① The special purpose acquisition company merger transaction will merge TechStar with Seeyond Holdings Ltd. to promote Seeyond's listing. Seeyond may become the third Lidar company to go public after Hesai Technology and RoboSense; ② From 2021 to the first half of 2024, Seeyond has accumulated losses of nearly 4.4 billion yuan, and its current market share is declining. The valuation for this listing is 11.7 billion Hong Kong dollars, and the founder previously worked at Baidu.

According to the Star Daily on December 24 (Reporter Yu Jiaxin), another Lidar company has landed in the capital markets.

Recently, TechStar Acquisition Corporation (hereinafter referred to as TechStar) announced that it has signed a business merger agreement with Seeyond Holdings Ltd. (hereinafter referred to as Seeyond) and its wholly-owned subsidiary Merger Sub to achieve a special purpose acquisition company merger transaction (SPAC merger transaction).

The announcement shows that the business merger agreement established by the parties includes the establishment of a founder lock-up agreement, PIPE (Private Investment in Public Equity) investment agreement, etc. Among them, the PIPE investors for this merger include Huangshan Jian Investment Capital, Fuze, and Zhuhai Hengqin Huagai, totaling 0.5513 billion Hong Kong dollars.

The announcement shows that the business merger agreement established by the parties includes the establishment of a founder lock-up agreement, PIPE (Private Investment in Public Equity) investment agreement, etc. Among them, the PIPE investors for this merger include Huangshan Jian Investment Capital, Fuze, and Zhuhai Hengqin Huagai, totaling 0.5513 billion Hong Kong dollars.

In other words, the special purpose acquisition company merger transaction will merge TechStar with Seeyond to promote Seeyond's listing.

TechStar was listed on the Hong Kong Stock Exchange on December 23, 2022, becoming the fifth SPAC company listed in Hong Kong, initiated by Xinyin Capital, Qicheng Group, Qicheng Capital, Ni Zhengdong, Li Zhu, and Liu Weijie, with joint sponsors being Qicheng Capital and China Securities Co., Ltd.

According to the plan, 40% of the 0.551 billion Hong Kong dollars will be used for research and development and upgrades, as well as other R&D-related activities, 25% for the construction and upgrading of production lines, 15% for optimizing the supply chain, 10% for overseas expansion; 10% for the company's general purposes, including other investments and acquisitions.

If this De-SPAC successfully completes, Seeyond may become the third Lidar company to go public after Hesai Technology and RoboSense.

In three and a half years, losses exceeded 4 billion yuan, and market share declined.

According to information on Tudatong's official website, the company was established in 2016 and is a provider of global image-grade Lidar solutions. It has R&D centers in Silicon Valley, Suzhou, and Shanghai, and has highly industrialized automotive-grade Lidar manufacturing bases in Ningbo and Suzhou.

On December 23, Tudatong officially announced that it will launch the new long-range Lidar Lingque E1X and combination products at CES 2025. Additionally, it will showcase how its product Lingque W is integrated into robotic dogs and unmanned ground vehicles.

In terms of performance, from 2021 to 2023, Tudatong's revenue was 4.6 million USD, 66.3 million USD, and 121 million USD, respectively; during this period, the unaudited losses were 0.114 billion USD (approximately 0.832 billion yuan), 0.188 billion USD (approximately 1.372 billion yuan), and 0.219 billion USD (approximately 1.598 billion yuan).

In the first half of 2024, Tudatong's revenue was approximately 66.1 million USD, recording an unaudited loss of 78.7 million USD (approximately 0.574 billion yuan).

Tudatong explained that the main reasons for the losses during this period include: the global Lidar solutions market, especially automotive-grade Lidar solutions market, is still in its early stages of development, the penetration rate of automotive industry Lidar solutions remains low, and the company has not fully achieved economies of scale; large R&D expenditures.

In contrast, Hesai and Suceng Juchuang are also currently in a loss state, but both parties mentioned anticipated times for profitability.

Among them, Hesai Technology's third quarter Earnings Reports projected revenue of 0.1 billion USD in the fourth quarter and a profit of 20 million USD, as well as achieving profitability for the whole year; Suceng also mentioned looking forward to achieving breakeven in some quarter of 2025, with 2026 being an opportunity for full-year profitability.

The reporter from the Star Daily noticed that TuDatong's market share continues to decline. According to data released by the Gaishi Automotive Research Institute, from January to May 2023, TuDatong's market share among Lidar suppliers in China was 27.5%, ranking second in the market, but by the end of 2023, its market share fell to 19%, ranking third. In the period from January to October this year, TuDatong's market share was 14.6%, sliding to fourth place.

Looking specifically at sales volume, in 2023, TuDatong's Lidar vehicle deliveries exceeded 0.15 million units, with a growth rate of over 100%; high-performance Lidar vehicle deliveries totaled over 0.22 million units.

In contrast, in 2023, Hesai Technology's total Lidar deliveries were approximately 0.2221 million units, a year-on-year increase of 176.1%. Su Teng Ju Chuang's Lidar sales for ADAS were about 0.24 million units, an increase of 550.41% year-on-year.

▍ Valuation of 11 billion yuan. The founder comes from the Baidu system.

The announcement documents show that in the most recent pre-IPO investment round in 2023, TuDatong raised a total of 144 million USD from four investors, and the post-investment valuation after this round was 10.9 billion Hong Kong dollars.

