Today's net Buy of Hong Kong stocks is 5.227 billion HK dollars.

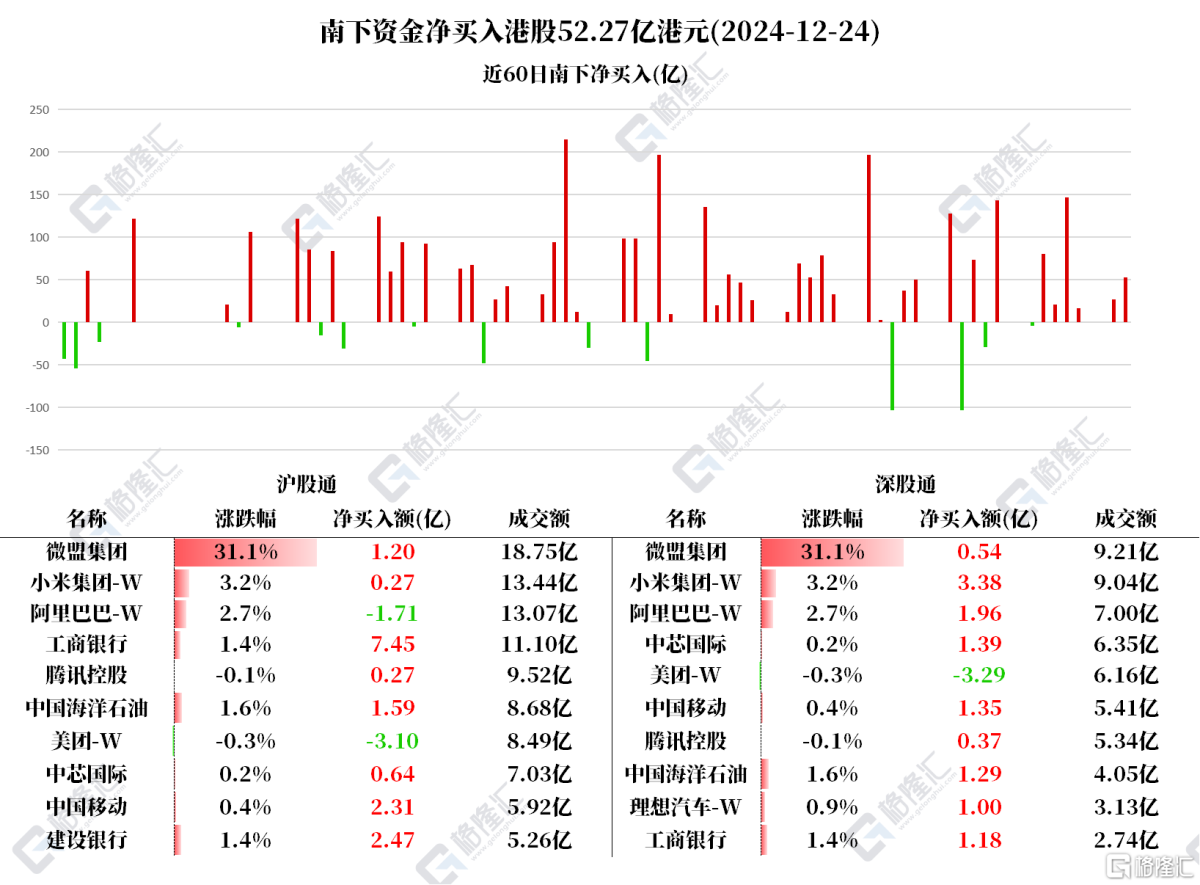

On December 24, southbound funds net bought Hong Kong stocks amounting to 5.227 billion HKD today.

Among them, the Hong Kong Stock Connect (Shanghai) net bought 2.903 billion HKD, and the Hong Kong Stock Connect (Shenzhen) net bought 2.325 billion HKD.

Net purchases include Industrial And Commercial Bank Of China 0.862 billion, CHINA MOBILE 0.366 billion, XIAOMI-W 0.365 billion, CNOOC 0.287 billion, China Construction Bank Corporation 0.247 billion, Semiconductor Manufacturing International Corporation 0.203 billion, WEIMOB INC 0.173 billion, and Li Auto-W 0.1 billion; net sales for MEITUAN-W totaled 0.639 billion.

