While not a mind-blowing move, it is good to see that the CGN Nuclear Technology Development Co., Ltd. (SZSE:000881) share price has gained 24% in the last three months. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 21% in the last three years, falling well short of the market return.

Since CGN Nuclear Technology Development has shed CN¥378m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

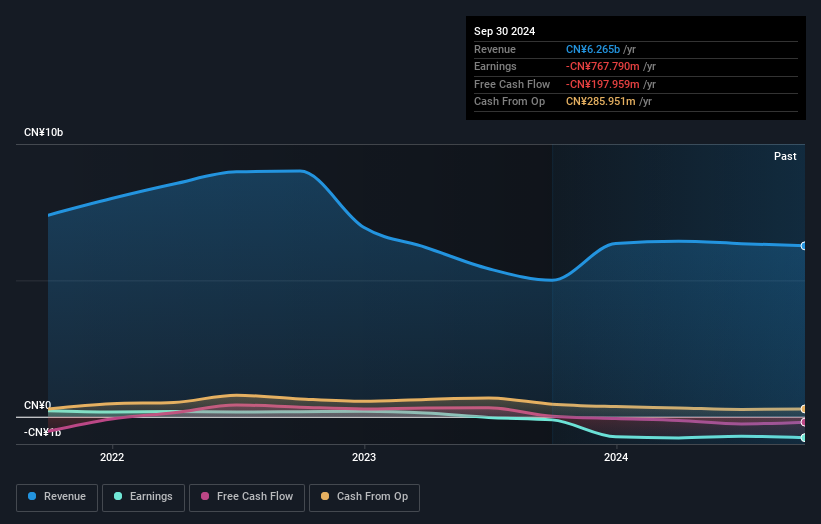

Given that CGN Nuclear Technology Development didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years CGN Nuclear Technology Development saw its revenue shrink by 13% per year. That's not what investors generally want to see. The annual decline of 6% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

In the last three years CGN Nuclear Technology Development saw its revenue shrink by 13% per year. That's not what investors generally want to see. The annual decline of 6% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

CGN Nuclear Technology Development provided a TSR of 8.1% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 2% over half a decade It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - CGN Nuclear Technology Development has 1 warning sign we think you should be aware of.

Of course CGN Nuclear Technology Development may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.