MicroStrategy ETFs Face Tracking Error Because Of Volatility: Here Are The Potential Risks Investors Face

MicroStrategy ETFs Face Tracking Error Because Of Volatility: Here Are The Potential Risks Investors Face

Sharp deviations have been witnessed in the exchange-traded funds tracking Michael Saylor's MicroStrategy Inc. (NASDAQ:MSTR), likely stemming from the exposure to its volatile swaps and options.

在跟蹤邁克爾·塞勒的MicroStrategy Inc.(納斯達克:MSTR)的交易所交易基金中,觀察到明顯的偏差,這可能源於其波動的掉期和期權的敞口。

What Happened: The T-Rex 2X Long MSTR Daily Target ETF (BATS:MSTU) launched on Sept. 18, 2024, and Defiance Daily Target 2x Long MSTR ETF (NASDAQ:MSTX) launched on Aug. 14, 2024, are the two U.S.-listed leveraged ETFs which aim to provide twice the daily returns of MicroStrategy.

發生了什麼:t-Rex 2X Long MSTR日目標ETF(BATS:MSTU)於2024年9月18日推出,Defiance Daily Target 2x Long MSTR ETF(納斯達克:MSTX)於2024年8月14日推出,是兩個美國上市的槓桿ETF,旨在提供MicroStrategy每日收益的兩倍。

However, these ETFs have shown significant tracking errors to their underlying asset, MicroStrategy, highlighting potential risks for investors.

然而,這些ETF顯示出與其基礎資產MicroStrategy之間的顯著跟蹤誤差,凸顯了投資者面臨的潛在風險。

- MSTU: On No. 21, MSTU declined 25.3%, 7% less than expected given MicroStrategy's 16% drop. However, on Nov. 25, MSTU fell 11.3%, exceeding the expected 8.7% decline based on MicroStrategy's 4.4% fall.

- MSTX: This fund also displayed tracking error, most notably on Nov. 25, when it plummeted 13.4%, 4.7% more than anticipated.

- MSTU:在21號,MSTU下跌25.3%,比MicroStrategy的16%下跌預期少了7%。然而,在11月25日,MSTU下跌11.3%,超過了基於MicroStrategy 4.4%下跌的預期8.7%下跌。

- MSTX:該基金也顯示出跟蹤誤差,特別是在11月25日下跌了13.4%,比預期多出4.7%。

This underscores a potential for significant deviations in leveraged ETFs like MSTU and MSTX from their intended two times daily performance, presenting heightened risks for investors.

這突顯了諸如MSTU和MSTX這類槓桿ETF在其預期的每日兩倍表現上的顯著偏差的潛在可能性,爲投資者帶來了更高的風險。

Why It Matters: MicroStrategy is the only publicly listed company holding the highest Bitcoin (CRYPTO: BTC) reserves, representing 2.1% of the total 21 million supply, at a cost of $27.1 billion. The company has also raised $20 billion of debt in 2024 to buy more.

重要性:MicroStrategy是唯一上市的公司,其持有的比特幣(加密貨幣:BTC)儲備最高,佔總2100萬供應量的2.1%,成本爲271億美元。該公司在2024年還籌集了200億美元的債務以購買更多。

According to a report by Financial Times, Dave Mazza, the chief executive of Roundhill Investments says that the ETF tracking error is not an ETF or leveraged ETF problem, it is a MicroStrategy ETF problem. He said that these ETFs indirectly own (through saps and options) over 10% of MicroStrategy's market cap, an unprecedented level for leveraged ETFs and a significant holding even among traditional ETFs.

根據《金融時報》的報告,Roundhill Investments的首席執行官Dave Mazza表示,ETF跟蹤誤差不是ETF或槓桿ETF的問題,而是MicroStrategy ETF的問題。他說,這些ETF間接擁有(通過掉期和期權)超過10%的MicroStrategy市值,這是槓桿ETF前所未有的水平,在傳統ETF中也是顯著的持有。

"Simply put, MicroStrategy is too small a company to accommodate the AUM and trading volume in these products. At this point, these ETFs have already reached the breaking point," Mazza told FT.

