The Datacenter power Business is experiencing rapid growth.

The stock price just hit a record high during the day, and the actual controller announced a divorce in the evening.

Limited impact.

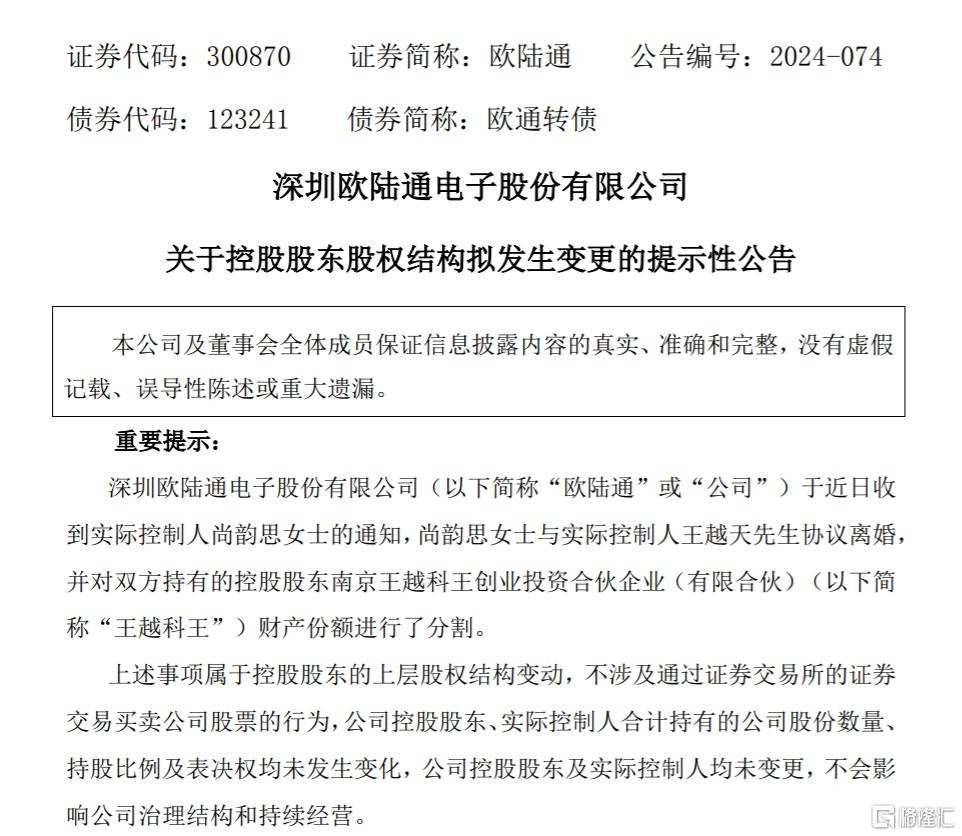

Today after the market close, Shenzhen Honor Electronic announced that the company's two actual controllers, Shang Yunsi and Wang Yuetian, have agreed to divorce, and the share of assets held by the controlling shareholder Wang Yuetian was divided between them.

According to information, the actual controllers of Shenzhen Honor Electronic are Wang Heqiu, Wang Yulin, Wang Yuetian, Shang Yunsi, and Wang Yuefei, and they act as a concerted party.

According to information, the actual controllers of Shenzhen Honor Electronic are Wang Heqiu, Wang Yulin, Wang Yuetian, Shang Yunsi, and Wang Yuefei, and they act as a concerted party.

Among them, Wang Heqiu and Wang Yulin are in a marital relationship, and Wang Yuetian and Wang Yuefei are their eldest and second sons respectively, while Shang Yunsi is Wang Yuetian's ex-wife.

The above five individuals indirectly hold more than 60% of the company's shares through Shenzhen Wang Yuetian, Shenzhen Genoli, and Taizhou Tongju.

After this divorce, Wang Yuetian plans to transfer his 12.04775% shares in Wang Yuetian Technology to Shang Yunshi.

