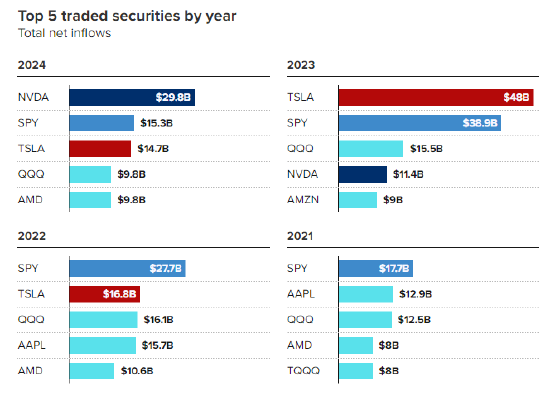

Vanda Research data shows that ordinary investors have invested nearly 30 billion dollars in NVIDIA this year, with the acquisition of McGillivray being part of it. As of December 17, it has become the most net bought stock by retail traders in 2024. The data indicates that the net inflow to NVIDIA has grown nearly ninefold compared to 2021.

Compared to the SPDR S&P 500 ETF Trust, NVIDIA's net inflow from such funds is almost twice as much.

Vanda Senior Vice President Marco Iachini stated, "It turns out that NVIDIA has somewhat overshadowed Tesla, as its price increase is impressive."

This is the latest highlight for NVIDIA. For over a year, this AI giant has been attracting investors of all sizes. This chip manufacturer has gained listing approval on the prestigious Dow Jones Industrial Average.

This is the latest highlight for NVIDIA. For over a year, this AI giant has been attracting investors of all sizes. This chip manufacturer has gained listing approval on the prestigious Dow Jones Industrial Average.

So far, this index is the best-performing among the 30 stocks since 2024.

Despite unstable trading in December last year, the stock prices of the "Seven Sisters" in the US stock market are expected to rise over 180% by the end of 2024. This surge has propelled the stock to become one of the elite companies with a market cap exceeding 3 trillion dollars. NVIDIA has also become the second-largest company by market cap in the USA.

Certainly, the enthusiasm for NVIDIA stocks has led the stock to play a larger role in the holdings of ordinary investors. Data shows that it is now the second largest holding for retail investors, just behind Tesla.

Moreover, NVIDIA's net retail inflow for 2024 has increased by over 885% compared to three years ago.

According to Wanda's Iachini, inflows of funds often surge around NVIDIA's earnings reports this year. Retail investors also bought in during the market downturn at the beginning of August, which coincided with a Large Cap sell-off.

It is certain that as the stock loses some momentum, inflows have somewhat cooled down.

Despite recent fluctuations, individual investors remain optimistic about the company's leadership in AI and focus on innovation.

这是英伟达的最新亮点。一年多来,这家人工智能巨头一直吸引着大大小小的投资者。这家芯片制造商获得了备受推崇的道琼斯工业平均指数(Dow Jones Industrial Average)的上市许可。

这是英伟达的最新亮点。一年多来,这家人工智能巨头一直吸引着大大小小的投资者。这家芯片制造商获得了备受推崇的道琼斯工业平均指数(Dow Jones Industrial Average)的上市许可。