"簡單來說,MicroStrategy是一家太小的公司,無法容納這些產品的資產管理規模和交易量。目前,這些ETF已經達到了臨界點,"馬紮告訴Ft。

According to Elisabeth Kashner, director of global fund analytics at FactSet, one solution to the tracking error is that these ETFs can stop the new unit creation and behave like a closed-end fund when swap lines are exhausted, however, this is discouraged by the Securities and Exchange Commission (SEC.)

根據FactSet全球基金分析董事伊麗莎白·卡什納的說法,追蹤誤差的一個解決方案是,當掉期額度用盡時,這些ETF可以停止新的單位創建,並像封閉式基金那樣運行,但這被證券交易委員會(SEC)不鼓勵。

Kashner told FT that T-Rex and Defiance, the firms that operate these ETFs face a suboptimal choice. "They can limit their growth or they can live with the limited accuracy and so far they have chosen to prioritise growth over accuracy," Kashner added.

卡什納告訴Ft,運營這些ETF的公司t-Rex和Defiance面臨一個次優選擇。 "他們可以限制他們的增長,或者他們可以接受有限的準確性,到目前爲止,他們選擇了優先考慮增長而不是準確性,"卡什納補充道。

Price Action: Shares of MicroStrategy were down over 1% in premarket trading on Tuesday. The stock has returned 385% on a year-to-date basis, compared to the Nasdaq Composite's return of 33.85% in the same period, according to Benzinga Pro data.

價格走勢:週二,MicroStrategy的股票在盤前交易中下跌超過1%。根據Benzinga Pro的數據,該股票的年初至今收益率爲385%,相比之下,納斯達克綜合指數在同一時期的收益率爲33.85%。

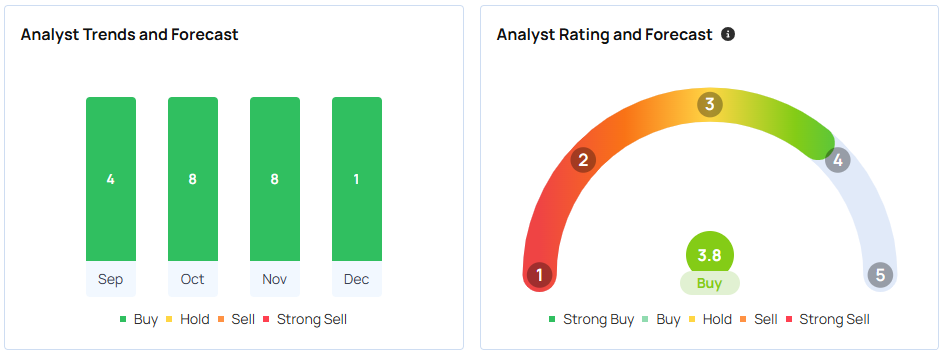

About 12 analysts tracked by Benzinga have a consensus 'buy' rating on the stock with a price target of $449.5 per share.

根據Benzinga追蹤的約12名分析師的共識,該股票的買入評級爲"買入",目標價格爲每股449.5美元。

The three most recent analyst ratings between Bernstein, TD Cowen, and Barclays imply a 62% upside for MSTR.

伯恩斯坦、TD Cowen和巴克萊銀行這三家機構最近的分析師評級暗示MSTR有62%的上漲空間。

- Mohammed El Erian Says This Country Faces Japan-Style Economic Risk Even As Tokyo Rebounds

- 穆罕默德·埃爾-埃裏安表示,儘管東京復甦,但這個國家面臨類似日本的經濟風險。

Photo courtesy: Shutterstock

照片提供:Shutterstock

This underscores a potential for significant deviations in leveraged ETFs like MSTU and MSTX from their intended two times daily performance, presenting heightened risks for investors.

This underscores a potential for significant deviations in leveraged ETFs like MSTU and MSTX from their intended two times daily performance, presenting heightened risks for investors.