In the context of the rapid growth of new energy vehicles, the installed capacity of power batteries is also growing rapidly. Since power batteries for new energy vehicles have a certain period of use, the power battery decommissioning market is gradually becoming the focus of attention. In the context of dual carbon, the lithium battery recycling industry is also developing, and some companies in this field are impacting their listing.

Gelonghui learned that recently, Guangdong Jinsheng Renewable Energy Co., Ltd. (“Jinsheng New Energy” for short) submitted a prospectus to the Hong Kong Stock Exchange to be listed on the Hong Kong Main Board. CICC and CMB International are co-sponsors.

According to reports, Jinsheng New Energy has hired CICC as a guidance agency to prepare for its A-share listing, and has submitted listing guidance and filing with the Guangdong Regulatory Bureau to impact the Shenzhen Main Board listing. However, in August 2024, the two sides terminated the A-share listing counseling agreement and went public in Hong Kong instead.

In recent years, against the backdrop of a slowdown in the pace of A-share IPOs and strict entry regulations, many companies have terminated their A-share IPOs. Among them, there is no shortage of companies that recycle and reuse waste lithium batteries like Jinsheng New Energy.

In recent years, against the backdrop of a slowdown in the pace of A-share IPOs and strict entry regulations, many companies have terminated their A-share IPOs. Among them, there is no shortage of companies that recycle and reuse waste lithium batteries like Jinsheng New Energy.

Is recycling lithium batteries a good business? You might as well find out through Jinsheng Renewable Energy.

01

Five brothers in Guangdong recycle waste batteries and start a unicorn

Jinsheng New Energy is headquartered in Zhaoqing, Guangdong. Behind its development is the story of five brothers teaming up to start a business.

According to public information, in 2005, the five Li brothers (Li Sen, Li Xin, Li Yao, Li Yan, and Li Wang) founded Gaoyao Jinye Metal Development Co., Ltd., which is mainly engaged in the non-ferrous metal smelting and rolling processing industry. After several years of development, it gradually grew from a small company with only 20 or 30 people.

In 2010, Li Brothers founded Zhaoqing Jinsheng Metal Industrial Co., Ltd. (the predecessor of Jinsheng New Energy), which is mainly engaged in the production and sale of nickel sulfate; in 2014, they also established Jiangxi Ruida New Energy Technology Co., Ltd. (“Jiangxi Ruida” for short), which specializes in lithium battery recycling business.

From 2021 to 2023, Jinsheng New Energy and its wholly-owned subsidiary Jiangxi Ruida were recognized by the Ministry of Industry and Information Technology as a “double white list” enterprise for recycling and hierarchical use of lithium batteries.

Jinsheng New Energy also entered the “2024 Global Unicorn List” published by Hurun Baifu, becoming a new energy unicorn valued at 12 billion yuan.

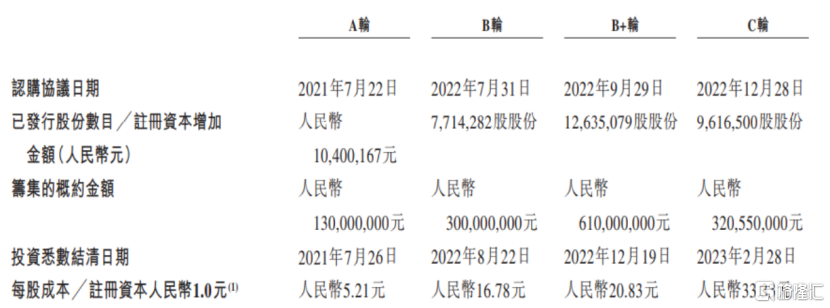

The company's development is inseparable from capital support. Since 2021, Jinsheng New Energy has successively completed 4 rounds of financing. Investors include CICC, Fosun, Dachen, Cornerstone, GAC, and Bosch.

The main terms of the company's fourth round of financing. The picture is from the prospectus

In terms of shareholder structure, prior to this issuance, the Lee Brothers were concerted actors and collectively controlled about 55.05% of Jinsheng New Energy's voting rights. Among them, Li Sen is currently the chairman and general manager of the company, and Li Xin is the vice chairman and deputy general manager.

02

Due to falling product prices, the company's performance in 2023 changed from profit to loss

In recent years, with the explosion in sales of new energy vehicles in China and the acceleration of the upgrading of consumer electronics products, the supply of decommissioned lithium batteries has increased significantly.

