OpenAI CEO Sam Altman-backed nuclear power startup Oklo Inc. (NASDAQ:OKLO) received an outperform rating from Wedbush Securities, marking another milestone in its push to power the artificial intelligence revolution through advanced nuclear technology.

What Happened: Wedbush analyst Dan Ives set a $26 price target for Oklo, citing the company's strategic position to capitalize on surging energy demands from data centers. "With the AI revolution underway, the industry will need roughly a tenfold increase in computing power by 2030," Ives wrote in his Thursday note, according to Investor's Business Daily.

The rating follows Oklo's Wednesday announcement of an agreement to supply up to 12 gigawatts of nuclear power to Switch, an AI provider and data center operator, through 2044. The company plans to develop, construct, and operate powerhouses across the United States, with its first Aurora reactor expected to be operational by 2027.

Why It Matters: Oklo's shares have surged approximately 100% in 2024, despite a 9% December decline. The stock's momentum aligns with broader nuclear energy sector gains, sparked by Constellation Energy Corp.'s (NASDAQ:CEG) September deal to power Microsoft Corp.'s (NASDAQ:MSFT) data centers.

Why It Matters: Oklo's shares have surged approximately 100% in 2024, despite a 9% December decline. The stock's momentum aligns with broader nuclear energy sector gains, sparked by Constellation Energy Corp.'s (NASDAQ:CEG) September deal to power Microsoft Corp.'s (NASDAQ:MSFT) data centers.

According to McKinsey & Co., data center energy demand is projected to grow from 4% to 11-12% of total U.S. energy consumption by 2030. This surge has attracted major tech companies, with Amazon.com Inc. (NASDAQ:AMZN), Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG), and Oracle Corp. (NYSE:ORCL) all investing in small modular reactor technology.

While Oklo forecasts a full-year operating loss of $40-50 million, its customer pipeline has grown significantly, reaching approximately 2,100 megawatts by the third quarter of 2024.

Price Action: Oklo stock closed at $22.02 on Monday, up 2.32% for the day. In after-hours trading, the stock dipped to $22.00. Year to date, Oklo shares have surged by 107.74%, according to data from Benzinga Pro.

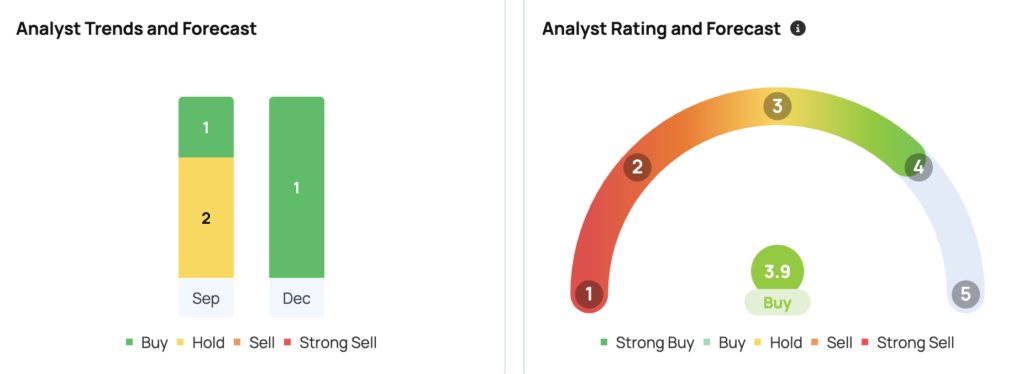

Oklo has a consensus price target of $15.33 from 4 analysts, with a high of $26 and a low of $10. The most recent ratings from Wedbush, Citigroup, and B. Riley Securities imply a downside of 30.30% from the average target.

- Tesla Shorts, Gordon Johnson, And James Chanos Express Skepticism On Robotaxi Potential Amid Usage Data Debate: The 'Promise' Worth Much More Than Reality

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.