Net purchases include Industrial And Commercial Bank Of China 0.862 billion, CHINA MOBILE 0.366 billion, XIAOMI-W 0.365 billion, CNOOC 0.287 billion, China Construction Bank Corporation 0.247 billion, Semiconductor Manufacturing International Corporation 0.203 billion, WEIMOB INC 0.173 billion, and Li Auto-W 0.1 billion; net sales for MEITUAN-W totaled 0.639 billion.

According to statistics, southbound funds have net bought Industrial And Commercial Bank Of China for two consecutive days, totaling 1.93136 billion HKD; net bought China Construction Bank Corporation for two consecutive days, totaling 0.4775 billion HKD.

Net purchases for WEIMOB INC for four consecutive days totaled 1.33549 billion HKD; net purchases for TENCENT for four consecutive days totaled 4.42407 billion HKD.

Net purchases for XIAOMI-W for five consecutive days totaled 1.50948 billion HKD; net purchases for CHINA MOBILE for eleven consecutive days totaled 5.28677 billion HKD.

For two consecutive days, there was a net sell of MEITUAN-W, totaling 1.86104 billion Hong Kong dollars.

Since being included in the Hong Kong stock connect, Southern funds have accumulated a net purchase of Alibaba amounting to 81.73432 billion Hong Kong dollars over 67 trading days.

Northern funds focus on individual stocks.

Industrial And Commercial Bank Of China, China Construction Bank Corporation: Morgan Stanley stated that before confirming the bottoming out of the real estate and industrial cycles in the second half of 2025, state-owned domestic bank H-shares like Agricultural Bank Of China and China Construction Bank Corporation offering about 7% high dividend yield will be a safe choice, as growth stocks carry risks, while interest returns from mainland time deposits and debts remain low.

XIAOMI-W: According to media reports, Xiaomi Group partner, president, head of mobile division, and general manager of Xiaomi brand, Lu Weibing, stated that the Xiaomi smartphone business has sustained growth over the past year, with global shipments expected to increase by 23.5 million units this year, bringing the annual estimated shipment to 0.17 billion units, a 16% increase compared to last year.

CNOOC: In terms of news, the State-owned Assets Supervision and Administration Commission recently issued guiding opinions encouraging state-owned enterprises to manage market cap. Everbright pointed out that with the arrival of the natural gas peak season and the long-term favorable outlook for natural gas demand, as well as the continuous advancement of market-oriented reform, the "three oil giants" are expected to benefit significantly. Additionally, their valuations are significantly undervalued compared to overseas giants, and long-term growth potential is expected to continue to be realized.

Semiconductor Manufacturing International Corporation: Goldman Sachs published a research report indicating an optimistic outlook for Semiconductor Manufacturing International Corporation's revenue performance driven by healthier inventory levels and localization trends. Overall, the bank expects Semiconductor Manufacturing International Corporation's gross margin to gradually recover and raised its H-share target price from 29.2 Hong Kong dollars to 33.4 Hong Kong dollars, maintaining a "Neutral" rating. Additionally, Goldman Sachs keeps its profit forecast for Semiconductor Manufacturing International Corporation for the 2024 fiscal year basically unchanged; forecasts for the 2025 to 2029 fiscal years have been raised by 2% to 4%. The bank also increased the revenue forecasts for Semiconductor Manufacturing International Corporation for the 2025 to 2029 fiscal years by about 1% each year; the gross margin was raised by 0.2 to 0.3 percentage points, maintaining the operating expense expectations basically unchanged.

WEIMOB INC: GTJA released a research report indicating that the WeChat small store has launched the "gift" function, introducing a new flow channel for WeChat e-commerce. Snack and beauty products with gift attributes, as well as the代运营 segment with high sensitivity to new channels are expected to benefit. Moreover, the gift function is expected to help the WeChat e-commerce system open new traffic entrances, assist user conversion, and simultaneously create new channel opportunities for consumer goods companies.

Li Auto-W: Li Auto performed exceptionally in the sales data for the 51st week of 2024 (December 16 - December 22), with weekly sales reaching 0.0139 million vehicles, leading the sales rankings of new power brands in the China market for 35 consecutive weeks.

净买入工商银行8.62亿、中国移动3.66亿、小米集团-W 3.65亿、中国海洋石油2.87亿、建设银行2.47亿、中芯国际2.03亿、微盟集团1.73亿、理想汽车-W 1亿;

净买入工商银行8.62亿、中国移动3.66亿、小米集团-W 3.65亿、中国海洋石油2.87亿、建设银行2.47亿、中芯国际2.03亿、微盟集团1.73亿、理想汽车-W 1亿;