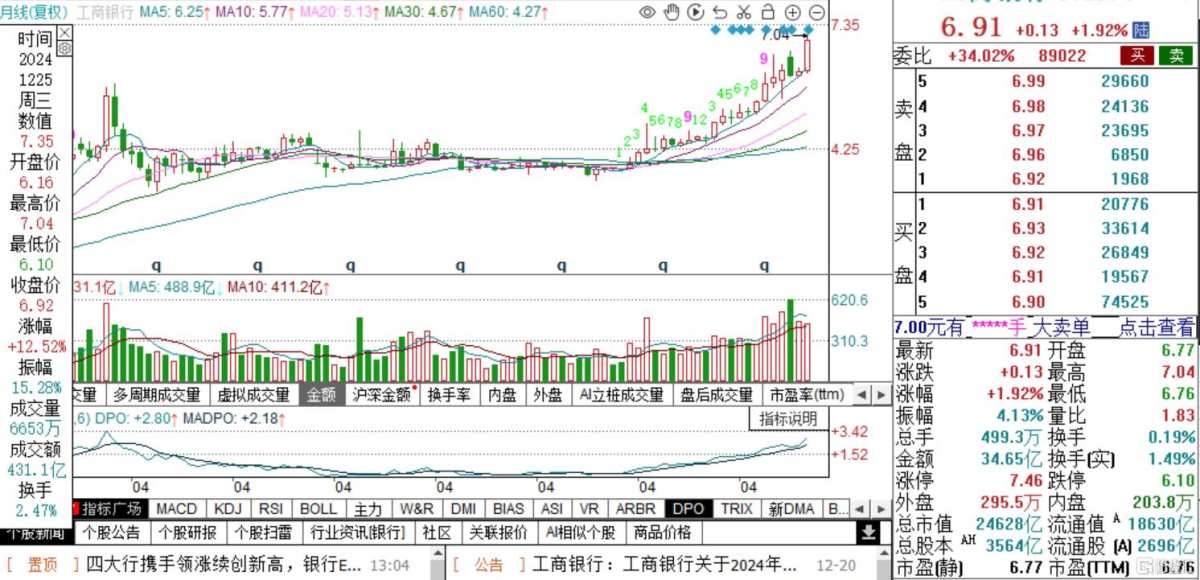

The total market value of Industrial and Commercial Bank has reached 2.5 trillion yuan.

Recently, Stocks in the banking sector have continuously attracted funds, with the four major banks repeatedly hitting historical highs.

A new 'King' has emerged in the A-shares market.

Today, the Industrial And Commercial Bank Of China, Agricultural Bank Of China, Bank Of China, and China Construction Bank Corporation once again reached historic highs.

As of the time of this report, Industrial And Commercial Bank Of China rose over 2%, Agricultural Bank Of China and Bank Of China rose over 1%, and China Construction Bank Corporation, CM BANK, and Postal Savings Bank Of China slightly increased.

As of the time of this report, Industrial And Commercial Bank Of China rose over 2%, Agricultural Bank Of China and Bank Of China rose over 1%, and China Construction Bank Corporation, CM BANK, and Postal Savings Bank Of China slightly increased.

Among them, Industrial And Commercial Bank Of China once rose 3.83% during the session, with a total market value of 2.5 trillion yuan, surpassing CHINA MOBILE, becoming the new market value 'King' in the A-shares.

Looking at it over a longer period, the price increase of banking sector Stocks has been very impressive this year.

Agricultural Bank Of China has risen over 55% cumulatively, Industrial And Commercial Bank Of China has risen over 54% cumulatively, CM BANK has risen over 52% cumulatively, Bank Of China has risen over 46% cumulatively, China Construction Bank Corporation has risen over 44% cumulatively, Bank Of Communications has risen over 43% cumulatively, and Postal Savings Bank Of China has risen over 37% cumulatively.

Analyzing this, the recent surge in Banks' Stocks may be due to several factors:

First, the market has shown weakness recently, micro-cap Stocks have significantly plummeted, and investors are in a strong risk-averse mood, while Large Cap Stocks and dividend-paying Stocks have performed well.

Today, the Shanghai Composite Index fell by as much as 0.57%, turning positive in the afternoon, the Shenzhen Component Index fell by 0.49%, and the Chinext Price Index fell by 0.48%.

Over 4,300 individual Stocks in the market declined, while only 960 Stocks rose, with 40 Stocks hitting the limit down, and 37 Stocks hitting the limit up.

The micro-cap stock index has been continuously declining, dropping over 4% at one point today, the CSI Midcap 2000 Index fell more than 2%, and the performance of the CSI 1000 Index was also poor.

Secondly, since September, policies to stabilize economic growth have been continuously introduced, and Banks belong to the pro-cyclical sector, which typically sees significant absolute returns during the early stage of policy implementation.

Guosheng Securities believes that policies are a forward-looking signal for the initiation of the banking market, with multiple rounds of bullish policies introduced recently, and the valuation of the banking sector is expected to see a recovery.

Thirdly, the monetary policy is clearly gaining strength, and there is still room for interest rate cuts in the future, with China's government bond yields falling, and the risk-free interest spread expected to widen, leading the market to favor dividend strategies.

Entering the mid-term dividend rush market.

As a representative of high dividends, bank stocks will see concentrated dividend payments at the beginning of next year, prompting some investors looking for stable returns to start accumulating shares.

Data shows that as of December 23, 22 A-share listed banks and 10 H-share listed banks have disclosed their mid-term dividend plans for 2024.

Among the nine Banks, mid-term Dividends have been distributed this year, with some Banks expected to distribute in the beginning of next year, while some Banks have not disclosed their mid-term Dividends.

For the announced but not yet distributed interim dividends, Industrial And Commercial Bank Of China, Agricultural Bank Of China, Postal Savings Bank Of China, and Chongqing Rural Commercial Bank will distribute dividends on January 7, January 8, January 8, and January 23 of next year, respectively.

Bank Of China and Bank Of Communications will distribute dividends on January 23 and January 24 of next year.

Most H Shares will distribute dividends next year, and the H Shares distributing dividends in January include China Construction Bank Corporation, Chongqing Rural Commercial Bank, Postal Savings Bank Of China, Industrial And Commercial Bank Of China, Agricultural Bank Of China, and China CITIC Bank Corporation.

The H Shares banks distributing dividends in February include Bank Of Communications, Bank Of China, and China Everbright Bank.

China Merchants pointed out that since the beginning of next year is the peak period for mid-term Dividends distribution, for some dividend-type investors, it is necessary to Buy the corresponding Stocks before the last trading day of the distribution to obtain the semi-annual Dividends, so there may be a rush for mid-term Dividends for some Banks' symbols at the end of the year and the beginning of the year, which has already been reflected in the recent market.

In addition, CITIC SEC pointed out that at the end of the year and the beginning of the year, the insurance sector will enter the season of increased allocation for the 'New Year Red'. Banks with high dividends, low volatility, and stable Operation are expected to remain the direction for insurance fund allocation.

In terms of allocation, two main lines are recommended from the perspective of 1-3 months: 1) Low volatility varieties contribute stable returns, while banks with high dividends and high capital have greater allocation value; 2) Growth varieties contribute elastic returns, and companies with excellent business models have more valuation space.