It's been a soft week for Zhejiang Jinke Tom Culture Industry Co., LTD. (SZSE:300459) shares, which are down 13%. Looking further back, the stock has generated good profits over five years. It has returned a market beating 98% in that time.

Although Zhejiang Jinke Tom Culture Industry has shed CN¥3.3b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

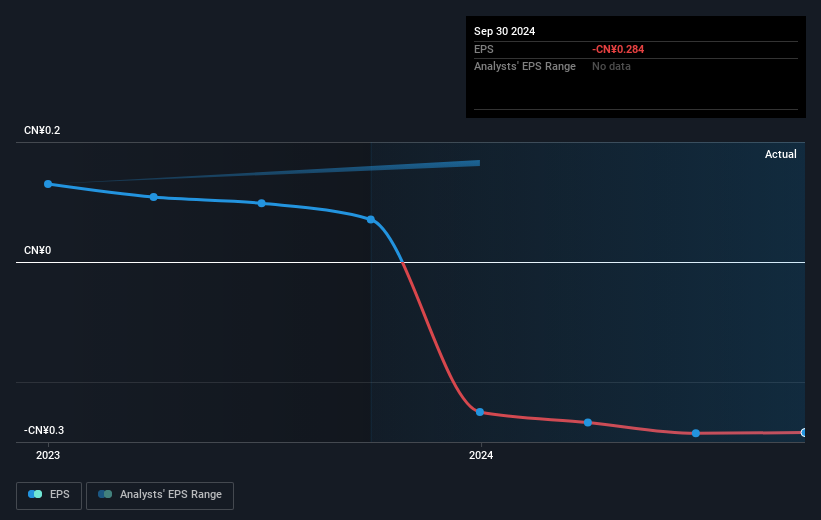

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over half a decade, Zhejiang Jinke Tom Culture Industry managed to grow its earnings per share at 20% a year. We do note that extraordinary items have impacted its earnings history. This EPS growth is higher than the 15% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company.

Over half a decade, Zhejiang Jinke Tom Culture Industry managed to grow its earnings per share at 20% a year. We do note that extraordinary items have impacted its earnings history. This EPS growth is higher than the 15% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Zhejiang Jinke Tom Culture Industry's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Zhejiang Jinke Tom Culture Industry has rewarded shareholders with a total shareholder return of 32% in the last twelve months. That gain is better than the annual TSR over five years, which is 15%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Zhejiang Jinke Tom Culture Industry , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.