The minutes from the December meeting show that the Reserve Bank of Australia is more confident in inflation continuing to move towards target levels, but given the recent rebound in Consumer activity and the continued tightness in the labor market, it is still too early to conclude victory.

The minutes released on Tuesday (December 24) from the meeting held on December 9-10 indicate that the Reserve Bank of Australia Board discussed options for loosening policy to boost economic growth or maintaining current restrictive levels. The Board believes that both outcomes are possible and chose to keep the interest rate unchanged at 4.35%, stating that recent data is insufficient to change the policy outlook.

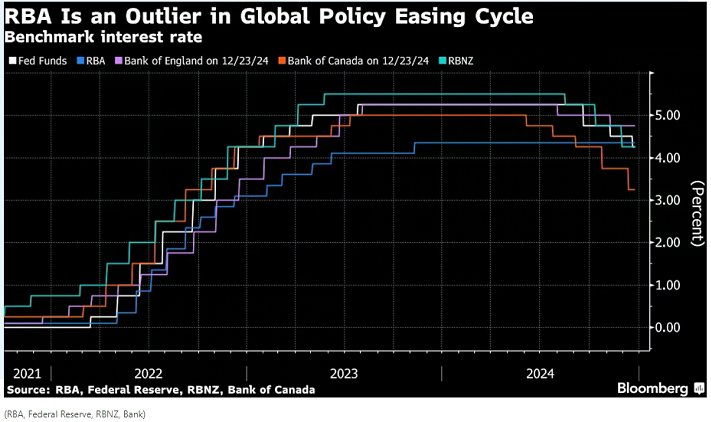

Figure: Central Bank benchmark interest rate (The Reserve Bank of Australia is an outlier in the global easing policy cycle, the blue line represents the RBA interest rate).

Board members noted that more information regarding employment, inflation, and Consumer activity, as well as a revised set of staff forecasts, will be published at the meeting on February 17-18, and hinted that the review could be real-time. Traders expect the central bank's first rate cut in February to have a probability greater than two-thirds and fully expect two cuts by July.

Board members noted that more information regarding employment, inflation, and Consumer activity, as well as a revised set of staff forecasts, will be published at the meeting on February 17-18, and hinted that the review could be real-time. Traders expect the central bank's first rate cut in February to have a probability greater than two-thirds and fully expect two cuts by July.

The minutes show: 'Members determine that the risk of inflation returning to target at a slower pace than expected since the last meeting has diminished, while the downside risks to economic activity have increased. Members are wary of the risk that if labor demand in non-market sectors suddenly slows, the increase in the unemployment rate could exceed expectations.'

The minutes draw attention to the thoughts of the Board during the month, in which the bank's governor, Philip Lowe, unexpectedly leaned dovish. With most developed countries' economies having significantly slowed down, Australia has been an outlier in the current economic cycle. The Federal Reserve has signaled that after cutting rates three times this year, it will cut rates twice more in 2025.

Meanwhile, the minutes also indicate that the Reserve Bank of Australia remains sensitive to the strong potential of the Consumer and employment market, and this strength is enough to thwart attempts to bring core inflation down to target levels.

A private survey shows that consumer confidence in Australia has declined and remains pessimistic, even though the unemployment rate unexpectedly fell to 3.9%. However, business confidence has deteriorated, highlighting the mixed economic results in Australia recently.

The meeting minutes pointed out several factors explaining why policymakers believe economic results could turn out in two ways:

1. Various employment indicators may suggest that progress towards full employment levels in the labor market has stalled.

2. Preliminary signs from Black Friday sales indicate strong consumer demand.

3. Global service price inflation has persisted longer than expected, and Australia may also be experiencing this.

4. In some cases, the various risks facing the global economic outlook could limit the pace of further deflation.

There is also uncertainty regarding the level of policy restrictions, as Australia’s Money Market interest rates remain lower than or comparable to those of other developed economies.

The meeting minutes showed: "Despite interest rate cuts abroad, market expectations and the central bank's estimates of neutral rates together imply that monetary policy in several economies may be more tightening than in Australia, and this is expected to continue into 2025."

The Reserve Bank of Australia's benchmark forecast is that the unemployment rate will rise to 4.3% in December and peak at 4.5% next year. The central bank's preferred inflation indicator, the trimmed mean, is expected to reach 3.4% by the end of this year, and by mid-2025, it will hit the upper limit of the 2-3% target range.

理事会成员们指出,有关就业、通胀和消费的更多信息,以及一套修订后的工作人员预测,将在2月17日至18日的会议上公布,并暗示审查可能是实时的。

理事会成员们指出,有关就业、通胀和消费的更多信息,以及一套修订后的工作人员预测,将在2月17日至18日的会议上公布,并暗示审查可能是实时的。