Every investor on earth makes bad calls sometimes. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of Open Lending Corporation (NASDAQ:LPRO), who have seen the share price tank a massive 75% over a three year period. That'd be enough to cause even the strongest minds some disquiet. The more recent news is of little comfort, with the share price down 30% in a year. The last week also saw the share price slip down another 11%.

After losing 11% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

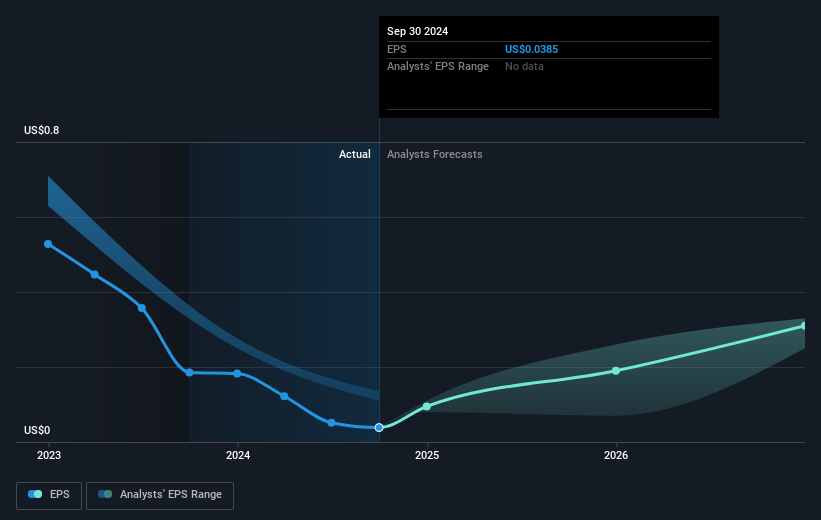

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Open Lending saw its EPS decline at a compound rate of 67% per year, over the last three years. This fall in the EPS is worse than the 37% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines. With a P/E ratio of 152.57, it's fair to say the market sees a brighter future for the business.

Open Lending saw its EPS decline at a compound rate of 67% per year, over the last three years. This fall in the EPS is worse than the 37% compound annual share price fall. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines. With a P/E ratio of 152.57, it's fair to say the market sees a brighter future for the business.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Open Lending's key metrics by checking this interactive graph of Open Lending's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 27% in the last year, Open Lending shareholders lost 30%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Open Lending has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.