① A total of 14 companies related to Asia Vets have completed their listing or submitted listing applications on the Hong Kong Stock Exchange or Nasdaq. ② The demand for the intelligent transformation of Autos and the implementation of high-level autonomous driving-related policies have become two major drivers for the Capital Markets to accept Asia Vets companies. ③ The current widespread issues of funding shortages and performance losses within the Industry are key factors driving Asia Vets companies to seek IPOs.

According to the Financial Associated Press on December 26 (reporter Xu Hao), Tesla's continuously upgraded FSD versions and rumors of entering China have not only boosted market sentiment but also allowed many long-suffering Asia Vets-related companies to stand at the forefront of Capital Markets in 2024.

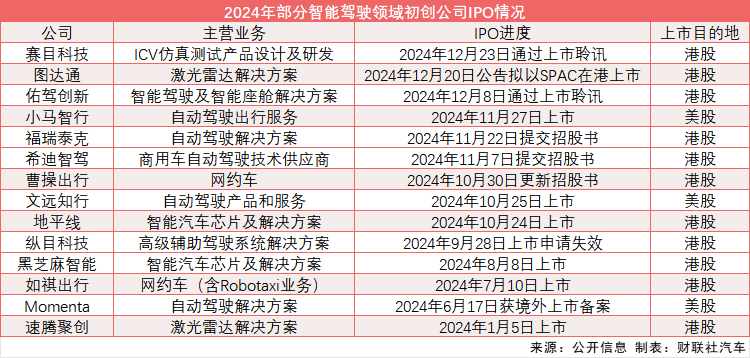

According to incomplete statistics from Financial Associated Press reporters, as of December 26, a total of 14 Asia Vets-related companies have completed listings or submitted listing applications on the Hong Kong Stock Exchange or Nasdaq. Among them, there are chip suppliers like Horizon and Nanfang Black Sesame Group, solution providers like Momenta and Pony.ai, as well as Robotaxi operators like Qichuxing, almost covering the entire Industry Chain of Asia Vets.

If the news related to Tesla's FSD is the spark igniting the Asia Vets track, then the market demand for intelligent transformation of Autos and the implementation of high-level autonomous driving-related policies have become two major drivers for the Capital Markets to embrace Asia Vets companies.

If the news related to Tesla's FSD is the spark igniting the Asia Vets track, then the market demand for intelligent transformation of Autos and the implementation of high-level autonomous driving-related policies have become two major drivers for the Capital Markets to embrace Asia Vets companies.

From the perspective of market demand, Asia Vets capability has become an important factor influencing Consumer car purchasing decisions. Data disclosed by the Ministry of Industry and Information Technology shows that in the first half of this year, the penetration rate of new Passenger Vehicles with L2-level assistance driving or above in China reached 55.7%, with the penetration rate of new cars equipped with Navigation Assistance Driving (NOA) functions reaching 11%. It is expected that the annual sales of intelligent connected vehicles will exceed 17 million units, with a penetration rate exceeding 60%. To seize the market, manufacturers undoubtedly need to further accelerate cooperation with Asia Vets companies.

At the policy level, in June this year, the Ministry of Industry and Information Technology, the Ministry of Public Security, the Ministry of Housing and Urban-Rural Development, and the Ministry of Transportation issued 'Basic Information for Joining the Smart Networked Vehicle Access and Road Pilot Joint Venture', launching pilot access and road trials for intelligent connected vehicles in Beijing, Shanghai, Guangzhou, and other 7 cities. The pilot products cover three major categories: Passenger Vehicles, buses, and trucks. This means that China's intelligent connected vehicles have taken a key step toward large-scale application of high-level intelligent driving, further promoting the commercialization of high-level intelligent driving.

"Since the beginning of this year, leading companies like Tesla, Waymo, and Baidu have made positive progress in the commercialization of Robotaxi. The attention on the Asia Vets track has significantly increased, and the valuation and market recognition of relevant companies have also risen correspondingly," said Liu Yudong, Executive General Manager of Chen Tao Capital.

Although Asia Vets-related companies are crowded into the Capital Markets, the process has not been smooth sailing. The widespread issues of funding shortages and performance losses within the Industry are key factors driving Asia Vets companies to seek IPOs. 'Losses are one reason these autonomous driving companies choose to go public,' said Zhang Xiaorong, director of the Deep Technology Research Institute.

Taking Saimu Technology, which just passed the listing hearing at the Hong Kong Stock Exchange on December 23, as an example, prior to this, Saimu Technology had experienced three applications, respectively in May 2023, October 2023, and December 2022. The prospectus shows that Saimu Technology is a company focusing on simulation testing technology for Intelligent Connected Vehicles (ICV), primarily engaged in the design and R&D of ICV simulation testing products, and providing related testing, verification, and evaluation solutions. From the performance perspective, the revenue of Saimu Technology from 2019 to the first half of 2024 was approximately 8.066 million yuan, 71.203 million yuan, 0.107 billion yuan, 0.145 billion yuan, 0.176 billion yuan, and 55.56 million yuan; net income was 5.594 million yuan, 51.579 million yuan, 37.571 million yuan, 48.686 million yuan, 53.431 million yuan, and -4.599 million yuan.

Data indicates that the revenue growth of Saimu Technology has slowed, with the net margin declining from 69.4% in 2019 to 35.1% in 2021, 33.5% in 2022, and 30.4% in 2023, and a loss occurring in the first half of 2024.

Not only Saimu Technology, but also many leading companies in the smart driving field are facing the reality of losses. Among them, Horizon has accumulated a net loss of over 22.6 billion yuan from 2021 to the first half of 2024; WeRide has accumulated a net loss of over 5.1 billion yuan from 2021 to the first half of 2024; Pony.ai has accumulated a net loss of over 2.3 billion yuan from 2022 to the first half of 2024.

"Autonomous driving is extremely capital-intensive, it's a capital-intensive industry requiring substantial funding to support R&D and market promotion, and going public can open necessary financing channels." Zhang Xiaorong believes that companies related to autonomous driving generally face profitability challenges, but going public can obtain funding support to promote technology development and commercialization.

With a market recovery, increased demand, and policy promotion, there are still constant applicants waiting outside the IPO door for the high-level smart driving track. "It is expected that (the company) will update the annual report next year, and will continue to advance the relevant IPO process." Previously, the autonomous driving solution supplier Zongmu Technology, which had submitted applications three times, provided the next step plan.

In addition to Zongmu Technology, Momenta is also queuing to enter the capital market. "Momenta will continue to promote its IPO plans next year." After rumors of a pause in IPOs in the industry, Momenta's Chairman Zhang Kai denied them.

McKinsey predicts that by 2030, China may become the largest autonomous driving market globally, with new car sales related to autonomous driving and mobility services generating over 500 billion dollars in revenue. Behind the heated market, however, is even fiercer market competition.

"Competition in China's smart driving market will intensify further, and whether a company can establish a competitive advantage will depend on its sustained investment in smart driving technology R&D, effective management and efficient utilization of smart driving data assets, and continuously improving its products' excellence in safety performance and reliability," said IDC China Senior Analyst Hong Wanting.

如果说特斯拉FSD的相关消息,是催热智驾赛道的一颗火种,那么市场对汽车智能化转型的需求和高阶自动驾驶相关政策的落地,则成为资本市场接纳智能驾驶企业的两大重要推手。

如果说特斯拉FSD的相关消息,是催热智驾赛道的一颗火种,那么市场对汽车智能化转型的需求和高阶自动驾驶相关政策的落地,则成为资本市场接纳智能驾驶企业的两大重要推手。