① After Tesla, Nvidia is also suppressing the S&P 500 Index Fund as the “favorite securities of US retail investors” for the second year in a row; ② Various signs also indicate that a dark horse competing for next year's favorite stocks surfaced in the fourth quarter.

Financial Services Association, December 26 (Editor Shi Zhengcheng) The SPDR S&P 500 Index Fund (SPY), which holds the crown of the world's largest ETF, once again lost touch with the title of “the favorite target of US retail investors” this year. After being stepped on by Tesla last year, it was severely crushed by AI leader Nvidia over the past year.

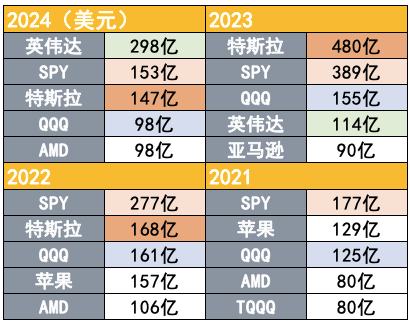

According to statistics from the research institute Vanda Research, as of the 17th of this month, retail investors had a total net purchase of 29.8 billion US dollars of Nvidia shares this year, which is almost double that of SPY Fund (net purchase of 15.3 billion US dollars).

In third place is Tesla ($14.7 billion), and there is even a chance to go one step further. QQQ ($9.8 billion), which tracks the Nasdaq 100 Index, ranked fourth, followed by another AI computing power concept stock AMD ($9.8 billion).

In third place is Tesla ($14.7 billion), and there is even a chance to go one step further. QQQ ($9.8 billion), which tracks the Nasdaq 100 Index, ranked fourth, followed by another AI computing power concept stock AMD ($9.8 billion).

(Net purchase amount of US stock retail investors, data as of December 17, source: Vanda Research)

Marco Iachini, senior vice president of Vanda Research, said that due to impressive gains, Nvidia became the stock that stole Tesla's limelight, and the share price performance explained everything.

As of Christmas, Nvidia had achieved a cumulative increase of 183.15% during the year. This not only made the company the second-highest listed company in the world by market capitalization, but also helped it open the door to the Dow's constituent stocks.

(Nvidia daily chart, source: TradingView)

According to the data, compared to when it was still a coin industry concept stock/gaming graphics card concept stock three years ago, Nvidia's net retail capital inflow level increased 885% this year.

Vanda's data also shows that after buying and rising stocks this year, Nvidia's share of typical small retail holdings has also rapidly increased. At the end of the year, the figure was already over 10%, second only to Tesla, and the data at the beginning of the year was 5.5%.

Moreover, as AI leaders continue to rise, retail investors also seem to have developed a sense of dependency — in addition to buying Nvidia shares on the day the earnings report was released, retail investors also made net purchases while Nvidia fell all the way from $140 to $100 this summer.

Of course, large retail shareholders' holdings will also lead to more intense volatility. Morning Star stock strategist Brian Colello said that as a company with a large market capitalization, Nvidia's volatility is “quite significant,” which shows the role retail traders can play in driving stock prices. Colello lamented that sometimes, it's surprising that large companies like this can have very large share price fluctuations on any given day.

Who will it be next year?

According to Iachini, if Nvidia continues to dominate “retail favorite stocks” next year, I'm afraid it will face some challenges. Even though the company's CEO Hwang In-hoon has an iconic black leather coat, there is still quite a difference compared to representatives of listed companies such as Musk who dominate the focus of public opinion.

The bigger variable is the emergence of a dark horse in the fourth quarter of this year — Palantir, an AI application concept stock.

Palantir's cumulative increase so far this year has reached 379.79%, of which it doubled in the fourth quarter. According to Vanda data, this stock will become the 9th most popular securities in 2024, surpassing established tech stocks Amazon, Google, and Microsoft.

(Palantir monthly chart, source: TradingView)

What made retail investors chant “Listed companies have me in their hearts” is that Alex Karp, CEO of Palantir, posted a Christmas video thanking investors last Sunday.

Karp said to retail investors, “I am deeply grateful to all those retail investors who took the time and opportunity to break through traditions and abandon clichés!”

(Source: Social Media)

排名第三的是特斯拉(147亿美元),甚至还有机会再进一步。追踪纳斯达克100指数的QQQ(98亿美元)位列第四,紧随其后的是另一家AI算力概念股AMD(98亿美元)。

排名第三的是特斯拉(147亿美元),甚至还有机会再进一步。追踪纳斯达克100指数的QQQ(98亿美元)位列第四,紧随其后的是另一家AI算力概念股AMD(98亿美元)。