① Today, China Construction Bank announced on its official website that the minimum repayment ratio for all Dragon Card Transformers credit cards has been adjusted from 10% to 5% starting today. ② Not long ago, the Bank Of Xi'An also made an adjustment, but currently, most commercial Banks have a minimum repayment amount of 10% for their credit cards. ③ In recent years, especially this year, credit card Business personnel are under significant pressure. It is reasonable for Banks to adjust their credit card Business.

On December 25, Financial Associated Press reported (Reporter Peng Kefeng) that a rare state-owned major bank took the initiative to lower the minimum repayment amount for credit cards.

Today, China Construction Bank announced on its official website that the minimum repayment ratio for all Dragon Card Transformers credit cards has been adjusted from 10% to 5% starting today. According to the official websites of the six major state-owned Banks, this is the first case this year announcing a reduction in the minimum repayment amount for credit cards.

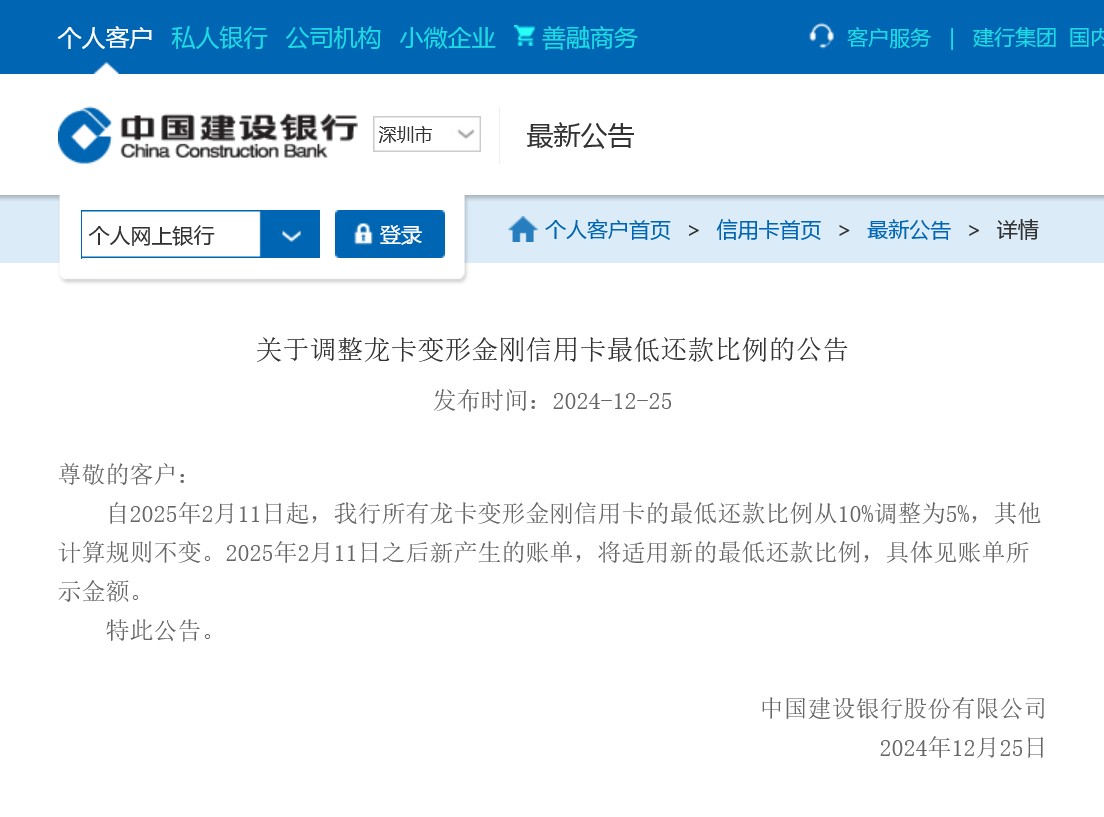

In the announcement, China Construction Bank stated that starting from February 11, 2025, the minimum repayment ratio for all Dragon Card Transformers credit cards will be adjusted from 10% to 5%, with other calculation rules remaining unchanged. New bills generated after February 11, 2025, will apply the new minimum repayment ratio, with specific amounts shown on the bill.

In the announcement, China Construction Bank stated that starting from February 11, 2025, the minimum repayment ratio for all Dragon Card Transformers credit cards will be adjusted from 10% to 5%, with other calculation rules remaining unchanged. New bills generated after February 11, 2025, will apply the new minimum repayment ratio, with specific amounts shown on the bill.

It is worth noting that according to information from the China Construction Bank's official website, the previous minimum repayment amount for Dragon Card credit cards was 10%. In November 2021, the announcement on the official website of China Construction Bank indicated that starting from December 17, 2021, there would be partial changes to the calculation rules for the minimum repayment amount of the Dragon Card credit cards. The minimum repayment amount includes the unpaid portion of previous months' minimum repayment, a certain percentage of accumulated unpaid consumption within the fixed limit (generally 10%, except for special card products), current new charges, interest and cash advance debt amounts, current installment payment principal and fee debt amounts, consumption debts that exceed the fixed limit, as well as the sum of other debts that the cardholder is required to repay as stipulated by the bank.

Recently, the Bank Of Xi'An also took similar actions, with industry insiders stating that business pressure prompted the adjustment.

A reporter from Financial Associated Press checked the official websites of the six major state-owned Banks and did not find any announcement from other Banks about lowering the minimum repayment amount for credit cards. The reporter learned from several Banks' customer service representatives and banking personnel that currently, most commercial Banks have a minimum repayment amount of 10% for their credit cards.

However, in late October this year, the credit card center of the Bank Of Xi'An issued an announcement stating that it plans to reduce the minimum repayment ratio from 10% to 5%. According to the announcement, to further enhance the service level of credit cards, the Bank Of Xi'An intends to adjust the minimum repayment amount standard for the principal portion of consumption in the bills of all credit card products, with this adjustment officially taking effect from November 15 of this year.

In addition, on November 22, the Credit Card Center of the Postal Savings Bank Of China announced that starting from January 6, 2025, it will provide a grace period service for credit card bill installment payments. An additional grace period of 4 days will be added to the normal bill installment application timeframe (from the day after the billing date to before 8 PM on the final repayment date), allowing customers to make installment requests by 5 PM on the fourth day after the final repayment date. However, to ensure customers repay or apply for installments within the normal timeframe, the installment application time displayed on the official website of China Postal Savings Bank, various online processing channels, and customer agreements remains "from the day after the billing date to before 8 PM on the final repayment date."

An insider from a listed bank told the Financial Associated Press that in recent years, especially this year, credit card business personnel have faced significant pressure, with noticeable declines in consumption amounts and transaction volumes, making it reasonable for banks to adjust their credit card services.

An Analyst from a brokerage focused on the banking industry pointed out to the Financial Associated Press that some banks are lowering the minimum repayment amounts for credit cards and providing grace periods, which helps alleviate the repayment pressure on users and offers better services to customers.

在公告中,建设银行表示,自2025年2月11日起,建行所有龙卡变形金刚信用卡的最低还款比例从10%调整为5%,其他计算规则不变。2025年2月11日之后新产生的账单,将适用新的最低还款比例,具体见账单所示金额。

在公告中,建设银行表示,自2025年2月11日起,建行所有龙卡变形金刚信用卡的最低还款比例从10%调整为5%,其他计算规则不变。2025年2月11日之后新产生的账单,将适用新的最低还款比例,具体见账单所示金额。