High-rolling investors have positioned themselves bearish on Rigetti Computing (NASDAQ:RGTI), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in RGTI often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 17 options trades for Rigetti Computing. This is not a typical pattern.

The sentiment among these major traders is split, with 23% bullish and 70% bearish. Among all the options we identified, there was one put, amounting to $27,700, and 16 calls, totaling $1,630,393.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $20.0 for Rigetti Computing over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $20.0 for Rigetti Computing over the last 3 months.

Volume & Open Interest Development

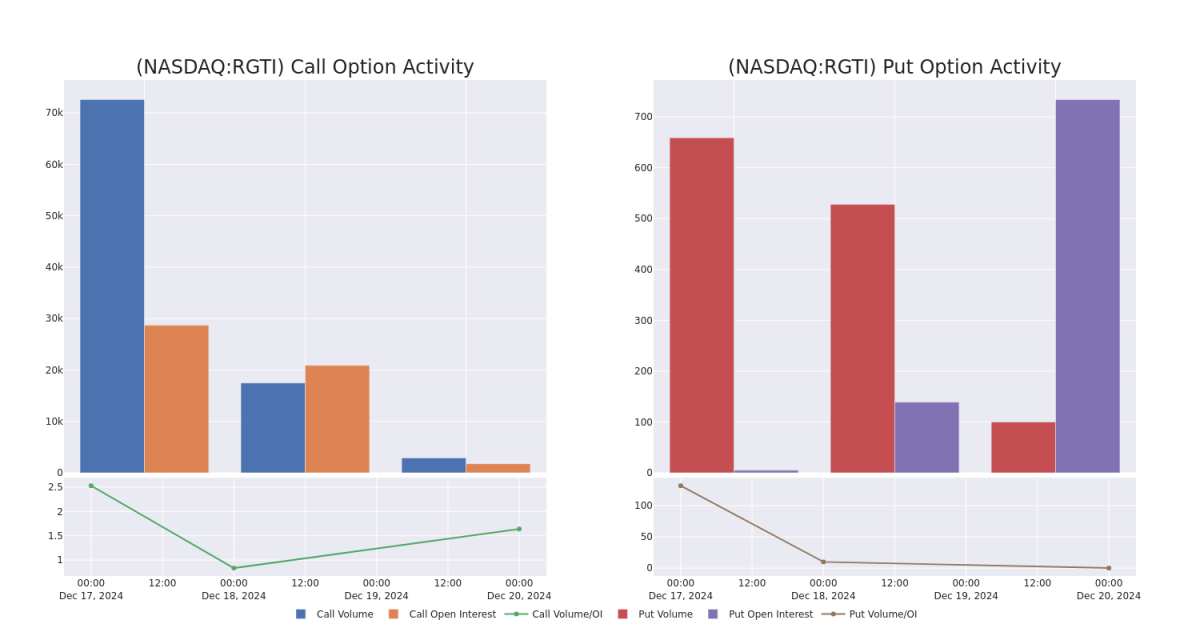

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Rigetti Computing's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Rigetti Computing's whale trades within a strike price range from $10.0 to $20.0 in the last 30 days.

Rigetti Computing Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RGTI | CALL | SWEEP | BEARISH | 01/31/25 | $3.4 | $2.4 | $2.35 | $12.50 | $540.5K | 416 | 2.3K |

| RGTI | CALL | TRADE | NEUTRAL | 05/16/25 | $4.1 | $3.9 | $4.0 | $16.00 | $288.4K | 93 | 2.0K |

| RGTI | CALL | SWEEP | BEARISH | 01/17/25 | $2.1 | $2.0 | $2.0 | $13.00 | $120.0K | 4.9K | 859 |

| RGTI | CALL | SWEEP | BEARISH | 01/17/25 | $3.3 | $3.2 | $3.2 | $10.00 | $120.0K | 7.6K | 1.3K |

| RGTI | CALL | TRADE | BEARISH | 01/17/25 | $6.7 | $1.7 | $3.7 | $10.00 | $90.6K | 7.6K | 245 |

About Rigetti Computing

Rigetti Computing Inc is engaged in the business of full-stack quantum computing. Its proprietary quantum-classical infrastructure provides ultra-low latency integration with public and private clouds for high-performance practical quantum computing. The company has developed the industry's first multi-chip quantum processor for scalable quantum computing systems. Geographically, it derives a majority of its revenue from the United States.

Following our analysis of the options activities associated with Rigetti Computing, we pivot to a closer look at the company's own performance.

Present Market Standing of Rigetti Computing

- With a volume of 89,179,572, the price of RGTI is up 24.69% at $11.68.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 80 days.

What The Experts Say On Rigetti Computing

In the last month, 2 experts released ratings on this stock with an average target price of $8.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Craig-Hallum downgraded its action to Buy with a price target of $12. * An analyst from B. Riley Securities persists with their Buy rating on Rigetti Computing, maintaining a target price of $4.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Rigetti Computing with Benzinga Pro for real-time alerts.