LiveOne, Inc. (NASDAQ:LVO) shares have had a really impressive month, gaining 39% after a shaky period beforehand. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

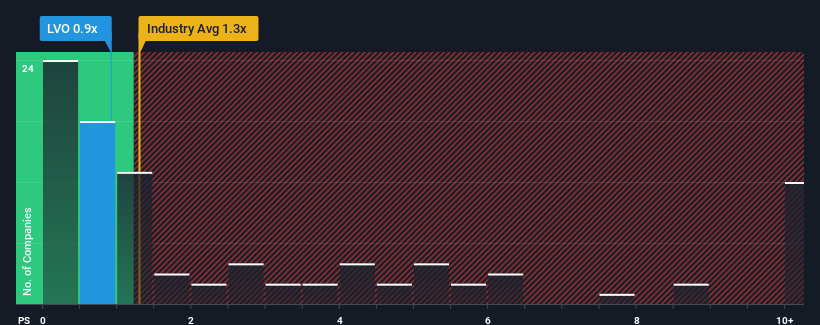

Even after such a large jump in price, you could still be forgiven for feeling indifferent about LiveOne's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in the United States is also close to 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does LiveOne's P/S Mean For Shareholders?

Recent times haven't been great for LiveOne as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on LiveOne will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like LiveOne's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like LiveOne's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. As a result, it also grew revenue by 27% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 5.1% over the next year. With the industry predicted to deliver 12% growth, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that LiveOne's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From LiveOne's P/S?

LiveOne's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our check of LiveOne's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Before you settle on your opinion, we've discovered 4 warning signs for LiveOne (2 are significant!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.