While it may not be enough for some shareholders, we think it is good to see the Sichuan Jinshi Technology Co.,Ltd (SZSE:002951) share price up 14% in a single quarter. But that doesn't change the fact that the returns over the last half decade have been disappointing. The share price has failed to impress anyone , down a sizable 63% during that time. Some might say the recent bounce is to be expected after such a bad drop. We'd err towards caution given the long term under-performance.

After losing 14% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

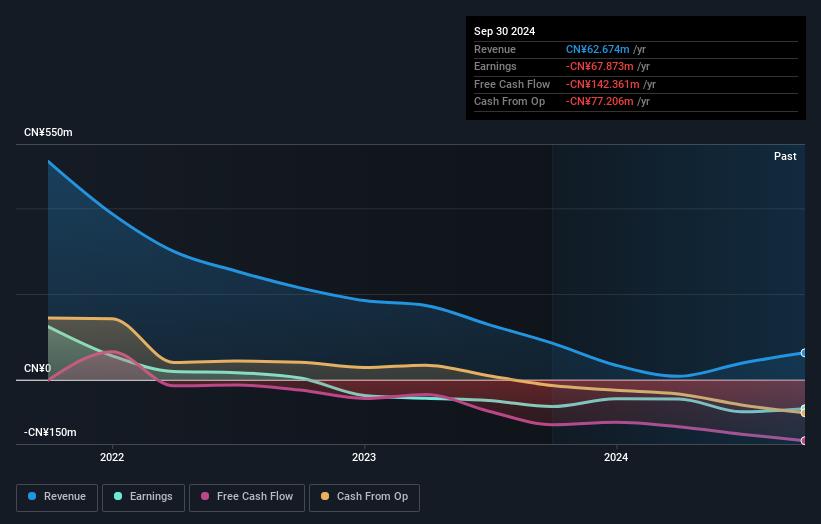

Given that Sichuan Jinshi TechnologyLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over half a decade Sichuan Jinshi TechnologyLtd reduced its trailing twelve month revenue by 43% for each year. That's definitely a weaker result than most pre-profit companies report. It seems appropriate, then, that the share price slid about 10% annually during that time. It's fair to say most investors don't like to invest in loss making companies with falling revenue. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

Over half a decade Sichuan Jinshi TechnologyLtd reduced its trailing twelve month revenue by 43% for each year. That's definitely a weaker result than most pre-profit companies report. It seems appropriate, then, that the share price slid about 10% annually during that time. It's fair to say most investors don't like to invest in loss making companies with falling revenue. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Sichuan Jinshi TechnologyLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Sichuan Jinshi TechnologyLtd's TSR for the last 5 years was -58%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Investors in Sichuan Jinshi TechnologyLtd had a tough year, with a total loss of 16% (including dividends), against a market gain of about 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 10% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Sichuan Jinshi TechnologyLtd , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.