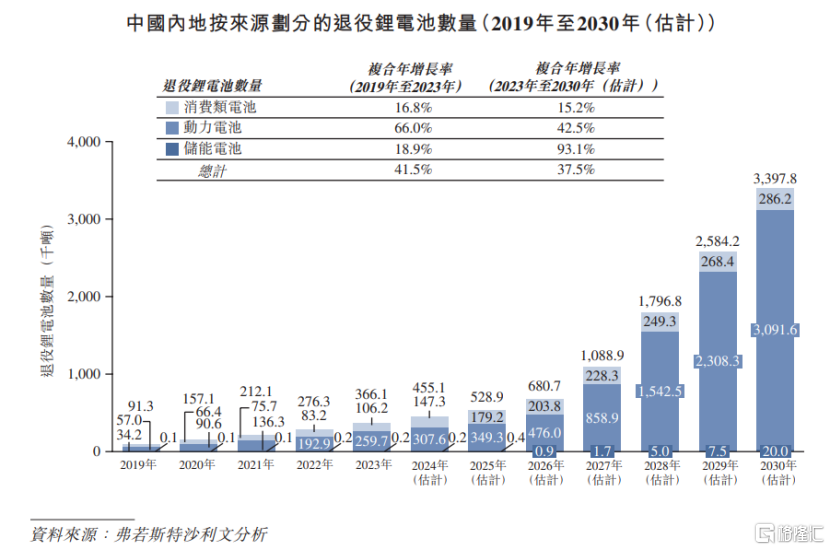

The total amount of decommissioned lithium batteries in mainland China reached 0.3661 million tons in 2023, and is expected to reach 3.4 million tons by 2030. The compound annual growth rate from 2023 to 2030 is 37.5%.

Among decommissioned lithium batteries, the number of consumer batteries and decommissioned power batteries in 2023 is about 0.1062 million tons and 0.2597 million tons, respectively, and is expected to continue to increase in the future.

Photo source: Prospectus

In this context, companies such as Jinsheng New Energy have successfully seized the opportunity and relied on recycling waste lithium batteries to support a huge business.

The power battery recycling industry chain includes various links such as battery application side, recycling channel network, cascade utilization, dismantling and recycling, and material reuse.

Among them, the main suppliers of decommissioned lithium batteries include lithium battery manufacturers, electric vehicle manufacturers, and lithium battery recycling companies such as Jinsheng New Energy that collect decommissioned batteries and battery waste from various sources.

Jinsheng New Energy's main job is to recycle decommissioned lithium batteries (including ternary batteries and lithium iron phosphate batteries) and battery production waste and excess materials. These materials go through a mechanical crushing process to extract valuable metals and “black powder” components, and then go through complex hydrometallurgy to produce solid or liquid compounds such as lithium carbonate and nickel sulfate.

The company then sells these refined products to manufacturers of ternary precursor and cathode materials to produce new lithium batteries, thus forming a circular economy model.

Specifically, Jinsheng New Energy provides a series of recycled products such as lithium carbonate, nickel sulfate, cobalt sulfate, and graphite. By the end of June 2024, sales of lithium recycling products and nickel recycling products contributed more than 70% of the company's revenue.

Revenue breakdown by product type, image source: Prospectus

In recent years, the company's performance has fluctuated to a certain extent. Due to a sharp drop in the current market price of finished products, the company experienced net losses in 2023 and the first half of 2024.

In 2021, 2022, 2023, and the first half of 2024 (the “reporting period”), the company's revenue was approximately 1.133 billion yuan, 2.905 billion yuan, 2.892 billion yuan, and 995 million yuan, respectively. The corresponding net profit was 0.069 billion yuan, 0.151 billion yuan, -0.473 billion yuan, and -147 million yuan, respectively.

In 2021, 2022, and 2023, the company's gross margins were 16.7%, 14.3%, and -5.6%, respectively, showing a downward trend year by year. Among them, due to rising raw material prices, the company's gross margin declined in 2022; in 2023, although the sales volume of the company's recycled products increased, the company recorded a gross loss due to a continuous sharp drop in the market price of the product and an increase in inventory impairment losses.

03

In 2023, it will be the second largest lithium battery recycling company in the world

The lithium battery material recycling and recycling market in which Jinsheng New Energy is located is an emerging market with intense competition. As the industry develops and demand increases, competition is expected to continue to intensify.

These competitors may put pressure on the company's contract price and gross margin. If the company is unable to cope with this competition, it may be robbed of market share by competitors, thereby affecting operating performance.

Among lithium battery recycling and recycling solution providers, lithium battery manufacturers and electric vehicle manufacturers or their subsidiaries have certain advantages, and they have their own channels to obtain decommissioned batteries.

Third-party solution providers, such as Jinsheng New Energy, need to establish a lithium battery recycling network to purchase decommissioned batteries from upstream suppliers.

In 2023, the sales revenue of recycled materials in the global lithium battery recycling and recycling solutions market reached 73.6 billion yuan.

In terms of sales revenue from recycled materials, the top five global lithium battery recycling and recycling solution providers accounted for about 20.8% in 2023. Among them, Jinsheng New Energy ranked second with a market share of about 3.8%, second only to Brunp Cycle under the Ningde Era (market share of about 11.5%); it also ranked first among third-party solution providers.

Photo source: Prospectus

In 2023, the global sales volume of recycled materials in the lithium battery recycling and recycling solution market reached about 1.1697 million tons. Based on the sales volume of recycled materials, the top five global lithium battery recycling and recycling solution providers accounted for about 24.9%. Among them, Jinsheng New Energy ranked second with a market share of 5%.

Overall, the lithium battery recycling industry in which Jinsheng New Energy is located has a lot of room for development, and the company already has a certain market position after years of development. However, compared with automobile and lithium battery manufacturers, the company does not have an advantage in recycling channels for waste lithium batteries, and the company faces the risk of product price fluctuations. It is not easy to significantly increase its market share in a competitive environment in the future.

近年来,在A股放缓IPO节奏、严把准入关的背景下,许多企业终止了A股IPO,其中不乏

近年来,在A股放缓IPO节奏、严把准入关的背景下,许多企业终止了A股IPO,其中不乏