After the transfer, Wang Yuetian's shareholding in Wang Yuetian Technology will decrease from 24.0955% to 12.04775%, while Shang Yunshi's shareholding will increase from 6.124% to 18.1718%.

However, this change does not seem to significantly affect Shenzhen Honor Electronic.

Shenzhen Honor Electronic stated in an announcement that the above matter pertains to changes in the upper equity structure of the controlling shareholder, and the total number of shares, shareholding ratio, and voting rights held by the company's controlling shareholder and actual controller have not changed, nor has there been a change in the controlling shareholder and actual controller, which will not affect the company's governance structure and sustainable operation.

The stock price has nearly doubled.

During today's trading session, Shenzhen Honor Electronic's stock price briefly rose more than 6%, hitting a historical high of 122.38 yuan/share, and ultimately closed up 0.55% at 113.99 yuan/share, with a total market value of 11.54 billion yuan.

Since September 24, Shenzhen Honor Electronic's stock price has been rising continuously, accumulating a rise of over 193.1%, with the stock price increasing from 38.89 yuan per share to 113.99 yuan, nearly doubling in 60 trading days.

Analysis shows that the continuous rise in Shenzhen Honor Electronic's stock price is closely related to its performance.

The Datacenter power Business is experiencing rapid growth.

According to the data, Shenzhen Honor Electronic mainly engages in the research and development, production, and sales of switching power supply products, with major products including power adapters, datacenter power supplies, and Other power supplies, widely used in office electronics, network communication, security monitoring, Smart Home, new Consumer Electronics devices, datacenters, power Battery equipment, pure electric transportation tools, and formation and capacity equipment among many fields.

Shenzhen Honor Electronic has become one of the major domestic power supply manufacturing enterprises for datacenters, and in the first half of this year, it has successively shipped to well-known domestic server system manufacturers such as Inspur Electronic Information Industry, Foxconn, Huaqin, Lenovo, ZTE, and New H3C.

With the Global AI boom, Shenzhen Honor Electronic's datacenter power supply business has developed well, helping the company achieve impressive performance growth in the third quarter of this year.

In the first three quarters of this year, Shenzhen Honor Electronic achieved revenue of 2.664 billion yuan, a year-on-year increase of 28.95%; net income was 0.157 billion yuan, a year-on-year increase of 277.01%; net margin was 5.89%, an increase of 3.88 percentage points year-on-year; gross margin was 21.28%, an increase of 1.75 percentage points year-on-year.

In the third quarter, Shenzhen Honor Electronic achieved revenue of 1.064 billion yuan, a year-on-year increase of 38.17%, once again setting a historical high for single-quarter revenue; net income was 70.7867 million yuan, a year-on-year increase of 104.78%; net margin was 6.65%, an increase of 2.16 percentage points year-on-year; gross margin was 21.78%, an increase of 2.02 percentage points year-on-year.

Regarding the significant growth in the third quarter performance, Shenzhen Honor Electronic stated that it was primarily due to the rapid growth in revenue from the Datacenter power business, particularly the significant increase in revenue from high-power Server power supplies.

It is reported that the revenue from the Datacenter power business was 0.495 billion yuan, a year-on-year increase of 77.16%, and its contribution to revenue continued to rise, becoming a major factor driving the company's revenue growth.

Among them, the high-power Server power supply business achieved revenue of 0.209 billion yuan, a significant year-on-year increase of 464.12%, accounting for 42.21% of the overall revenue of the Datacenter power business, maintaining strong growth momentum.

The gross margin for the Datacenter power business was 26.24%, an increase of 6.50 percentage points year-on-year, mainly due to the increase in the shipment proportion of high-power Server power supply products, product structure improvement, and profit margin optimization.

In addition, the power tool charger business has returned to a normalized growth track, with significant revenue recovery.

At the same time, Shenzhen Honor Electronic is also actively optimizing customer and product structures to increase the shipment proportion of high-value and high-gross-margin products, driving the increase in gross margin, which indicates a clear recovery of the company's profitability.

资料显示,

资料显示,