The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Shandong Sito Bio-technology Co., Ltd. (SZSE:300583) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

How Much Debt Does Shandong Sito Bio-technology Carry?

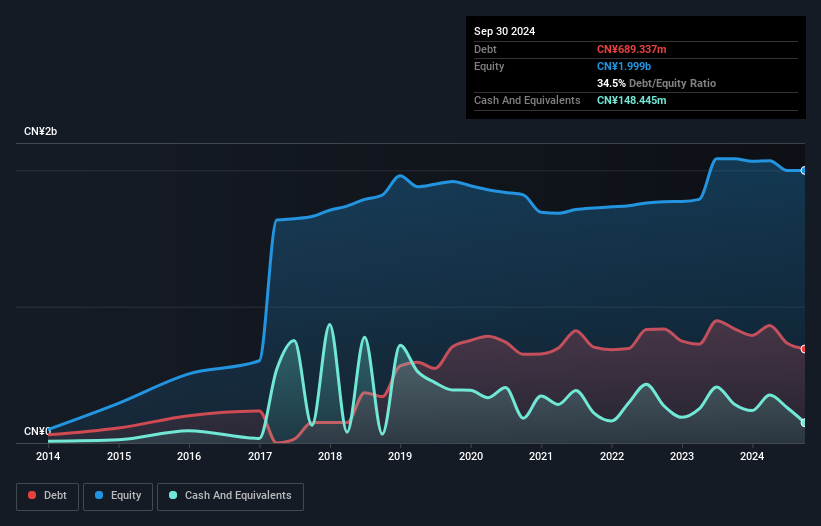

The image below, which you can click on for greater detail, shows that Shandong Sito Bio-technology had debt of CN¥689.3m at the end of September 2024, a reduction from CN¥837.7m over a year. On the flip side, it has CN¥148.4m in cash leading to net debt of about CN¥540.9m.

A Look At Shandong Sito Bio-technology's Liabilities

The latest balance sheet data shows that Shandong Sito Bio-technology had liabilities of CN¥974.9m due within a year, and liabilities of CN¥113.6m falling due after that. Offsetting these obligations, it had cash of CN¥148.4m as well as receivables valued at CN¥455.0m due within 12 months. So its liabilities total CN¥485.0m more than the combination of its cash and short-term receivables.

The latest balance sheet data shows that Shandong Sito Bio-technology had liabilities of CN¥974.9m due within a year, and liabilities of CN¥113.6m falling due after that. Offsetting these obligations, it had cash of CN¥148.4m as well as receivables valued at CN¥455.0m due within 12 months. So its liabilities total CN¥485.0m more than the combination of its cash and short-term receivables.

Since publicly traded Shandong Sito Bio-technology shares are worth a total of CN¥3.92b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Shandong Sito Bio-technology has a quite reasonable net debt to EBITDA multiple of 2.5, its interest cover seems weak, at 2.4. In large part that's it has so much depreciation and amortisation. These charges may be non-cash, so they could be excluded when it comes to paying down debt. But the accounting charges are there for a reason -- some assets are seen to be losing value. Either way there's no doubt the stock is using meaningful leverage. Shareholders should be aware that Shandong Sito Bio-technology's EBIT was down 23% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Shandong Sito Bio-technology will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Shandong Sito Bio-technology created free cash flow amounting to 5.3% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

We'd go so far as to say Shandong Sito Bio-technology's EBIT growth rate was disappointing. Having said that, its ability to handle its total liabilities isn't such a worry. Looking at the bigger picture, it seems clear to us that Shandong Sito Bio-technology's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Shandong Sito Bio-technology that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.