Tesla Inc.'s (NASDAQ:TSLA) robotaxi ambitions face fresh skepticism from prominent market critics, with new data from New York City's ride-sharing market fueling debate about the technology's revenue potential.

What Happened: GLJ Research analyst Gordon Johnson argued on social media platform X that Tesla shorts would benefit from robotaxi approval, stating the "promise is worth much, much more than the reality."

His comments came alongside data shared by veteran short-seller James Chanos, President and Managing Partner, Chanos and Company showing New York City's daily ride-sharing usage averages 768,000 trips, or roughly three rides per capita monthly.

— Gordon Johnson (@GordonJohnson19) December 23, 2024

The VERY best thing that can happen for $TSLA shorts is for robotaxis to be approved, and for the economics to be come clear to all. The "promise" is worth MUCH, MUCH more than the "reality".

The skepticism contrasts sharply with bullish forecasts from leading Tesla analysts. Wedbush Securities' Dan Ives, who maintains a Street-high price target of $515, values Tesla's autonomous business at $1 trillion and projects robotaxis could capture 20% of ride-shares by 2030.

Gary Black, Managing Partner at The Future Fund LLC, takes a more measured stance with a $380 target. Black recently questioned Tesla owners' willingness to add their vehicles to a robotaxi fleet, despite potential earnings of $40,000 annually per vehicle based on his calculations of 25 daily trips at $1 per mile.

Why It Matters: Uber Technologies CEO Dara Khosrowshahi has also expressed doubts about Tesla's robotaxi strategy, citing challenges in fleet management and customer service that differ significantly from vehicle manufacturing.

Tesla reportedly plans to launch its ride-hail service in Texas and California in 2025, pending regulatory approval. The company is in early talks with Austin authorities for autonomous vehicle testing.

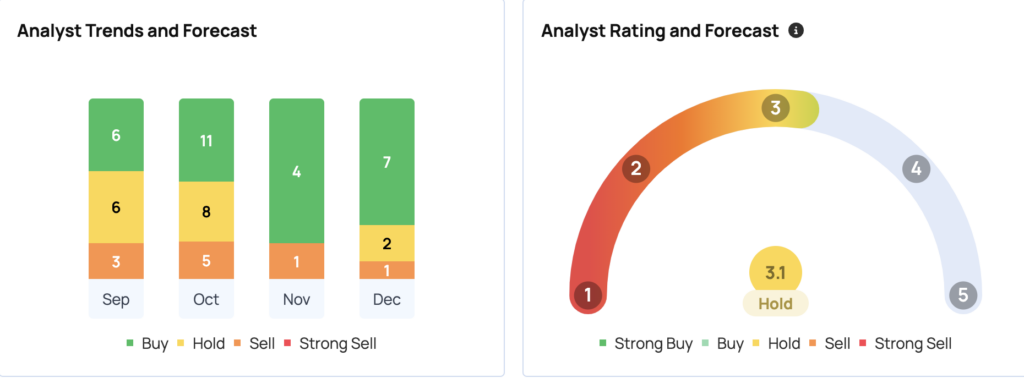

The electric vehicle maker's stock has gained 71% year-to-date, with Morgan Stanley naming it their top pick for 2025. According to Benzinga Pro, Tesla currently has a consensus price target of $280.41 from 33 analysts, with recent ratings from Baird, Mizuho, and Goldman Sachs averaging $446.67.

- Microsoft Invested Nearly $14 Billion In OpenAI But Now Its Reducing Its Dependence On The ChatGPT-Parent: Report

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.