While it may not be enough for some shareholders, we think it is good to see the New Guomai Digital Culture Co., Ltd. (SHSE:600640) share price up 18% in a single quarter. But that doesn't change the fact that the returns over the last half decade have been disappointing. Indeed, the share price is down 52% in the period. Some might say the recent bounce is to be expected after such a bad drop. We'd err towards caution given the long term under-performance.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

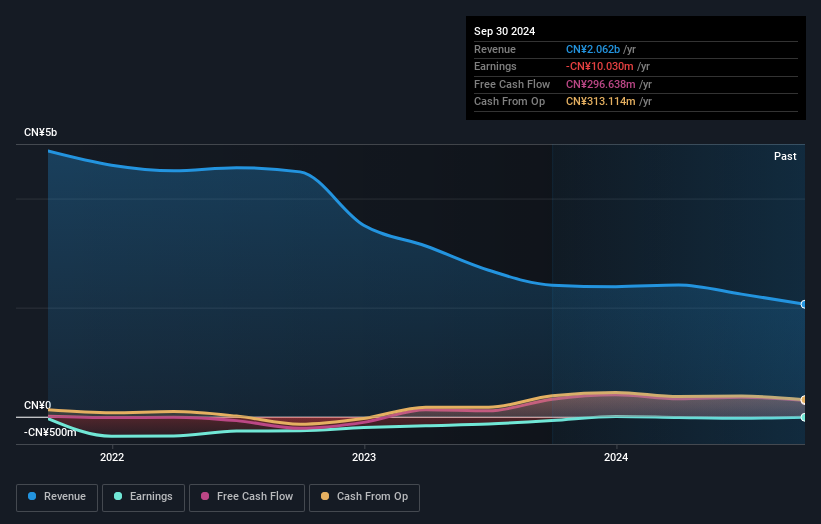

Because New Guomai Digital Culture made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over half a decade New Guomai Digital Culture reduced its trailing twelve month revenue by 13% for each year. That puts it in an unattractive cohort, to put it mildly. It seems appropriate, then, that the share price slid about 9% annually during that time. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

Over half a decade New Guomai Digital Culture reduced its trailing twelve month revenue by 13% for each year. That puts it in an unattractive cohort, to put it mildly. It seems appropriate, then, that the share price slid about 9% annually during that time. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

New Guomai Digital Culture provided a TSR of 14% over the year (including dividends). That's fairly close to the broader market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 9% over the last five years. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with New Guomai Digital Culture .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.