$Apple (AAPL.US)$ is on track to become the first company to reach a $4 trillion market capitalization by "early 2025," driven by strong iPhone sales and artificial intelligence innovations, according to Wedbush Securities analyst Dan Ives.

What Happened: The tech giant's shares have surged nearly 40% since January, closing at $255 per share on Monday with a market cap of $3.86 trillion. This performance puts Apple ahead of rivals $NVIDIA (NVDA.US)$ at $3.35 trillion and $Microsoft (MSFT.US)$ at $3.22 trillion.

Recent supply chain checks in Asia indicate robust iPhone 16 upgrade trends heading into the Christmas season. "We believe the success of iPhone 16 with a strong holiday season ahead over the next week will be the launchpad for a renaissance of growth in Cupertino over the next 12 to 18 months," Ives wrote in a weekend report, according to New York Post.

Apple's recent iOS 18.2 update showcases its AI ambitions, introducing features like Visual Intelligence for text summarization and Image Playground for generating original images. These enhancements are exclusive to iPhone 15 Pro and iPhone 16 users.

Apple's recent iOS 18.2 update showcases its AI ambitions, introducing features like Visual Intelligence for text summarization and Image Playground for generating original images. These enhancements are exclusive to iPhone 15 Pro and iPhone 16 users.

Dan Ives forecast that Apple's stock will eclipse the $300 per share plateau within the next 12 months and that the company's market capitalization will blow past $4 trillion "by early 2025." @nypost— Dan Ives (@DivesTech) December 23, 2024

Why It Matters: The company's renewed focus on AI appears to be paying off. Apple reported iPhone sales of $46.22 billion in its fiscal fourth quarter, marking a 6% year-over-year increase and reversing two consecutive quarters of decline.

Despite its strong position, Apple faces industry challenges. The company's revenue growth of 6.07% lags behind the technology hardware sector average of 21.95%, according to Benzinga data. However, Apple maintains superior profitability metrics, with its EBITDA of $32.5 billion significantly exceeding industry averages.

The stock's current price-to-earnings ratio of 40.8 suggests potential undervaluation compared to industry peers, even as the company strengthens its AI capabilities through partnerships, including a recent collaboration with NVIDIA to enhance large language model performance.

Price Action: Apple stock closed at $255.27 on Monday, up 0.31% for the day. In after-hours trading, the stock edged down 0.13%. Year to date, Apple shares have surged by 37.51%, according to data from Benzinga Pro.

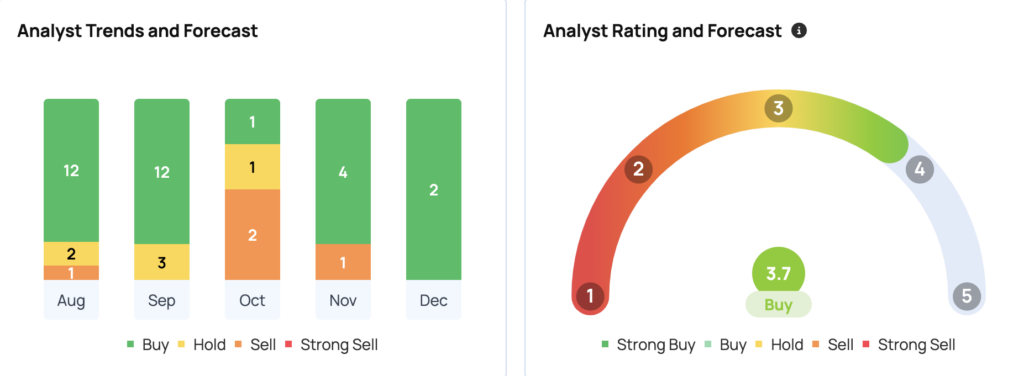

Apple has a consensus price target of $242.26 from 31 analysts, with a high of $300 by Wedbush and a low of $180 by DZ Bank. The most recent ratings from Morgan Stanley, Needham, and Wedbush set an average target of $277.67, implying an 8.91% upside for the stock.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.