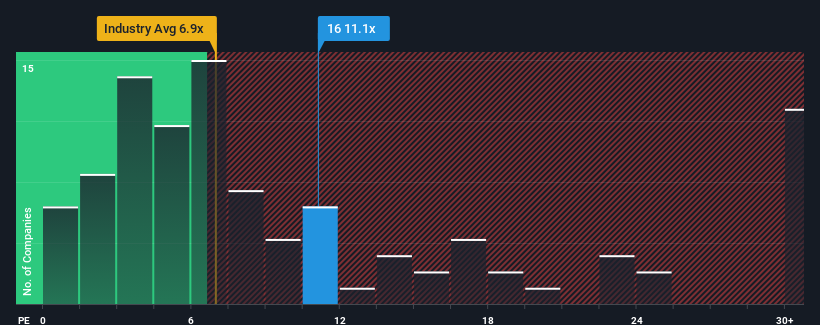

It's not a stretch to say that Sun Hung Kai Properties Limited's (HKG:16) price-to-earnings (or "P/E") ratio of 11.1x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 10x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Sun Hung Kai Properties hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

How Is Sun Hung Kai Properties' Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Sun Hung Kai Properties' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 29% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 29% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 13% per year during the coming three years according to the analysts following the company. That's shaping up to be similar to the 13% per annum growth forecast for the broader market.

In light of this, it's understandable that Sun Hung Kai Properties' P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Sun Hung Kai Properties maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

You always need to take note of risks, for example - Sun Hung Kai Properties has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.