At the time of this IPO sprint, TuDatong's valuation had risen to 11.7 billion Hong Kong dollars (approximately 11 billion yuan).

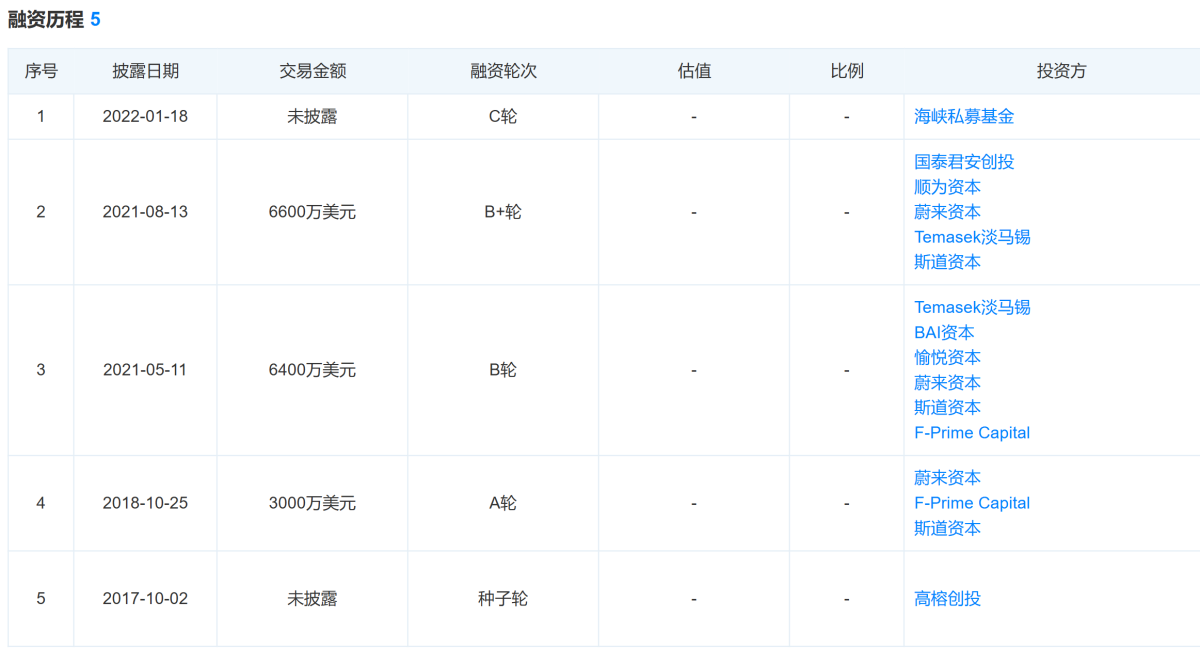

According to Tianyancha data, TuDatong obtained multiple rounds of financing before going public, with investors including NIO Capital, Temasek, Fidelity Investments, Gaorong Capital, Stone Capital, Huachuang Capital, Yuyue Capital, Shunwei Capital, GTJA Venture Capital, BAI Capital, and F-Prime Capital among several well-known institutions.

Among them, NIO is not only a major customer of TuDatong but also participated in multiple rounds of financing, with NIO Capital starting to lead the investment from TuDatong's Series A financing.

Similar to companies like WeRide, FOURTH PARADIGM, Horizon Robotics, and Pony.ai, the founder and CEO of Tudatong, Bao Junwei, also comes from Baidu.

Bao Junwei graduated with a bachelor's degree from the Physics Department of Peking University, then attended the University of California, Berkeley and obtained a PhD in Electrical Engineering.

In 2014, Bao Junwei joined Baidu's U.S. R&D Center, responsible for developing hardware acceleration for large-scale Datacenters and high-performance networks. In 2015, he joined Baidu's Autonomous Driving Division, overseeing the onboard computing systems and Sensors team. In November 2016, Bao Junwei resigned with Li Yimin, who was also in charge of sensor technology at Baidu, to establish Tudatong, where Bao Junwei serves as CEO and Li Yimin as CTO.

Before the IPO, Bao Junwei controlled approximately 21.16% of the voting rights in the company, of which he controlled 6.04% of the voting rights through his company HighAltos Limited; 10.61% through Phthalo Blue LLC; and 3.47% through the employee stock ownership plan. Li Yimin held 2.22% of shares, while other existing shareholders held 76.62%.

After the IPO, Bao Junwei controlled 4.59% of the voting rights through his company HighAltos Limited; he controlled 8.07% through Phthalo Blue LLC, and Li Yimin held 1.69% of shares. At the same time, NIO founder Li Bin's fund HonourKey Limited held 9.15%.

The stakes of the TechStar initiator were 1.84%, while the existing shareholders of TechStar held 8.09%. PIPE investors collectively held 4.06%, of which Huangshan Construction Investment held 2.85%, and Fuce held 1.15%.

公告显示,各方订立的业务合并协议,内容包括订立发起人禁售协议、PIPE(私募基金)投资协议等。其中,此次合并的PIPE款项投资方包括黄山建投资本、富策和珠海横琴华盖,合计款项5.513亿港元。

公告显示,各方订立的业务合并协议,内容包括订立发起人禁售协议、PIPE(私募基金)投资协议等。其中,此次合并的PIPE款项投资方包括黄山建投资本、富策和珠海横琴华盖,合计款项5.513亿港元。