Dalian Zhiyun Automation Co., Ltd. (SZSE:300097) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

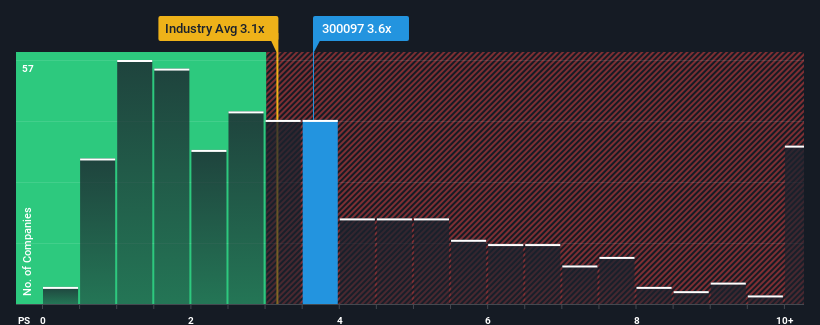

In spite of the heavy fall in price, it's still not a stretch to say that Dalian Zhiyun Automation's price-to-sales (or "P/S") ratio of 3.6x right now seems quite "middle-of-the-road" compared to the Machinery industry in China, where the median P/S ratio is around 3.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

How Has Dalian Zhiyun Automation Performed Recently?

For example, consider that Dalian Zhiyun Automation's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Dalian Zhiyun Automation will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Dalian Zhiyun Automation's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Dalian Zhiyun Automation's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 53% drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 22% shows it's an unpleasant look.

With this in mind, we find it worrying that Dalian Zhiyun Automation's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Dalian Zhiyun Automation's P/S?

With its share price dropping off a cliff, the P/S for Dalian Zhiyun Automation looks to be in line with the rest of the Machinery industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Dalian Zhiyun Automation currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Before you take the next step, you should know about the 1 warning sign for Dalian Zhiyun Automation that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.