Despite an already strong run, Semtech Corporation (NASDAQ:SMTC) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 186% following the latest surge, making investors sit up and take notice.

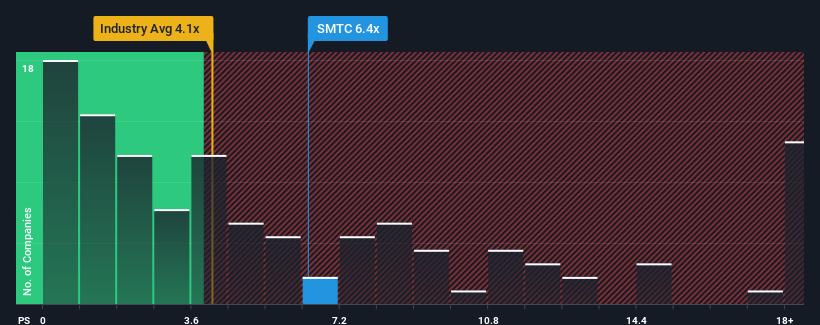

Since its price has surged higher, Semtech may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 6.4x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 4.2x and even P/S lower than 1.7x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Semtech Has Been Performing

Semtech could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Semtech will help you uncover what's on the horizon.How Is Semtech's Revenue Growth Trending?

In order to justify its P/S ratio, Semtech would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Semtech would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Still, the latest three year period was better as it's delivered a decent 19% overall rise in revenue. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 24% during the coming year according to the eleven analysts following the company. That's shaping up to be materially lower than the 39% growth forecast for the broader industry.

With this information, we find it concerning that Semtech is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Semtech's P/S Mean For Investors?

Semtech's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that Semtech currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Semtech that you should be aware of.

If these risks are making you reconsider your opinion on Semtech, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.