merchants to use quick measurement of small orders to predict sales and deploy production rhythms, amplify the certainty of profits, and reduce production waste.

Also, take the jewelry industry as an example. Yan Hui, a merchant from Qingdao, revealed that every year since SHEIN opened its store, it has been able to make several particularly popular segmented products, all of which have been slowly tested on the platform.

Furthermore, SHEIN also provides merchants with various forms of cooperation such as platform operation, independent operation, and semi-hosting to help different types of businesses go overseas. Half of them were launched in May of this year.

For example, for small to medium businesses with no sales or operation experience, SHEIN can provide proxy operation services, including support for product operation, warehousing, logistics, customer service, and after-sales services, so that they can focus on the product aspects they are good at. Semi-hosting is somewhere in between the first two. Under this model, merchants enjoy product pricing, operation, etc., and the platform undertakes operational support plans such as logistics and exclusive marketing activities.

It is also worth mentioning that SHEIN's semi-hosting model is different from other platforms. The result is that after SHEIN launched semi-hosting, it quickly attracted more than 20,000 merchants to settle in, and more than 70% of the new entrants achieved profit breakthroughs within the first quarter.

This also shows us that as SHEIN promotes the iteration of the platform-based model, extending from empowering “suppliers” to empowering “merchants,” upgrades may benefit consumers, platforms, and merchants. Similar to SHEIN's logic of leading the fashion industry, it may quickly stir up a larger market.

Furthermore, from an industrial belt perspective, last year, SHEIN pioneered the launch of the National 500 City Industrial Belt. By the first half of this year, more than 300 industrial belts in over 20 provinces had already settled in, covering mainstream industrial belts such as bags, apparel, underwear, small commodities, toys, footwear, and accessories. In September of this year, SHEIN also launched the “Premium” Overseas Program, which aims to accelerate the introduction of more high-quality merchants and brands and enable the high-quality development of the industrial belt.

SHEIN's flexible on-demand supply chain model has also continued to be implemented and achieved great results in non-standard industries that pursue personalized fashion, such as home furnishings and jewelry.

As SHEIN promotes the layout of the industrial belt, it will also make more categories, e-commerce characteristics, or the role of the global version of Taobao, more clear.

03

Higher Dimensional Value - Helping China's Industrial Transformation and Upgrading

In the past, under the logic of fashion storytelling, SHEIN was more like a commercial innovator and an international model. However, behind the new character positioning — the upgraded ZARA+ global version of Taobao, SHEIN has a higher dimensional value anchor.

This also enhances SHEIN's development certainty.

Perhaps many companies can achieve a major design explosion through digital tools, and can also develop a digital management system similar to SHEIN. However, building an industrial cluster that serves itself, and also serves such a large-scale industrial belt and brand to help the transformation and upgrading of the industry and the rise of the brand, is a very difficult and valuable thing; it is a deep moat.

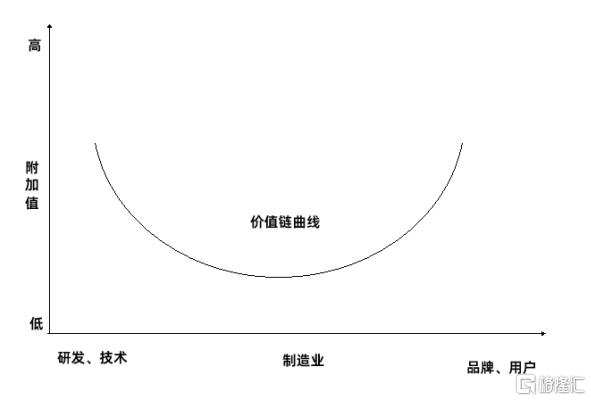

From the perspective of industrial transformation and upgrading, China's manufacturing industry has achieved remarkable achievements since the transformation and opening up, but it is undeniable that many manufacturing industries are still stuck at the bottom of the smile curve, making it difficult to reach the high added value link.

Feedback on e-commerce platforms, etc., low price competition once became the norm, but it not only reduced profit margins, but also profoundly affected product quality, etc., and brand image. Only when merchants get real profits will they dare to invest in R&D, brands, etc.

With advantages such as innovative models, marketing, and brands, SHEIN can help the industry to bring merchants overseas, while also helping more industries to reduce waste through flexible on-demand supply chain upgrades, pay more attention to product and brand leapfrogging, and enhance long-term development quality and market competitiveness. Thus, it helps China's industrial belt rise to both ends of the “smile curve” of the global industrial chain.

Although in order to promote the platform-based model and attract merchants to enter the industry, SHEIN has made arrangements to allow merchants to have more autonomy, and may not necessarily show huge performance catalysts in the short term, but this path is likely to become more and more valuable, transforming immeasurable space and value over time. (End of full text)

再来看LSA等发布的数据,在法国,SHEIN已成为第二大服装时尚品牌,领先H&M、Primark甚至Kiabi,并预计今年将超过ZARA;在德国,SHEIN已成为第四大服装品牌,仅次于ZARA、C&A和NIKE,今年很可能再进一名;在日本,SHEIN的线上用户数大超优衣库……

再来看LSA等发布的数据,在法国,SHEIN已成为第二大服装时尚品牌,领先H&M、Primark甚至Kiabi,并预计今年将超过ZARA;在德国,SHEIN已成为第四大服装品牌,仅次于ZARA、C&A和NIKE,今年很可能再进一名;在日本,SHEIN的线上用户数大超优衣库……